BOC Hong Kong (Holdings) [SEHK:2388] Eyes Growth with AI Investments and Southeast Asia Expansion

Reviewed by Simply Wall St

BOC Hong Kong (Holdings) (SEHK:2388) has showcased impressive financial performance with an 18% earnings growth, significantly outpacing the industry average. The recent launch of new product lines and strategic focus on customer satisfaction have strengthened its market position, although challenges such as a low ROE and volatile dividends persist. This report delves into key areas such as financial health, strategic growth initiatives, and external challenges impacting the company's future prospects.

Dive into the specifics of BOC Hong Kong (Holdings) here with our thorough analysis report.

Innovative Factors Supporting BOC Hong Kong (Holdings)

BOC Hong Kong (Holdings) has demonstrated strong financial health, with earnings growth of 18% over the past year surpassing the banks industry average of 1.6%. This impressive growth is complemented by a notable improvement in net profit margins, which increased from 52.4% to 57%. The company's strategic focus on customer satisfaction, as evidenced by improved customer satisfaction scores, has reinforced its market position. Additionally, the launch of new product lines in Q4, as highlighted by Chenggang Liu, DCE, reflects the company's commitment to innovation and market expansion. The leadership's experience and strategic initiatives have been pivotal in driving these positive outcomes.

Challenges Constraining BOC Hong Kong (Holdings)'s Potential

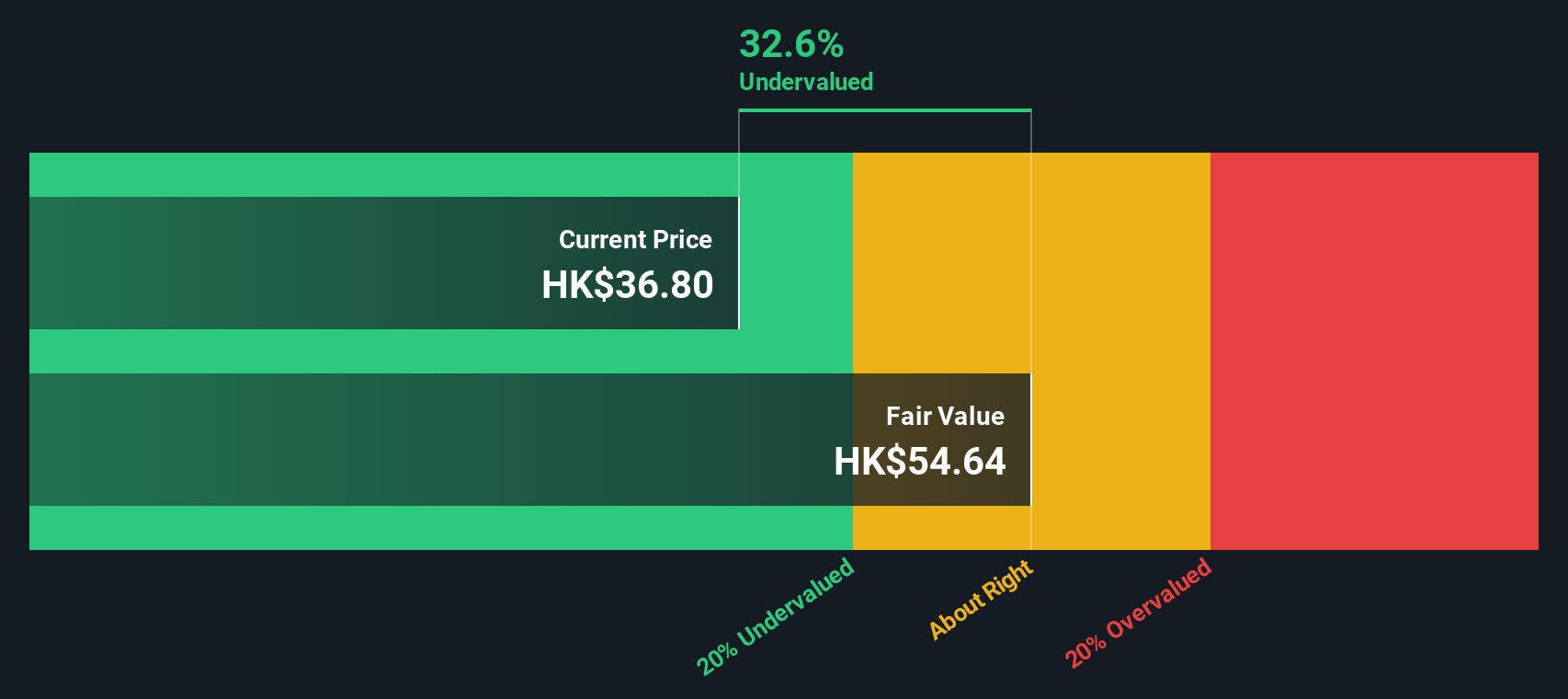

While the company has strengths, it faces challenges, including a low Return on Equity (ROE) of 11.3%, which is below industry standards. The forecasted earnings growth rate of 1.3% per year also lags behind the Hong Kong market average of 11.5%. Additionally, the company's dividend payments have been volatile over the past decade, with a current yield of 6.78% falling short of the top 25% of dividend payers in the Hong Kong market. The company's valuation, with a Price-To-Earnings Ratio of 7.5x, suggests it is expensive compared to its peers and the industry average, despite being undervalued based on discounted cash flow estimates.

Growth Avenues Awaiting BOC Hong Kong (Holdings)

The company is poised for growth through strategic initiatives such as geographic expansion into Southeast Asia, which Chenggang Liu, DCE, mentioned as a key focus area. Investing in AI technology to streamline operations and enhance customer experience is another promising avenue. Furthermore, ongoing discussions with potential partners to enhance service offerings indicate a proactive approach to exploring new opportunities. The increase in dividend payments over the past 10 years also suggests potential for future growth.

External Factors Threatening BOC Hong Kong (Holdings)

However, the company must navigate several external threats, including economic headwinds and regulatory challenges. The management, as noted by Chenggang Liu, is aware of these challenges and is taking steps to address them. Supply chain disruptions remain a concern, potentially impacting product availability and operational efficiency. Analyst forecasts indicating limited upside potential for the company's share price further underscore the need for vigilance in maintaining its competitive edge.

See what the latest analyst reports say about BOC Hong Kong (Holdings)'s future prospects and potential market movements.Conclusion

BOC Hong Kong (Holdings) showcases strong financial performance with an 18% earnings growth, well above the industry average, and improved profit margins, indicating effective management and strategic customer focus. However, the company's ROE of 11.3% and forecasted earnings growth of 1.3% suggest potential constraints in matching market expectations, compounded by volatile dividends and a Price-To-Earnings Ratio of 7.5x that positions it as costly relative to peers. Despite these challenges, the company's strategic initiatives, such as Southeast Asia expansion and AI investment, signal promising growth avenues. Yet, external threats like economic and regulatory pressures, alongside supply chain issues, necessitate careful navigation to sustain its competitive edge and realize its growth potential.

Make It Happen

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if BOC Hong Kong (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:2388

BOC Hong Kong (Holdings)

An investment holding company, provides banking and related financial services to corporate and individual customers in Hong Kong, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026