- Hong Kong

- /

- Specialty Stores

- /

- SEHK:1929

3 Asian Dividend Stocks Offering Yields Up To 6.4%

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by trade tensions and monetary policy shifts, investors are increasingly turning their attention to Asia for opportunities. In this context, dividend stocks can offer a compelling option for those seeking income stability amid economic uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.05% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.98% | ★★★★★★ |

| NCD (TSE:4783) | 4.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.05% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Daicel (TSE:4202) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.47% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.53% | ★★★★★★ |

Click here to see the full list of 1086 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

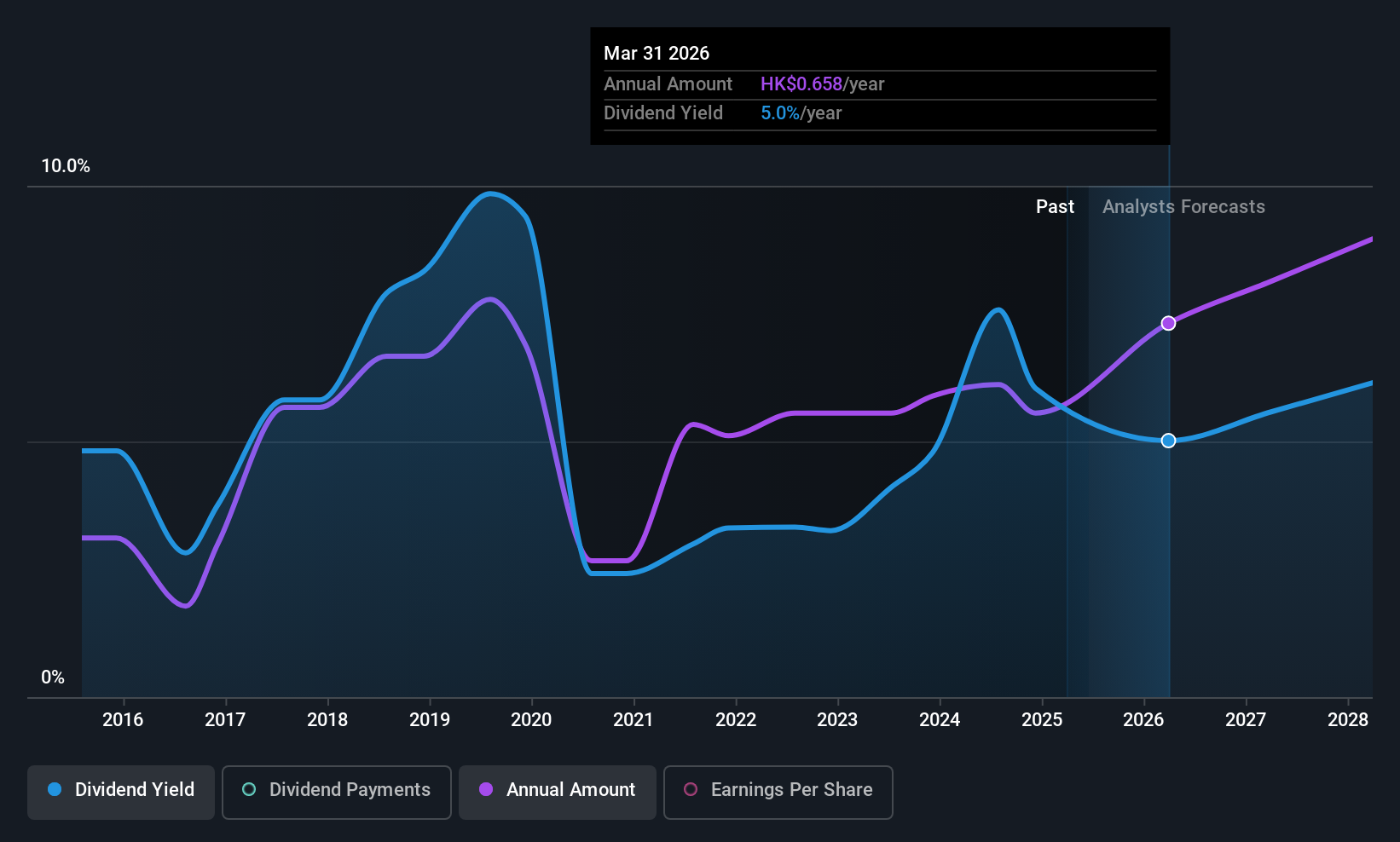

Chow Tai Fook Jewellery Group (SEHK:1929)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chow Tai Fook Jewellery Group Limited is an investment holding company that manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally, with a market cap of HK$162.97 billion.

Operations: Chow Tai Fook Jewellery Group Limited generates revenue primarily from Mainland China, contributing HK$74.58 billion, and from Hong Kong, Macau, and other markets with HK$15.98 billion.

Dividend Yield: 3.1%

Chow Tai Fook Jewellery Group's dividend payments, while covered by both earnings and cash flows, have been volatile over the past decade. The company's current payout ratio of 87.8% suggests dividends are sustainable but not without risk due to its high debt levels. Although recent executive changes could bring strategic growth, the dividend yield of 3.15% remains lower than top-tier payers in Hong Kong, indicating room for improvement in dividend stability and attractiveness.

- Click here and access our complete dividend analysis report to understand the dynamics of Chow Tai Fook Jewellery Group.

- The analysis detailed in our Chow Tai Fook Jewellery Group valuation report hints at an inflated share price compared to its estimated value.

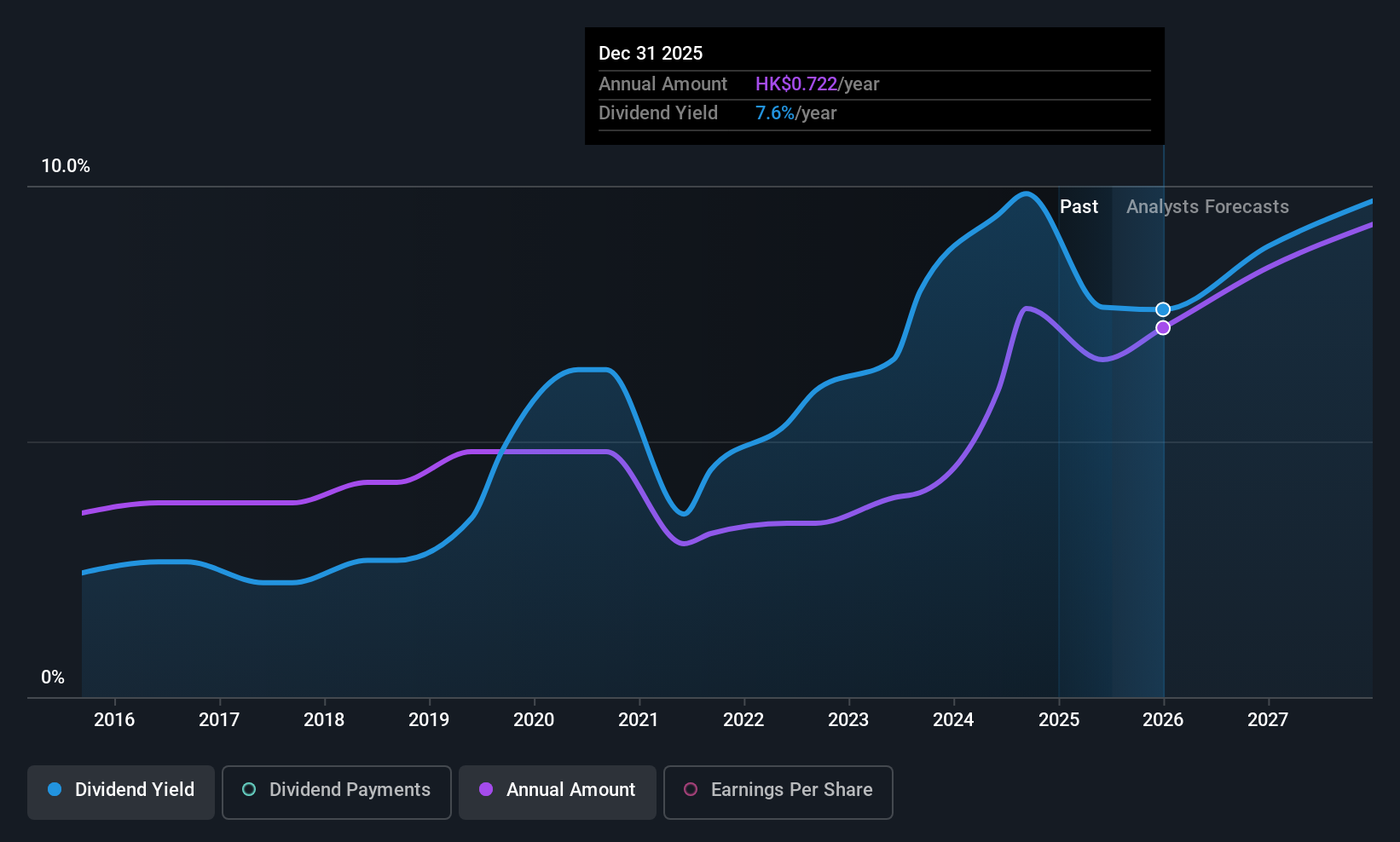

Dah Sing Banking Group (SEHK:2356)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dah Sing Banking Group Limited is an investment holding company offering banking, financial, and related services in Hong Kong, Macau, and the People's Republic of China with a market cap of HK$15.32 billion.

Operations: Dah Sing Banking Group Limited generates revenue primarily from Personal Banking (HK$3.16 billion), Treasury and Global Markets (HK$1.91 billion), Corporate Banking (HK$161.15 million), and Mainland China and Macau Banking (HK$346.31 million).

Dividend Yield: 6.4%

Dah Sing Banking Group's dividend payments, while covered by a low payout ratio of 43.9%, have been volatile over the past decade. The interim dividend of HK$0.31 per share reflects recent earnings growth, with net income rising to HK$1.58 billion for the half year ended June 30, 2025. Despite a high bad loan ratio of 3.1% and low allowance for bad loans at 44%, dividends remain sustainable though not top-tier in yield compared to peers in Hong Kong.

- Delve into the full analysis dividend report here for a deeper understanding of Dah Sing Banking Group.

- Our valuation report here indicates Dah Sing Banking Group may be overvalued.

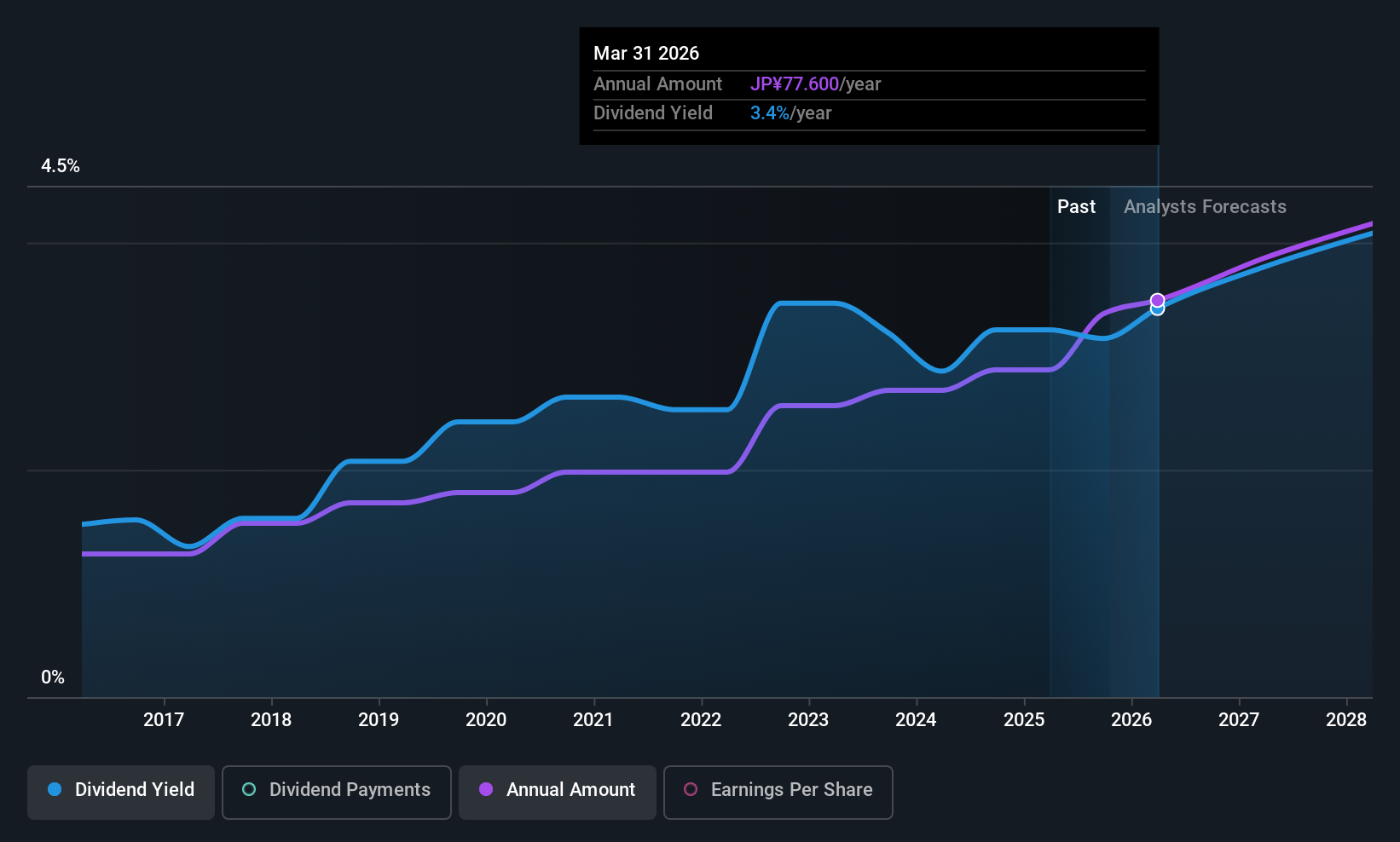

Air Water (TSE:4088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Air Water Inc. operates in Japan, providing a diverse range of products and services across industrial gas, chemical, medical, energy, agriculture and food products, logistics, seawater industries with a market cap of ¥508.61 billion.

Operations: Air Water Inc.'s revenue segments include Energy Solution at ¥78.14 billion, Health and Safety at ¥249.87 billion, Digital & Industry at ¥362.63 billion, and Agriculture & Foods at ¥179.54 billion.

Dividend Yield: 3.4%

Air Water's dividend reliability is supported by a stable 10-year history of growth, though its cash payout ratio of 144.1% indicates dividends are not well covered by cash flows. Despite this, the payout ratio remains low at 34%, suggesting earnings coverage is sufficient. The company's P/E ratio of 10.1x offers good value relative to the JP market average of 14.4x, although recent board discussions on structural changes may impact future stability and performance.

- Unlock comprehensive insights into our analysis of Air Water stock in this dividend report.

- Our valuation report unveils the possibility Air Water's shares may be trading at a discount.

Make It Happen

- Click through to start exploring the rest of the 1083 Top Asian Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1929

Chow Tai Fook Jewellery Group

An investment holding company, manufactures and sells jewelry products in Mainland China, Hong Kong, Macau, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives