Bank of East Asia's (HKG:23) Dividend Is Being Reduced To HK$0.16

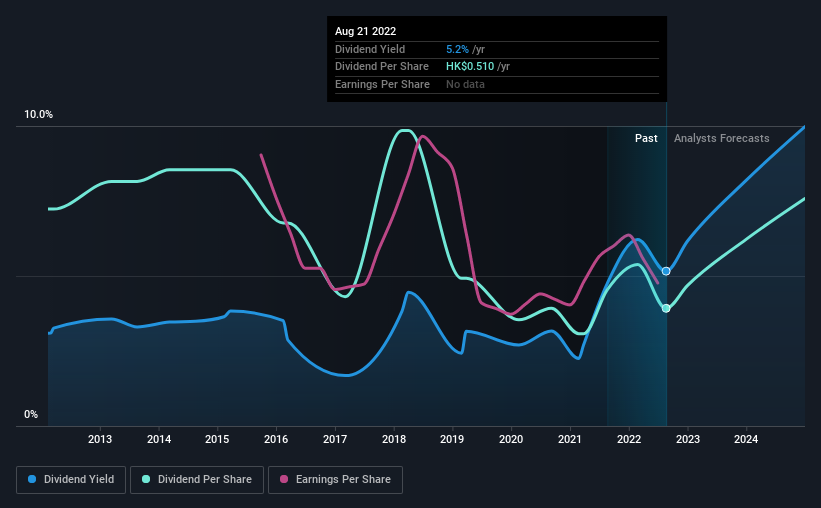

The Bank of East Asia, Limited (HKG:23) has announced that on 30th of September, it will be paying a dividend ofHK$0.16, which a reduction from last year's comparable dividend. Based on this payment, the dividend yield will be 5.2%, which is lower than the average for the industry.

See our latest analysis for Bank of East Asia

Bank of East Asia's Earnings Will Easily Cover The Distributions

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible.

Bank of East Asia has a long history of paying out dividends, with its current track record at a minimum of 10 years. Taking data from its last earnings report, calculating for the company's payout ratio shows 45%, which means that Bank of East Asia would be able to pay its last dividend without pressure on the balance sheet.

Looking forward, EPS is forecast to rise by 79.6% over the next 3 years. The future payout ratio could be 47% over that time period, according to analyst estimates, which is a good look for the future of the dividend.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was HK$0.94 in 2012, and the most recent fiscal year payment was HK$0.51. The dividend has shrunk at around 5.9% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Bank of East Asia May Find It Hard To Grow The Dividend

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. However, Bank of East Asia's EPS was effectively flat over the past five years, which could stop the company from paying more every year. Growth of 1.5% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

In Summary

Overall, we think that Bank of East Asia could make a reasonable income stock, even though it did cut the dividend this year. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Bank of East Asia that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Bank of East Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:23

Bank of East Asia

Provides various banking and related financial services.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives