As global markets navigate the complexities of trade policies and economic fluctuations, investors are keeping a close watch on opportunities across various sectors. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing area for potential growth. Despite being considered a somewhat outdated term, these stocks can offer significant upside when backed by strong fundamentals and robust balance sheets.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Halcyon Technology (SET:HTECH) | THB2.66 | THB798M | ✅ 2 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.178 | SGD35.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.12 | SGD855.97M | ✅ 3 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.91 | HK$3.3B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.31 | HK$49.34B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.97 | HK$1.64B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,161 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Shengjing Bank (SEHK:2066)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shengjing Bank Co., Ltd. operates in Mainland China, providing banking products and related financial services, with a market cap of HK$9.06 billion.

Operations: Shengjing Bank's revenue is primarily derived from Corporate Banking, which contributes CN¥4.67 billion, followed by Retail Banking at CN¥1.87 billion and Treasury Business at CN¥176.56 million.

Market Cap: HK$9.06B

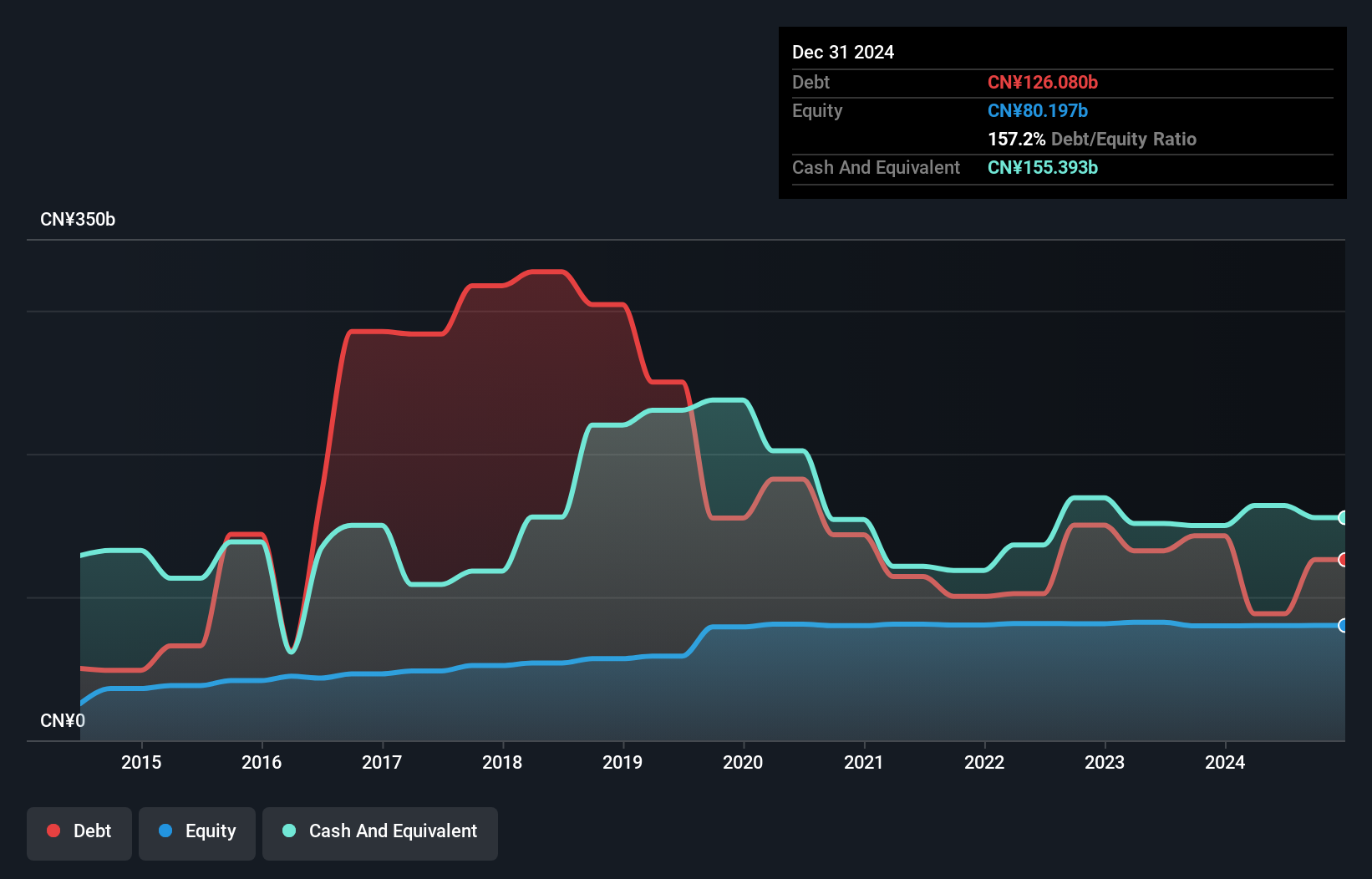

Shengjing Bank, with a market cap of HK$9.06 billion, primarily generates revenue from Corporate Banking (CN¥4.67 billion) and Retail Banking (CN¥1.87 billion). Despite having high-quality earnings and appropriate loan levels, the bank faces challenges with declining net interest income and net income year-over-year. The bank's return on equity is low at 0.8%, and it has a high level of bad loans at 2.7%. Recent board changes include the resignation of Mr. Wang Jun due to retirement, while Mr. Li Weiming has been nominated as a non-executive director candidate for the board's eighth session.

- Get an in-depth perspective on Shengjing Bank's performance by reading our balance sheet health report here.

- Learn about Shengjing Bank's historical performance here.

Linklogis (SEHK:9959)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linklogis Inc. is an investment holding company that provides supply chain finance technology and data-driven solutions in China, with a market cap of HK$2.78 billion.

Operations: The company's revenue segments include CN¥663.66 million from Supply Chain Finance Technology Solutions - Anchor Cloud, CN¥306.89 million from FI Cloud within the same category, CN¥51.06 million from Emerging Solutions - Cross-Border Cloud, and CN¥9.57 million from SME Credit Tech Solutions.

Market Cap: HK$2.78B

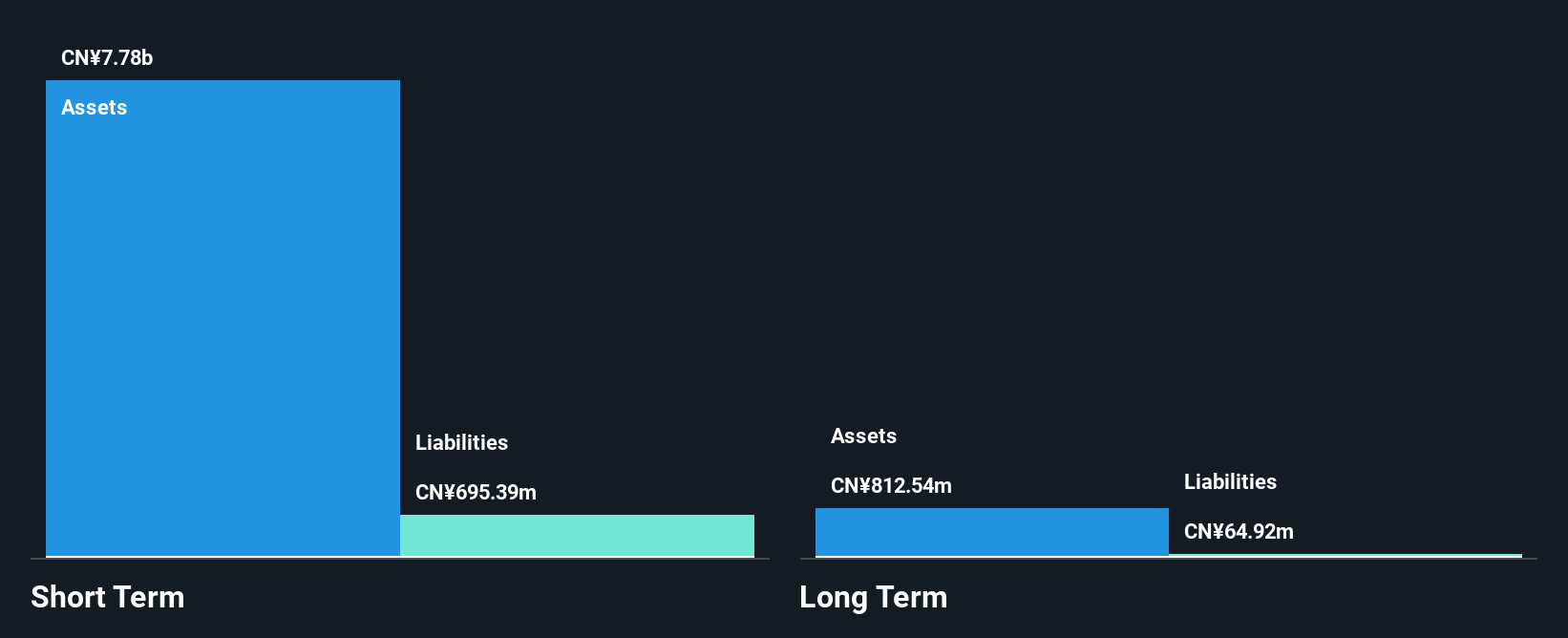

Linklogis Inc., with a market cap of HK$2.78 billion, is navigating the challenges of being unprofitable while showing potential in its supply chain finance technology sector. The company's revenues reached CN¥1.03 billion for 2024, yet it reported a net loss of CN¥835.38 million, indicating ongoing profitability struggles despite reducing losses by 43.8% annually over five years. The management and board are seasoned with average tenures exceeding four years, providing stability as they propose amendments to corporate governance structures ahead of the June AGM. A special dividend announcement reflects some positive cash flow dynamics amidst these challenges.

- Unlock comprehensive insights into our analysis of Linklogis stock in this financial health report.

- Evaluate Linklogis' prospects by accessing our earnings growth report.

Grand Venture Technology (SGX:JLB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grand Venture Technology Limited provides precision manufacturing solutions for various industries including semiconductor, life sciences, electronics, aerospace, and medical sectors across Singapore, Malaysia, the United States, China, and internationally with a market cap of SGD313.84 million.

Operations: The company generates revenue from three main segments: SGD22.92 million from life sciences, SGD87.84 million from the semiconductor industry, and SGD48.76 million from electronics, aerospace, medical sectors, and others.

Market Cap: SGD313.84M

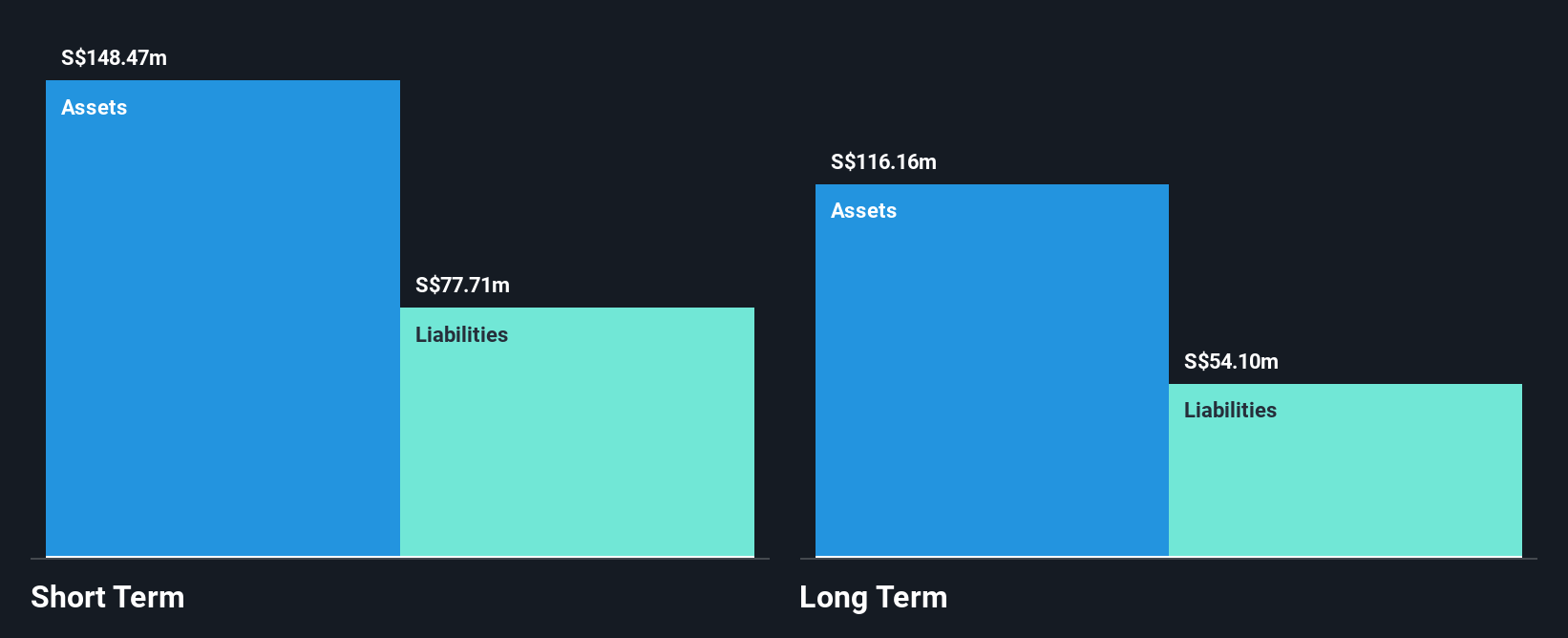

Grand Venture Technology Limited, with a market cap of SGD313.84 million, is experiencing robust earnings growth, having doubled its earnings over the past year and exceeding industry averages. The company generates significant revenue from semiconductor (SGD87.84 million), life sciences (SGD22.92 million), and electronics sectors (SGD48.76 million). Despite low return on equity at 8.3%, it has improved profit margins to 7% and reduced its debt-to-equity ratio from 84% to 52.5%. Recent corporate developments include amendments to the company's constitution and a dividend increase, reflecting strategic adjustments in governance and shareholder returns amidst market volatility.

- Click to explore a detailed breakdown of our findings in Grand Venture Technology's financial health report.

- Explore Grand Venture Technology's analyst forecasts in our growth report.

Key Takeaways

- Discover the full array of 1,161 Asian Penny Stocks right here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9959

Linklogis

An investment holding company, engages in the provision of supply chain finance technology and data-driven emerging solutions in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives