- Hong Kong

- /

- Metals and Mining

- /

- SEHK:98

Exploring Undiscovered Gems In Hong Kong July 2024

Reviewed by Simply Wall St

As of July 2024, the Hong Kong market reflects a nuanced landscape, with the Hang Seng Index experiencing notable fluctuations amidst global economic uncertainties and local challenges. This environment may present unique opportunities for investors to explore small-cap stocks that could be poised for growth despite broader market headwinds. In identifying potential undiscovered gems in such a climate, it's crucial to consider companies with robust fundamentals, strategic management teams, and the ability to adapt swiftly to changing economic conditions. These attributes can position small-caps favorably in navigating through periods of volatility and capturing growth as market dynamics evolve.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 23.22% | 6.87% | 31.81% | ★★★★★★ |

| S.A.S. Dragon Holdings | 37.35% | 4.13% | 12.06% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -12.97% | 12.59% | ★★★★★★ |

| China Leon Inspection Holding | 17.06% | 24.06% | 27.08% | ★★★★★★ |

| PW Medtech Group | NA | 17.93% | -2.70% | ★★★★★★ |

| Sundart Holdings | 0.01% | -2.76% | -4.34% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Xin Point Holdings | 2.03% | 9.80% | 15.04% | ★★★★★☆ |

| Hung Hing Printing Group | 3.97% | -2.51% | 33.57% | ★★★★★☆ |

| Laopu Gold | 8.43% | 26.56% | 36.28% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Bank of Tianjin (SEHK:1578)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank of Tianjin Co., Ltd. offers a variety of banking and financial services mainly in the People's Republic of China, with a market capitalization of HK$9.89 billion.

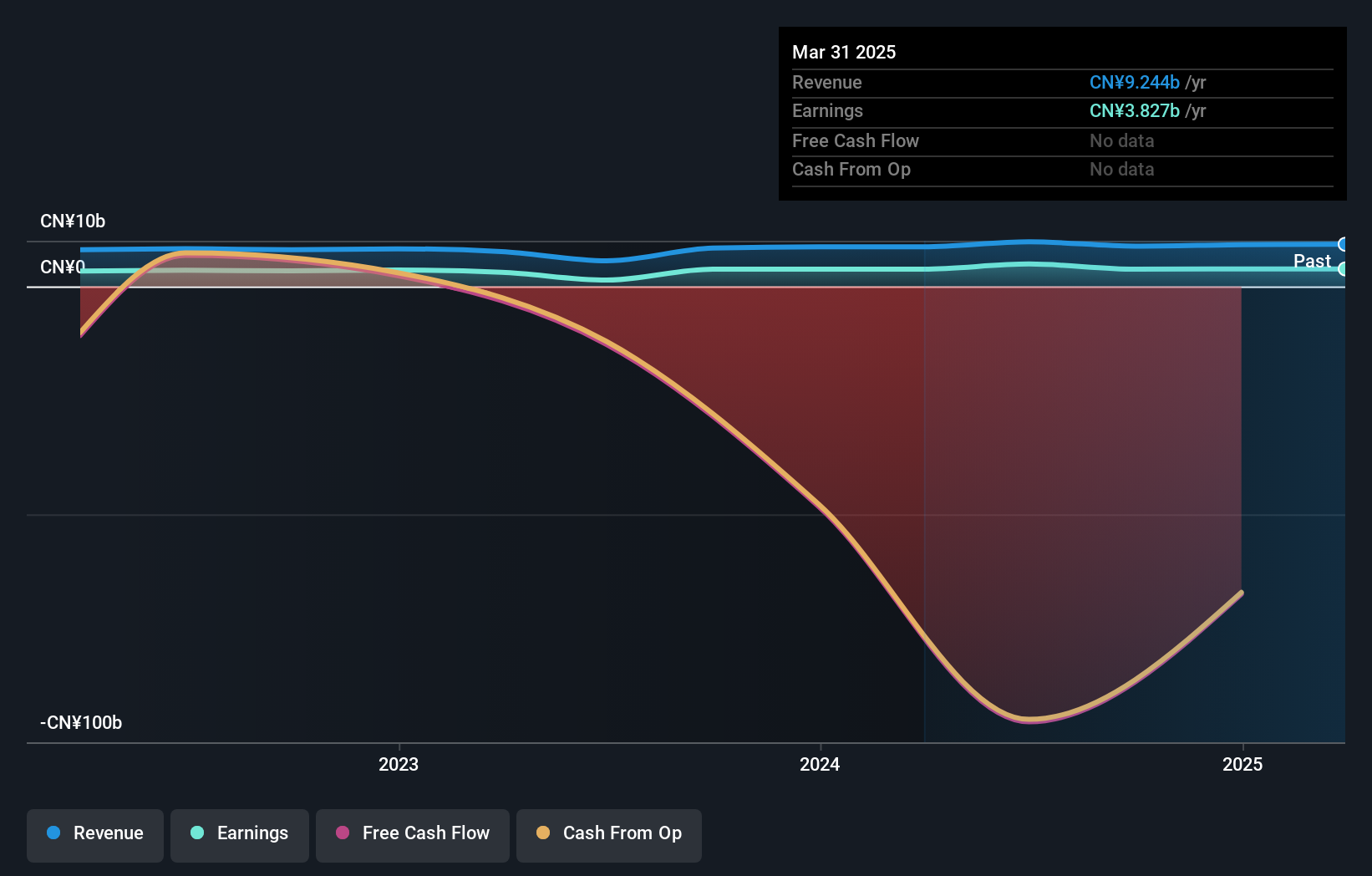

Operations: The Bank of Tianjin operates with a consistent gross profit margin of 100%, generating revenue primarily through its banking operations. Over the years, it has shown a fluctuating net income margin, peaking at 50.14% in mid-2017 and experiencing a notable decline to around 24.54% by mid-2023, indicating variability in profitability relative to its total revenue.

Bank of Tianjin, with its total assets at CN¥871.1B and a robust allowance for bad loans at 168%, stands out among Hong Kong's lesser-known investment opportunities. The bank's earnings have surged by 22.5% over the past year, outpacing the industry's modest 1.6% growth, showcasing its potential in a competitive sector. Recent strategic board changes and a successful CN¥10B bond issuance further underscore its proactive management and financial health, making it an intriguing prospect for discerning investors looking beyond mainstream options.

- Unlock comprehensive insights into our analysis of Bank of Tianjin stock in this health report.

Examine Bank of Tianjin's past performance report to understand how it has performed in the past.

Beijing Jingneng Clean Energy (SEHK:579)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Jingneng Clean Energy Co., Limited is engaged in the generation of gas-fired power and heat energy, wind power, photovoltaic power, and hydropower across the People’s Republic of China, with a market capitalization of approximately HK$15.58 billion.

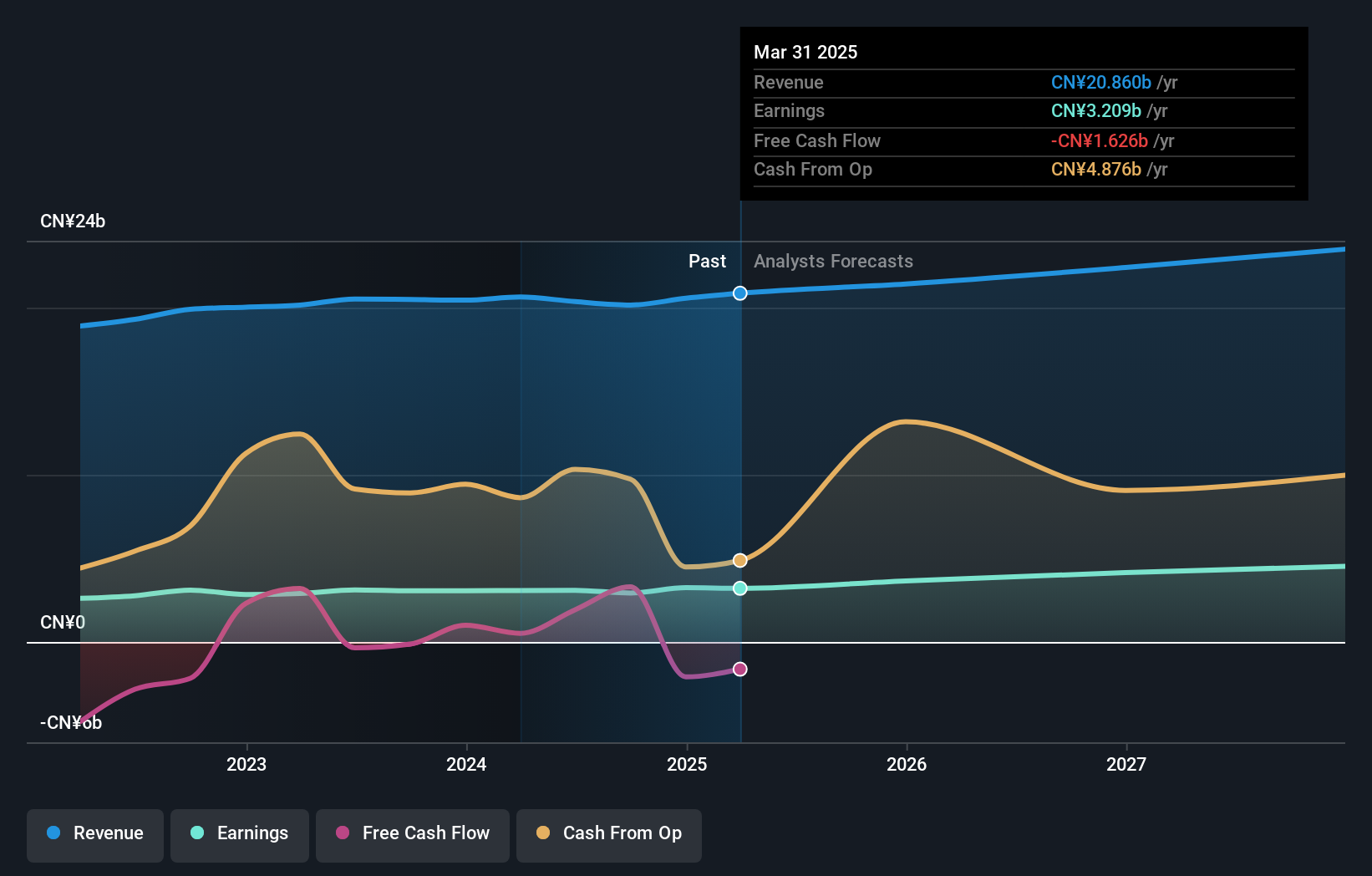

Operations: The company generates its revenue primarily through the sale of clean energy, consistently showing growth in gross profit over the years. It has demonstrated an increasing gross profit margin, reaching 52.70% by mid-2024, reflecting improved efficiency or higher value product offerings. Operating and non-operating expenses are significant parts of its financial structure, impacting net income which also showed an upward trend with a net income margin of approximately 14.92% in early 2024.

Beijing Jingneng Clean Energy, a lesser-known yet promising player in the renewable energy sector, has shown robust financial health and growth potential. Over the past five years, earnings have increased by 9.1% annually. Recently, the company declared a final dividend of RMB 13.98 per share for 2023, underscoring its profitability and shareholder value focus. With earnings projected to grow by 18.05% annually and trading at 33.8% below its estimated fair value, Beijing Jingneng offers an intriguing opportunity for discerning investors seeking exposure in Asia's dynamic energy market.

Xingfa Aluminium Holdings (SEHK:98)

Simply Wall St Value Rating: ★★★★★★

Overview: Xingfa Aluminium Holdings Limited is an investment holding company specializing in the production and distribution of aluminium profiles for construction and industrial applications, primarily operating within the People’s Republic of China, with a market capitalization of HK$3.29 billion.

Operations: Xingfa Aluminium Holdings primarily generates revenue through the production and sale of aluminum profiles, with a significant focus on construction aluminum profiles which constitute the bulk of its income. The company also engages in manufacturing industrial aluminum profiles, complemented by other smaller segments contributing to its diverse revenue streams.

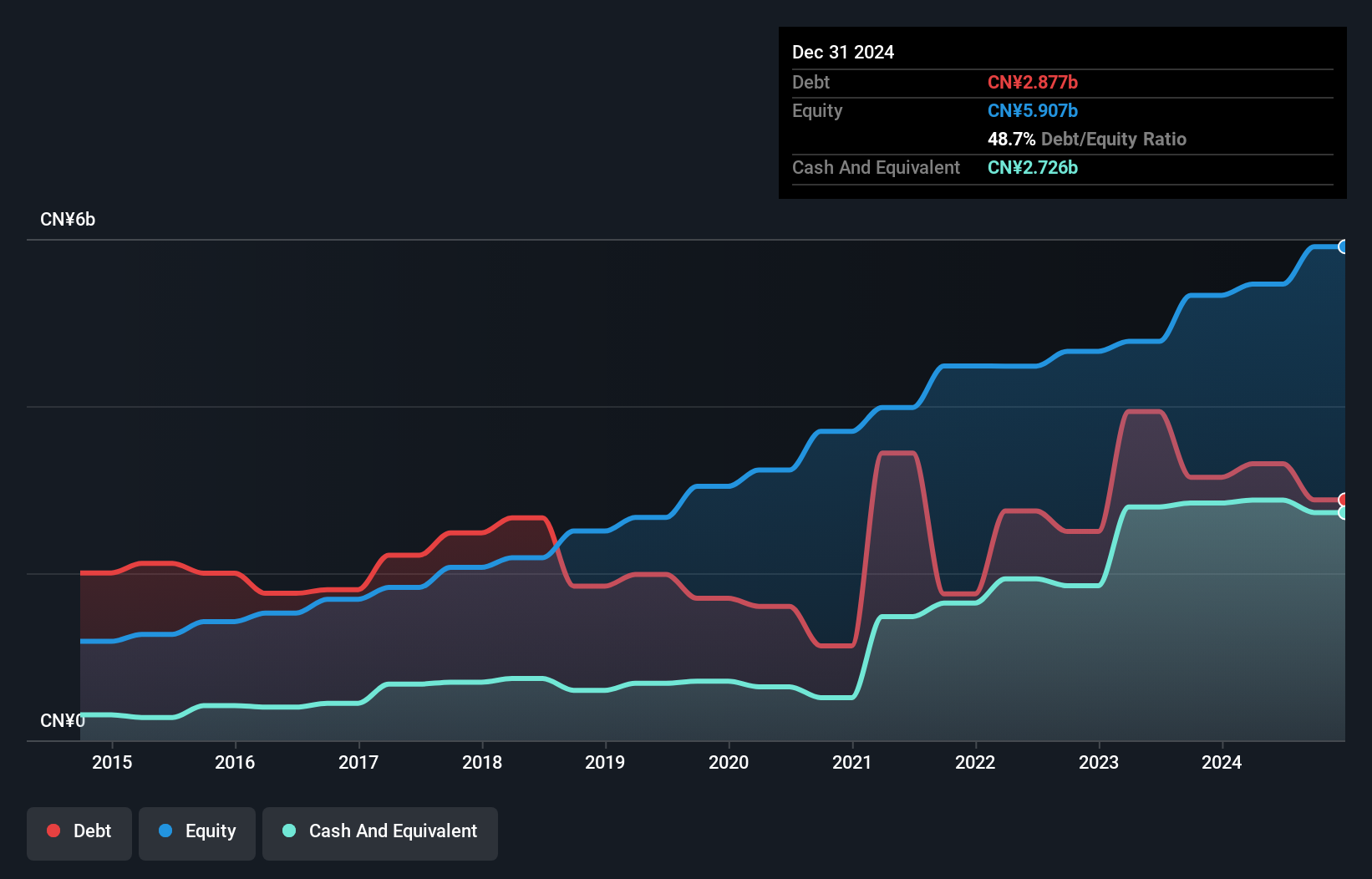

Xingfa Aluminium Holdings, trading at 49.9% below its estimated fair value, presents a compelling entry point. The company has demonstrated robust financial health with a debt to equity ratio improvement from 73.7% to 59.1% over five years and an impressive earnings growth of 75.7% last year, outpacing the Metals and Mining industry's growth of 2.6%. Recently, Xingfa appointed Deloitte as its new auditors during the AGM on May 30, 2024, ensuring continued transparency in its financial operations.

- Navigate through the intricacies of Xingfa Aluminium Holdings with our comprehensive health report here.

Learn about Xingfa Aluminium Holdings' historical performance.

Next Steps

- Explore the 180 names from our SEHK Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:98

Xingfa Aluminium Holdings

An investment holding company, manufactures and sells aluminium profiles in the People’s Republic of China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives