Agricultural Bank of China (SEHK:1288) Declares 2024 Interim Dividend Amid Digital Growth Initiatives

Reviewed by Simply Wall St

Agricultural Bank of China (SEHK:1288) recently affirmed its commitment to shareholder value with the approval of its 2024 interim profit distribution, offering a cash dividend of RMB 1.164 per ten ordinary shares. This move underscores the bank's financial health, driven by its strategic focus on rural economies and asset quality. In the following discussion, we will explore the bank's competitive advantages, challenges, growth opportunities, and the external pressures it faces in the current financial environment.

See the full analysis report here for a deeper understanding of Agricultural Bank of China.

Competitive Advantages That Elevate Agricultural Bank of China

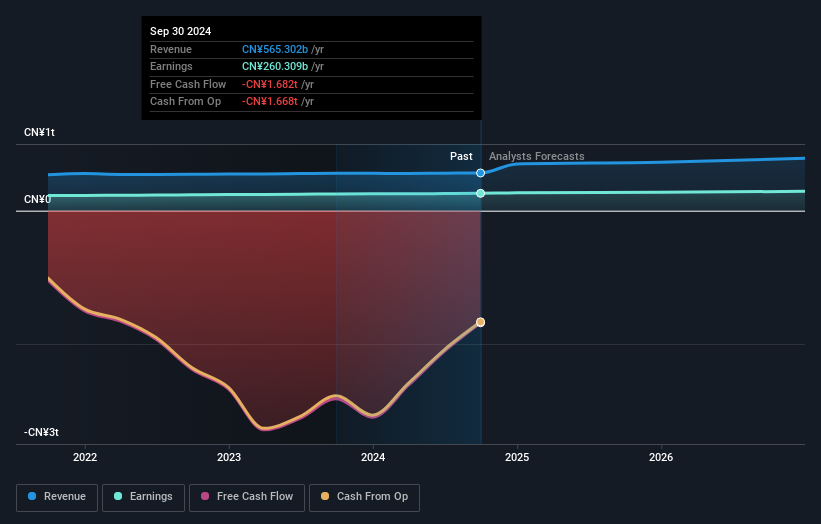

The bank's commitment to the rural economy has significantly bolstered its performance, tapping into a market segment often overlooked by other financial institutions. This strategic focus has been pivotal in driving growth, as highlighted by an executive who noted the bank's astounding performance in serving rural areas. Additionally, the bank's asset quality and risk management practices are evident in its stable net interest spread and high provision coverage ratio, which exceeds 800%. These factors provide a strong cushion against potential financial risks, demonstrating the bank's resilience and financial health. Furthermore, the bank has shown substantial growth in both personal and corporate loans, with a personal loan balance of CNY 8.75 trillion and corporate finance reaching CNY 14.3 trillion, indicating healthy demand for its lending products.

Challenges Constraining Agricultural Bank of China's Potential

The bank faces certain challenges. The Price-To-Earnings Ratio of 5.1x is higher than the industry average of 4.7x, suggesting potential overvaluation. This could be a concern for investors seeking value relative to industry peers. Additionally, the Return on Equity of 9.2% is considered low, as a ROE below 20% is typically viewed as inadequate. These financial metrics highlight areas where the bank may need to focus on improving efficiency and profitability. Moreover, the bank's earnings growth over the past year was 3.4%, falling short of its 5-year average of 5.7%, indicating a need to accelerate growth to meet historical performance levels.

Growth Avenues Awaiting Agricultural Bank of China

Opportunities abound for the bank, particularly in the realm of digital and technological advancements. By investing in AI, IoT, and Big Data, the bank is enhancing its service offerings and operational efficiency, providing a competitive edge. This focus on technology aligns with broader economic recovery efforts, as noted by an executive who emphasized the positive impact of macroeconomic policies. Additionally, the bank's commitment to county area business growth leverages its traditional strengths, presenting further opportunities to expand its market share in these regions. The recent approval of the interim profit distribution, with dividends denominated in RMB, underscores the bank's commitment to delivering value to shareholders.

Competitive Pressures and Market Risks Facing Agricultural Bank of China

External factors such as market volatility and regulatory changes pose significant threats. The bank acknowledges that policy changes may increase market volatility, potentially impacting financial performance. Furthermore, adapting to evolving regulatory environments requires continuous strategic adjustments. Asset quality concerns also loom, with potential future deterioration in sectors like real estate posing risks to financial stability. These challenges necessitate vigilant risk management to safeguard against adverse impacts on the bank's operations and growth trajectory.

Conclusion

The Agricultural Bank of China's strategic focus on the rural economy has allowed it to capture a unique market segment, driving growth and showcasing its resilience through strong risk management and asset quality. However, the bank faces challenges with its Price-To-Earnings Ratio of 5.1x and Return on Equity of 9.2%, which may deter value-seeking investors and highlight areas for efficiency improvement. The bank's investment in digital technologies and commitment to expanding its county area business present substantial growth opportunities. While external risks such as market volatility and regulatory changes pose threats, the bank's proactive approach to risk management is crucial for maintaining stability. Without a specific valuation summary, the bank's performance and future outlook must be assessed holistically, considering both its strategic advantages and areas needing improvement.

Where To Now?

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1288

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives