- Japan

- /

- Capital Markets

- /

- TSE:8473

3 Reliable Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In a week marked by record highs in major U.S. stock indexes and mixed performances across sectors, investors are keeping a close eye on economic indicators and potential interest rate cuts as they navigate the current market landscape. With growth stocks outperforming their value counterparts significantly, many are considering dividend stocks as a stable component of their portfolios amidst the ongoing volatility. Amid these dynamic conditions, reliable dividend stocks can offer consistent returns and act as a buffer against market fluctuations, making them an attractive option for those looking to balance risk with income generation in their investment strategies.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.60% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.86% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

Click here to see the full list of 1927 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

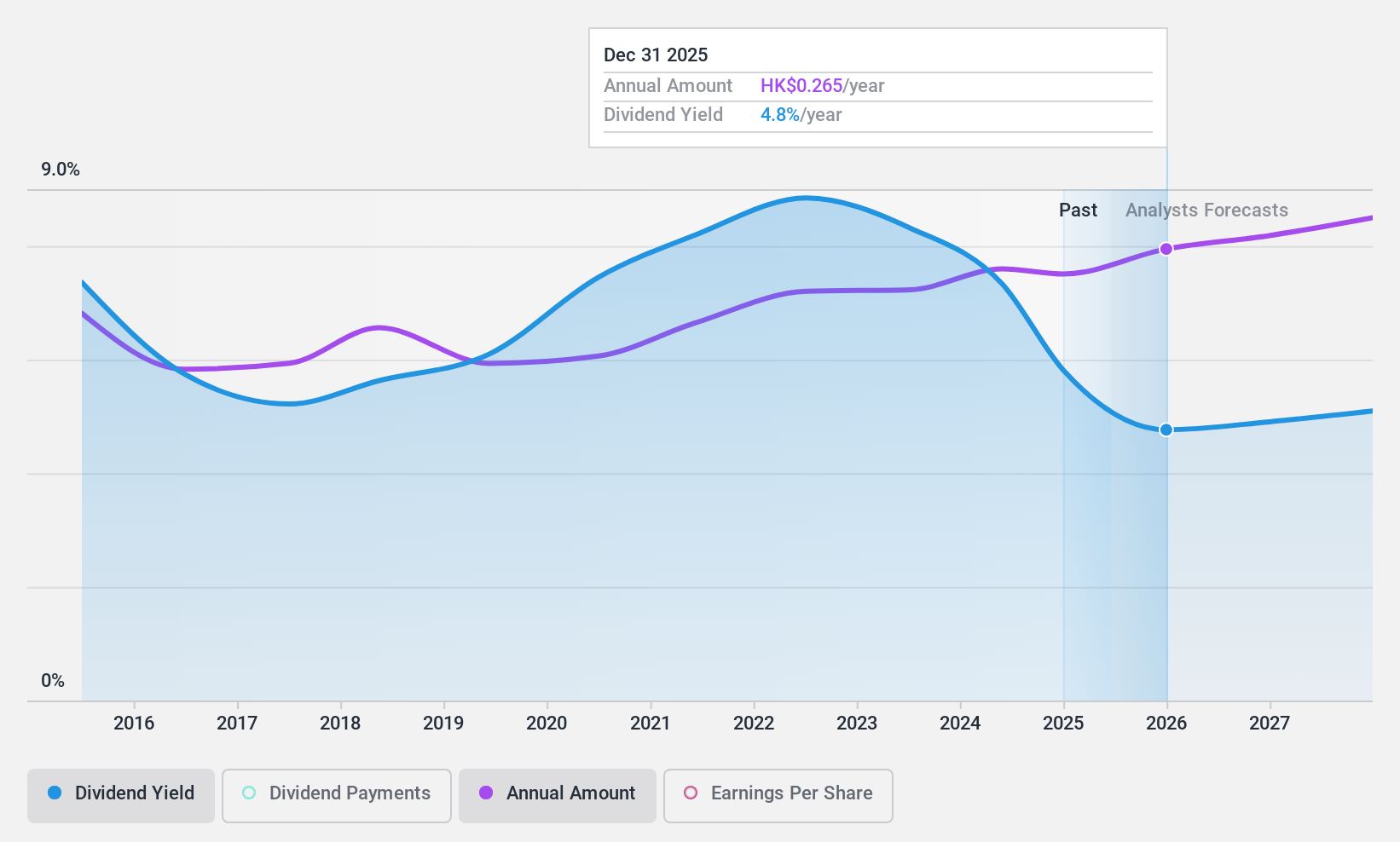

Agricultural Bank of China (SEHK:1288)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Agricultural Bank of China Limited, along with its subsidiaries, offers a range of banking products and services and has a market capitalization of approximately HK$1.82 trillion.

Operations: Agricultural Bank of China Limited, in conjunction with its subsidiaries, generates revenue through diverse banking products and services.

Dividend Yield: 6%

Agricultural Bank of China offers a stable dividend yield of 6.05%, supported by a low payout ratio of 47.3%, indicating sustainability and coverage by earnings. Dividends have grown consistently over the past decade, although they are below the top tier in Hong Kong's market. Recent shareholder approval for interim dividends underscores its commitment to returning value to investors, with payments scheduled for January 2025 following recent profit affirmations and earnings growth reports.

- Click here and access our complete dividend analysis report to understand the dynamics of Agricultural Bank of China.

- Our valuation report unveils the possibility Agricultural Bank of China's shares may be trading at a discount.

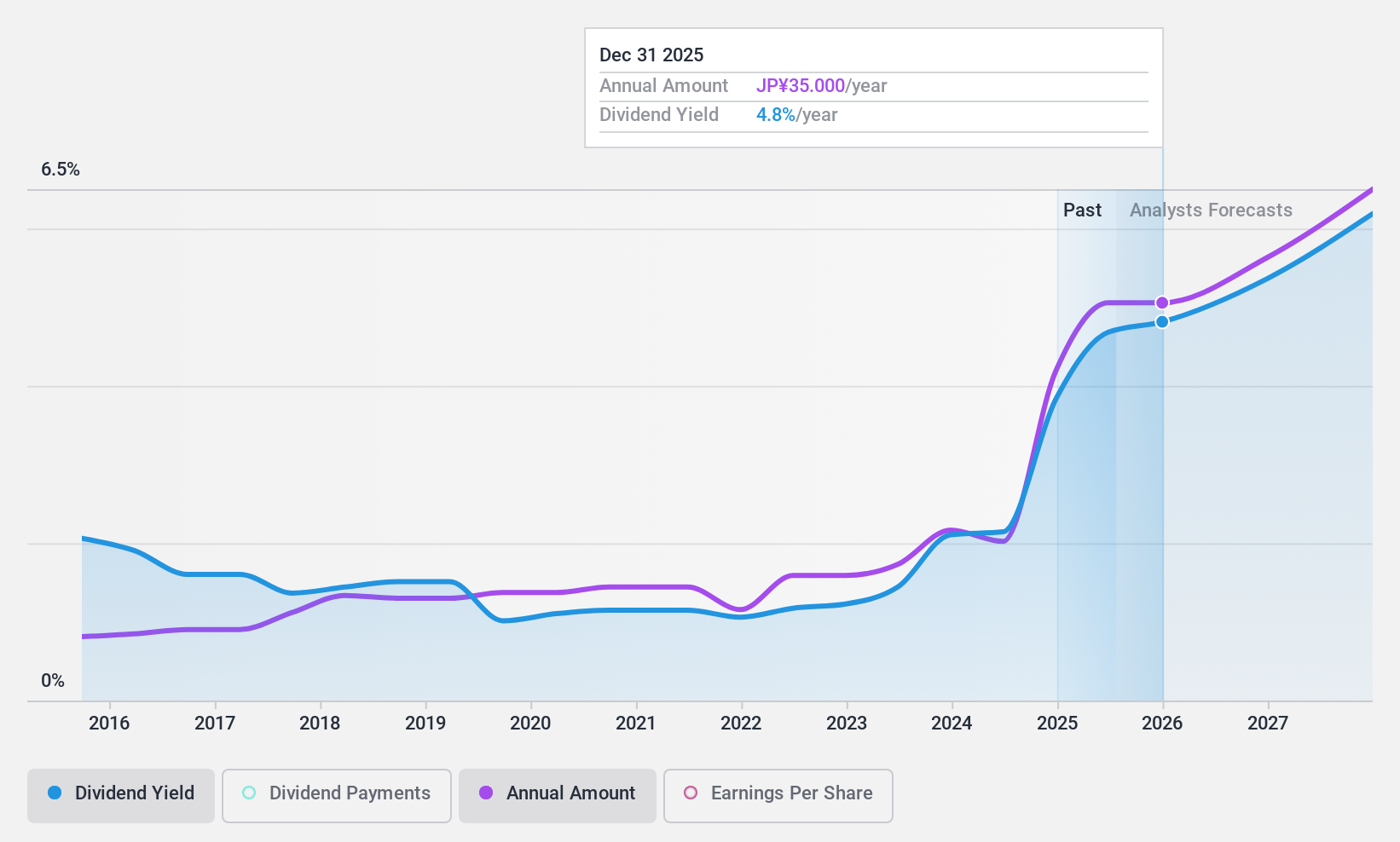

EM Systems (TSE:4820)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EM Systems Co., Ltd. develops and sells IT systems for pharmacies, clinics, and care/welfare businesses in Japan, with a market cap of ¥53.23 billion.

Operations: EM Systems Co., Ltd.'s revenue is primarily derived from its Dispensing System Business at ¥18.94 billion, followed by the Medical System Business at ¥2.39 billion, and the Nursing/Welfare System Business at ¥581 million.

Dividend Yield: 3.8%

EM Systems maintains a reliable dividend history, supported by a low payout ratio of 23.3%, ensuring coverage by earnings. While its 3.77% yield is slightly below the top tier in Japan, dividends have shown stability and growth over the past decade. Recent share buybacks totaling ¥999.25 million reflect strategic capital management and potential value enhancement for shareholders, despite recent share price volatility and large one-off items affecting financial results.

- Navigate through the intricacies of EM Systems with our comprehensive dividend report here.

- Our expertly prepared valuation report EM Systems implies its share price may be lower than expected.

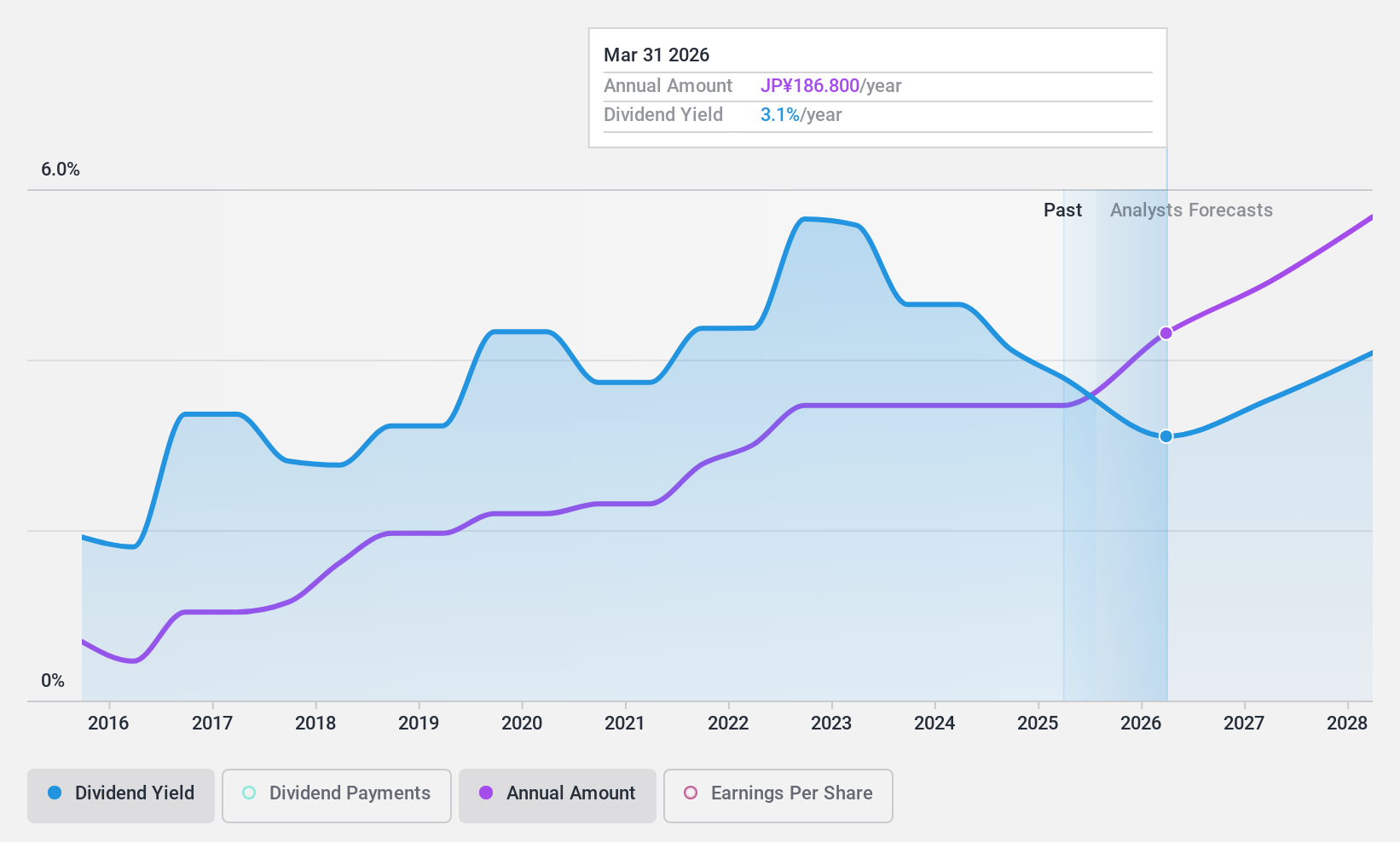

SBI Holdings (TSE:8473)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SBI Holdings, Inc. operates in the online securities and investment sectors in Japan and Saudi Arabia, with a market cap of ¥1.21 trillion.

Operations: SBI Holdings, Inc.'s revenue segments include online securities and investment businesses in Japan and Saudi Arabia.

Dividend Yield: 3.7%

SBI Holdings' dividend payments, while covered by earnings and cash flows with a payout ratio of 55.1% and a cash payout ratio of 2.4%, have been volatile over the past decade. The recent JPY 30 per share dividend for Q2 indicates ongoing commitments to shareholders despite past dilution concerns. Strategic alliances, such as the biotechnology fund in Saudi Arabia and launching an ETF focused on Saudi equities, highlight SBI's expansion efforts which may influence future financial stability and growth potential.

- Click to explore a detailed breakdown of our findings in SBI Holdings' dividend report.

- The valuation report we've compiled suggests that SBI Holdings' current price could be quite moderate.

Seize The Opportunity

- Gain an insight into the universe of 1927 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8473

SBI Holdings

Engages in the online securities and investment businesses in Japn and Saudi Arabia.

Undervalued with solid track record and pays a dividend.