Is Chery Auto (SEHK:9973) Undervalued? A Fresh Look at Its Recent Valuation Signals

Reviewed by Kshitija Bhandaru

Chery Automobile (SEHK:9973) shares have drawn investor attention recently, with performance reflecting shifting sentiment in the Hong Kong automotive sector. Despite some volatility this week, Chery remains a key player that many are watching closely.

See our latest analysis for Chery Automobile.

Although Chery’s share price has pulled back, logging a 5.09% drop over the past week, the year-to-date share price return of -4.26% signals that momentum has been fading. The sector is reassessing growth prospects and short-term risks are weighing on sentiment.

If shifts in the auto sector have you looking for new opportunities, now’s the perfect time to explore See the full list for free.

With Chery trading at a notable intrinsic discount and investor momentum cooling, is this a rare chance to pick up shares with untapped upside? Or is the market already factoring in future growth prospects?

Price-to-Earnings of 10.1x: Is it justified?

Chery Automobile’s shares trade at a price-to-earnings ratio of 10.1x, a level that stands out significantly against its sector. With the last close at HK$30.56, investors are currently paying much less for Chery’s earnings compared to peers.

The price-to-earnings (P/E) ratio reflects what investors are willing to pay for each dollar of company earnings. This metric is especially important in the automotive industry, where stable profits and growth prospects often guide valuation benchmarks.

For Chery, the current P/E ratio signals that the market may be undervaluing its profit potential, possibly due to short-term volatility or uncertainties about future performance. This valuation stands well below both the Asian Auto industry’s average P/E of 21.8x and the peer average of 11.7x. This suggests a notable discount even among similar companies. Should sentiment shift or profits sustain, there may be room for the market to re-rate the stock.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.1x (UNDERVALUED)

However, weaker revenue trends or lingering concerns over future profitability could limit any near-term upside for Chery shares. This is despite their current discount.

Find out about the key risks to this Chery Automobile narrative.

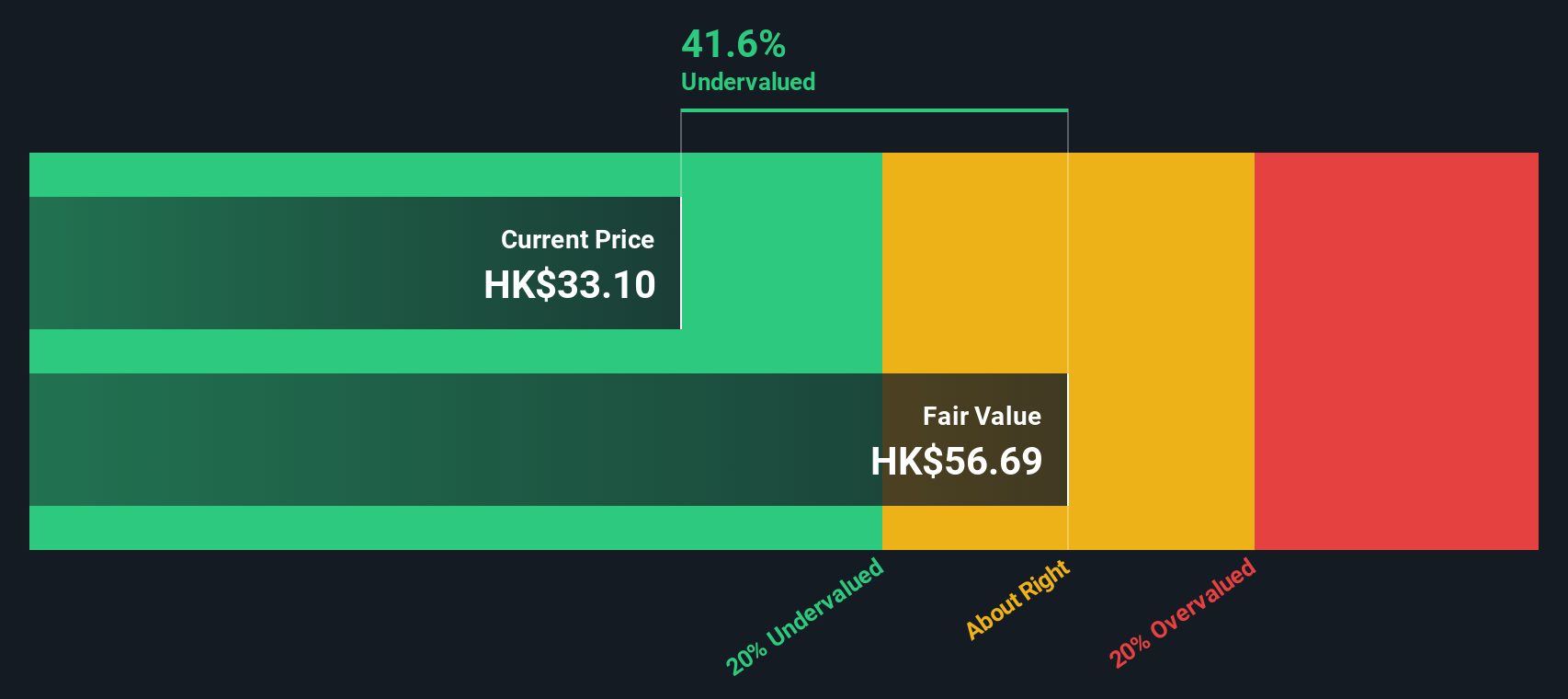

Another View: DCF Model Suggests Significant Undervaluation

While the current price-to-earnings ratio signals Chery may be undervalued on earnings, the SWS DCF model presents an even more pronounced perspective. According to this method, Chery shares are trading about 45.5% below our estimated fair value, highlighting potentially greater upside than valuation multiples alone suggest. Is the market being overly cautious, or is opportunity knocking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Chery Automobile for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Chery Automobile Narrative

If you see things differently or want your own in-depth perspective, it’s easy to build your own view from the data in just a few minutes. Do it your way

A great starting point for your Chery Automobile research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for the next opportunity. The Simply Wall Street Screener surfaces actionable ideas in just minutes. Now is the time to act before others do.

- Unlock the power of strong cash flows by checking out these 874 undervalued stocks based on cash flows hiding in plain sight, each showing compelling potential for long-term value.

- Boost your passive income strategy by exploring these 20 dividend stocks with yields > 3% offering robust yields beyond 3% and solid fundamentals for reliable returns.

- Embrace innovation in medicine and artificial intelligence by reviewing these 33 healthcare AI stocks that are transforming healthcare with smart solutions and scalable breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9973

Chery Automobile

Designs, develops, manufactures, and sells passenger vehicles in the People's Republic of China, rest of Asia, Europe, Americas, Oceania, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives