After Leaping 52% Zhejiang Leapmotor Technology Co., Ltd. (HKG:9863) Shares Are Not Flying Under The Radar

Zhejiang Leapmotor Technology Co., Ltd. (HKG:9863) shareholders would be excited to see that the share price has had a great month, posting a 52% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.2% over the last year.

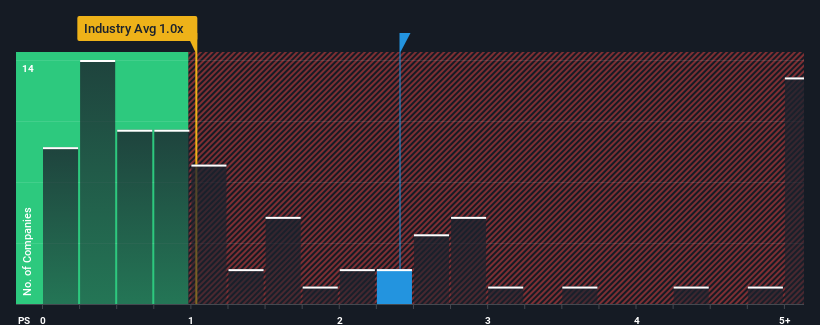

After such a large jump in price, given close to half the companies operating in Hong Kong's Auto industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Zhejiang Leapmotor Technology as a stock to potentially avoid with its 2.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Zhejiang Leapmotor Technology

How Has Zhejiang Leapmotor Technology Performed Recently?

Recent times have been advantageous for Zhejiang Leapmotor Technology as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Leapmotor Technology.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Zhejiang Leapmotor Technology's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered an exceptional 35% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 65% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 18% per annum, which is noticeably less attractive.

In light of this, it's understandable that Zhejiang Leapmotor Technology's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Zhejiang Leapmotor Technology's P/S

The large bounce in Zhejiang Leapmotor Technology's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Zhejiang Leapmotor Technology shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 2 warning signs we've spotted with Zhejiang Leapmotor Technology.

If you're unsure about the strength of Zhejiang Leapmotor Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Leapmotor Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9863

Zhejiang Leapmotor Technology

Zhejiang Leapmotor Technology Co., Ltd. principally engages in the research and development, production, and sale of energy vehicles in the People’s Republic of China.

Exceptional growth potential with adequate balance sheet.