- Hong Kong

- /

- Auto Components

- /

- SEHK:6830

Shareholders May Not Be So Generous With Huazhong In-Vehicle Holdings Company Limited's (HKG:6830) CEO Compensation And Here's Why

Key Insights

- Huazhong In-Vehicle Holdings to hold its Annual General Meeting on 3rd of June

- CEO Minfeng Zhou's total compensation includes salary of CN¥1.37m

- The overall pay is 95% above the industry average

- Huazhong In-Vehicle Holdings' total shareholder return over the past three years was 13% while its EPS was down 29% over the past three years

The share price of Huazhong In-Vehicle Holdings Company Limited (HKG:6830) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 3rd of June. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Huazhong In-Vehicle Holdings

How Does Total Compensation For Minfeng Zhou Compare With Other Companies In The Industry?

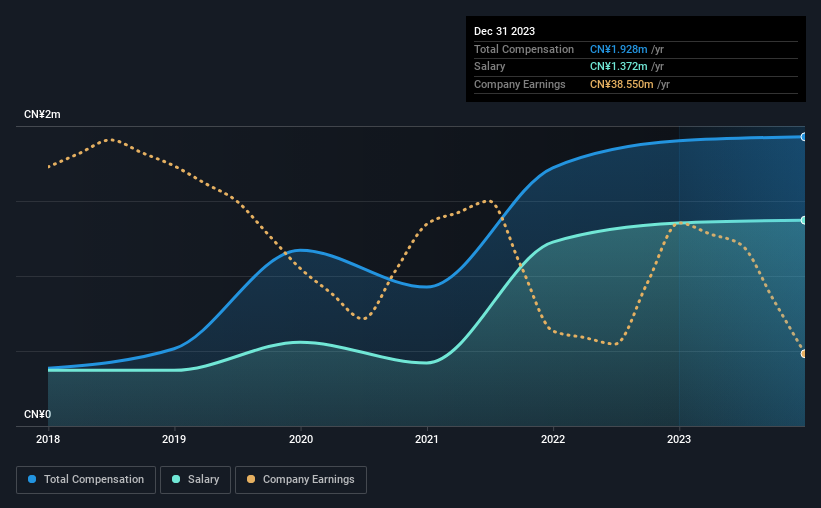

Our data indicates that Huazhong In-Vehicle Holdings Company Limited has a market capitalization of HK$4.1b, and total annual CEO compensation was reported as CN¥1.9m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is CN¥1.37m, represents most of the total compensation being paid.

On comparing similar companies from the Hong Kong Auto Components industry with market caps ranging from HK$1.6b to HK$6.3b, we found that the median CEO total compensation was CN¥988k. Accordingly, our analysis reveals that Huazhong In-Vehicle Holdings Company Limited pays Minfeng Zhou north of the industry median. Furthermore, Minfeng Zhou directly owns HK$3.0b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥1.4m | CN¥1.4m | 71% |

| Other | CN¥556k | CN¥548k | 29% |

| Total Compensation | CN¥1.9m | CN¥1.9m | 100% |

Talking in terms of the industry, salary represented approximately 83% of total compensation out of all the companies we analyzed, while other remuneration made up 17% of the pie. In Huazhong In-Vehicle Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Huazhong In-Vehicle Holdings Company Limited's Growth Numbers

Over the last three years, Huazhong In-Vehicle Holdings Company Limited has shrunk its earnings per share by 29% per year. In the last year, its revenue is down 3.9%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Huazhong In-Vehicle Holdings Company Limited Been A Good Investment?

With a total shareholder return of 13% over three years, Huazhong In-Vehicle Holdings Company Limited shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Huazhong In-Vehicle Holdings you should be aware of, and 1 of them is a bit concerning.

Switching gears from Huazhong In-Vehicle Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Huazhong In-Vehicle Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6830

Huazhong In-Vehicle Holdings

An investment holding company, manufactures, supplies, and sells automobile body parts in Mainland China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026