- Hong Kong

- /

- Auto Components

- /

- SEHK:425

Minth Group Limited (HKG:425) Just Released Its Half-Yearly Earnings: Here's What Analysts Think

Investors in Minth Group Limited (HKG:425) had a good week, as its shares rose 5.3% to close at HK$11.18 following the release of its interim results. Results were roughly in line with estimates, with revenues of CN¥11b and statutory earnings per share of CN¥0.93. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Minth Group

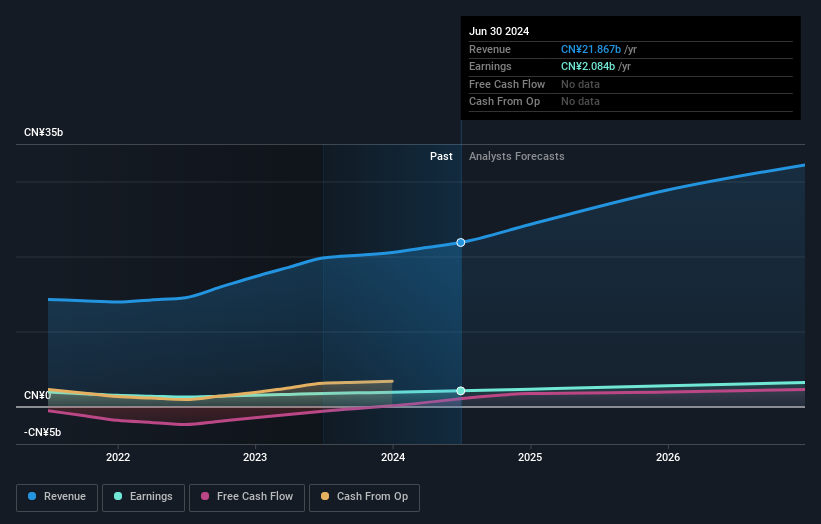

Following the latest results, Minth Group's 18 analysts are now forecasting revenues of CN¥24.3b in 2024. This would be a solid 11% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to ascend 11% to CN¥1.99. Yet prior to the latest earnings, the analysts had been anticipated revenues of CN¥24.7b and earnings per share (EPS) of CN¥1.98 in 2024. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at HK$20.50. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Minth Group at HK$27.04 per share, while the most bearish prices it at HK$14.99. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting Minth Group's growth to accelerate, with the forecast 23% annualised growth to the end of 2024 ranking favourably alongside historical growth of 13% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 10% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Minth Group is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Minth Group going out to 2026, and you can see them free on our platform here.

You can also see whether Minth Group is carrying too much debt, and whether its balance sheet is healthy, for free on our platform here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:425

Minth Group

An investment holding company, designs, develops, manufactures, processes, and sells automobile body parts and moulds of passenger cars.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)