David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that New Focus Auto Tech Holdings Limited (HKG:360) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for New Focus Auto Tech Holdings

What Is New Focus Auto Tech Holdings's Net Debt?

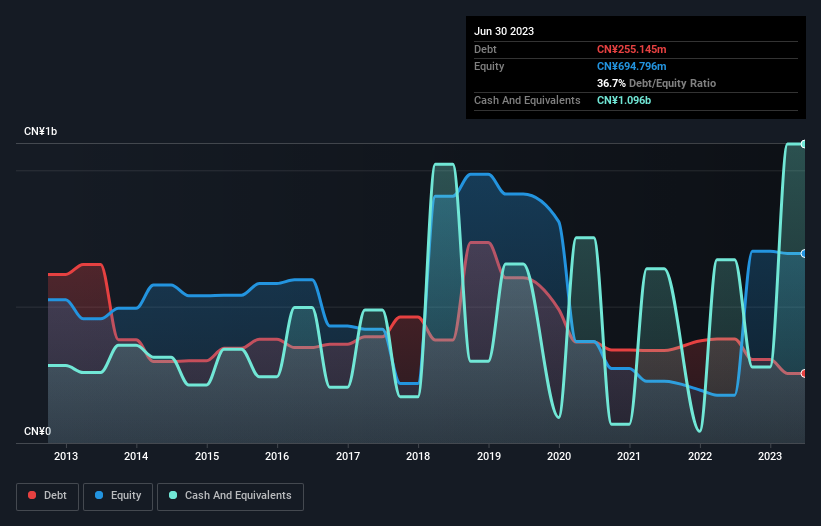

The image below, which you can click on for greater detail, shows that New Focus Auto Tech Holdings had debt of CN¥255.1m at the end of June 2023, a reduction from CN¥381.7m over a year. But it also has CN¥1.10b in cash to offset that, meaning it has CN¥841.1m net cash.

A Look At New Focus Auto Tech Holdings' Liabilities

According to the last reported balance sheet, New Focus Auto Tech Holdings had liabilities of CN¥701.5m due within 12 months, and liabilities of CN¥42.1m due beyond 12 months. Offsetting these obligations, it had cash of CN¥1.10b as well as receivables valued at CN¥94.4m due within 12 months. So it actually has CN¥447.1m more liquid assets than total liabilities.

This surplus strongly suggests that New Focus Auto Tech Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Simply put, the fact that New Focus Auto Tech Holdings has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since New Focus Auto Tech Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, New Focus Auto Tech Holdings saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that's not too bad, we'd prefer see growth.

So How Risky Is New Focus Auto Tech Holdings?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that New Focus Auto Tech Holdings had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CN¥42m and booked a CN¥36m accounting loss. Given it only has net cash of CN¥841.1m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example New Focus Auto Tech Holdings has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if New Focus Auto Tech Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:360

New Focus Auto Tech Holdings

An investment holding company, engages in the manufacturing and sales of electronic and power-related automotive parts and accessories in the People’s Republic of China, the United States, Europe, and the Asia Pacific.

Excellent balance sheet with weak fundamentals.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026