- Hong Kong

- /

- Auto Components

- /

- SEHK:2025

Here's Why Shareholders May Consider Paying Ruifeng Power Group Company Limited's (HKG:2025) CEO A Little More

Key Insights

- Ruifeng Power Group's Annual General Meeting to take place on 29th of May

- Salary of CN¥314.0k is part of CEO Lianzhou Meng's total remuneration

- Total compensation is 63% below industry average

- Ruifeng Power Group's EPS declined by 31% over the past three years while total shareholder return over the past three years was 95%

Shareholders will be pleased by the robust performance of Ruifeng Power Group Company Limited (HKG:2025) recently and this will be kept in mind in the upcoming AGM on 29th of May. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

Check out our latest analysis for Ruifeng Power Group

How Does Total Compensation For Lianzhou Meng Compare With Other Companies In The Industry?

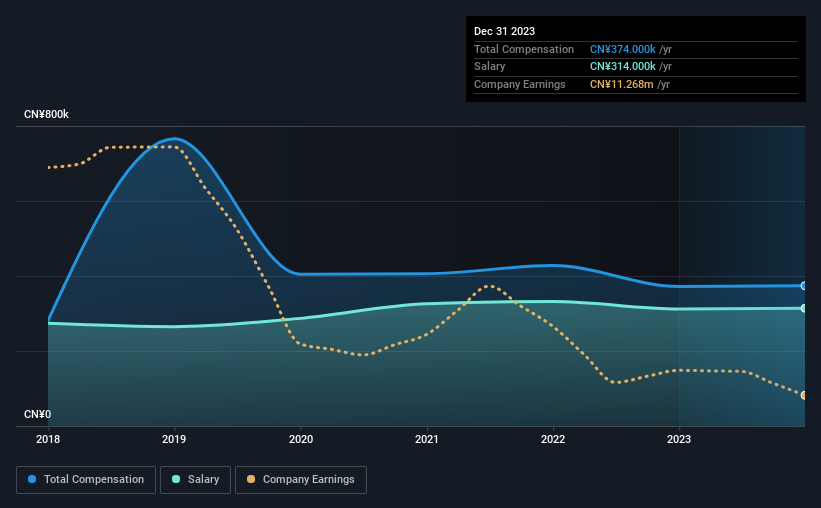

Our data indicates that Ruifeng Power Group Company Limited has a market capitalization of HK$1.4b, and total annual CEO compensation was reported as CN¥374k for the year to December 2023. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is CN¥314.0k, represents most of the total compensation being paid.

For comparison, other companies in the Hong Kong Auto Components industry with market capitalizations ranging between HK$781m and HK$3.1b had a median total CEO compensation of CN¥1.0m. In other words, Ruifeng Power Group pays its CEO lower than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥314k | CN¥312k | 84% |

| Other | CN¥60k | CN¥60k | 16% |

| Total Compensation | CN¥374k | CN¥372k | 100% |

Speaking on an industry level, nearly 83% of total compensation represents salary, while the remainder of 17% is other remuneration. Although there is a difference in how total compensation is set, Ruifeng Power Group more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Ruifeng Power Group Company Limited's Growth Numbers

Over the last three years, Ruifeng Power Group Company Limited has shrunk its earnings per share by 31% per year. In the last year, its revenue is up 20%.

Investors would be a bit wary of companies that have lower EPS But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Ruifeng Power Group Company Limited Been A Good Investment?

Boasting a total shareholder return of 95% over three years, Ruifeng Power Group Company Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 2 warning signs for Ruifeng Power Group (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2025

Ruifeng Power Group

An investment holding company, engages in the design, development, manufacture, and sale of cylinder blocks and heads in the People's Republic of China.

Adequate balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)