- Hong Kong

- /

- Auto Components

- /

- SEHK:1930

Is Shinelong Automotive Lightweight Application (HKG:1930) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Shinelong Automotive Lightweight Application Limited (HKG:1930) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Shinelong Automotive Lightweight Application

What Is Shinelong Automotive Lightweight Application's Debt?

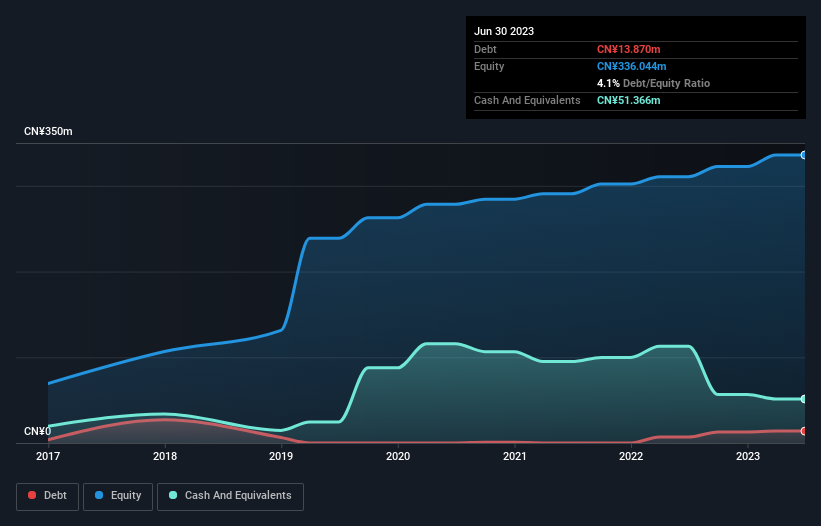

You can click the graphic below for the historical numbers, but it shows that as of June 2023 Shinelong Automotive Lightweight Application had CN¥13.9m of debt, an increase on CN¥6.94m, over one year. But it also has CN¥51.4m in cash to offset that, meaning it has CN¥37.5m net cash.

How Strong Is Shinelong Automotive Lightweight Application's Balance Sheet?

According to the last reported balance sheet, Shinelong Automotive Lightweight Application had liabilities of CN¥245.2m due within 12 months, and liabilities of CN¥16.5m due beyond 12 months. Offsetting this, it had CN¥51.4m in cash and CN¥100.7m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥109.6m.

This deficit isn't so bad because Shinelong Automotive Lightweight Application is worth CN¥198.2m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. While it does have liabilities worth noting, Shinelong Automotive Lightweight Application also has more cash than debt, so we're pretty confident it can manage its debt safely.

In addition to that, we're happy to report that Shinelong Automotive Lightweight Application has boosted its EBIT by 72%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Shinelong Automotive Lightweight Application will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Shinelong Automotive Lightweight Application may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Shinelong Automotive Lightweight Application saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing Up

Although Shinelong Automotive Lightweight Application's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of CN¥37.5m. And we liked the look of last year's 72% year-on-year EBIT growth. So we are not troubled with Shinelong Automotive Lightweight Application's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example Shinelong Automotive Lightweight Application has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1930

Shinelong Automotive Lightweight Application

An investment holding company, designs and develops moulding services and solutions in Mainland China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026