How Geely's Surging September Sales Could Influence Investor Sentiment for SEHK:175

Reviewed by Sasha Jovanovic

- Geely Automobile Holdings Limited announced its unaudited group sales results for September 2025, reporting vehicle sales of 273,125 units for the month and 2.17 million units year to date, both higher than the same period last year.

- This surge in sales volume highlights increasing demand for Geely's vehicles and suggests strengthening market performance for the company throughout 2025.

- We'll examine how Geely's substantial growth in vehicle sales volume could influence its future earnings narrative and analyst outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Geely Automobile Holdings Investment Narrative Recap

To be a shareholder in Geely Automobile Holdings, you need confidence in its ability to outpace intense competition, leverage innovation in new energy vehicles, and expand into key international markets. The recent announcement of record sales volumes in September 2025 may help build momentum toward its revised annual sales guidance, acting as a catalyst for near-term investor sentiment. However, sustained pricing pressure and profit margin risks from fierce domestic and global competition remain important factors to watch; these could limit earnings growth even as volumes accelerate.

Of the recent company updates, Geely’s upward revision of its 2025 sales target from 2,710,000 to 3,000,000 units in July ties directly to the sales surge reported for September. This alignment between operational execution and forward-looking targets supports the narrative that Geely is focused on rapid volume growth, but also places pressure on the company to sustain its pace amid evolving industry challenges such as the shift to NEVs and international market uncertainties.

In stark contrast, investors should pay careful attention to how competitive pricing in the NEV market could impact net margins over the coming quarters…

Read the full narrative on Geely Automobile Holdings (it's free!)

Geely Automobile Holdings is projected to reach CN¥463.1 billion in revenue and CN¥22.5 billion in earnings by 2028. This outlook assumes a 19.5% annual revenue growth rate and an earnings increase of CN¥7.4 billion from current earnings of CN¥15.1 billion.

Uncover how Geely Automobile Holdings' forecasts yield a HK$26.28 fair value, a 39% upside to its current price.

Exploring Other Perspectives

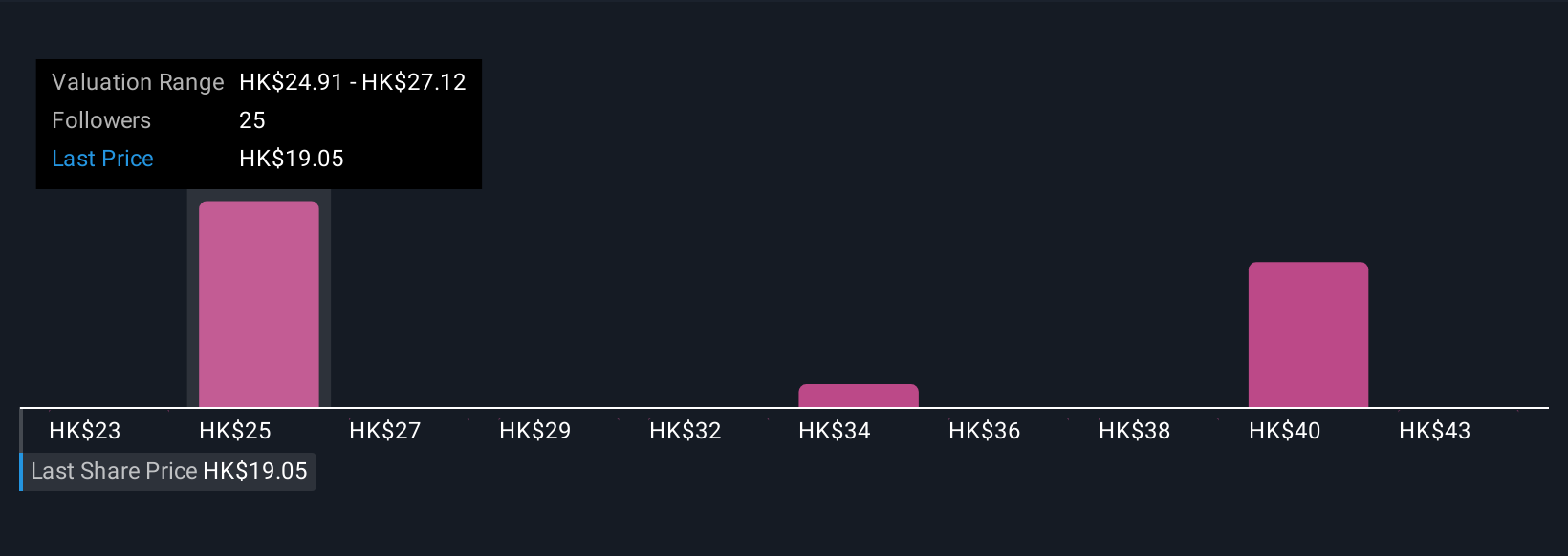

Six private investors from the Simply Wall St Community place Geely’s fair value between HK$22.70 and HK$44.78 per share. While the latest record vehicle sales may suggest business momentum, the threat of margin pressure in the New Energy Vehicle segment remains a key concern for the company’s performance. Look through different fair value opinions to see the range of possible outcomes.

Explore 6 other fair value estimates on Geely Automobile Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Geely Automobile Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Geely Automobile Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Geely Automobile Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Geely Automobile Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:175

Geely Automobile Holdings

An investment holding company, operates as an automobile manufacturer primarily in the People’s Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives