- Greece

- /

- Telecom Services and Carriers

- /

- ATSE:HTO

Hellenic Telecommunications Organization S.A. (ATH:HTO) Stock Is Going Strong But Fundamentals Look Uncertain: What Lies Ahead ?

Most readers would already be aware that Hellenic Telecommunications Organization's (ATH:HTO) stock increased significantly by 20% over the past month. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. Specifically, we decided to study Hellenic Telecommunications Organization's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Hellenic Telecommunications Organization

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hellenic Telecommunications Organization is:

6.9% = €148m ÷ €2.1b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every €1 of its shareholder's investments, the company generates a profit of €0.07.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Hellenic Telecommunications Organization's Earnings Growth And 6.9% ROE

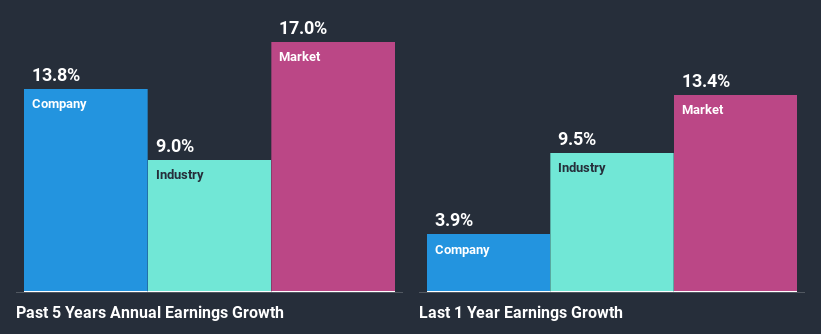

As you can see, Hellenic Telecommunications Organization's ROE looks pretty weak. Even compared to the average industry ROE of 11%, the company's ROE is quite dismal. Although, we can see that Hellenic Telecommunications Organization saw a modest net income growth of 14% over the past five years. Therefore, the growth in earnings could probably have been caused by other variables. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that Hellenic Telecommunications Organization's growth is quite high when compared to the industry average growth of 6.3% in the same period, which is great to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Hellenic Telecommunications Organization fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Hellenic Telecommunications Organization Efficiently Re-investing Its Profits?

While Hellenic Telecommunications Organization has a three-year median payout ratio of 91% (which means it retains 8.6% of profits), the company has still seen a fair bit of earnings growth in the past, meaning that its high payout ratio hasn't hampered its ability to grow.

Besides, Hellenic Telecommunications Organization has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 72% over the next three years. The fact that the company's ROE is expected to rise to 25% over the same period is explained by the drop in the payout ratio.

Conclusion

On the whole, we feel that the performance shown by Hellenic Telecommunications Organization can be open to many interpretations. While no doubt its earnings growth is pretty substantial, its ROE and earnings retention is quite poor. So while the company has managed to grow its earnings in spite of this, we are unconvinced if this growth could extend, especially during troubled times. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you decide to trade Hellenic Telecommunications Organization, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hellenic Telecommunications Organization might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ATSE:HTO

Hellenic Telecommunications Organization

Engages in the provision of telecommunications and related services to residential and businesses in Greece and Romania.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives