- Greece

- /

- Metals and Mining

- /

- ATSE:IKTIN

The total return for Iktinos Hellas Greek Marble Industry Technical and Touristic (ATH:IKTIN) investors has risen faster than earnings growth over the last five years

It hasn't been the best quarter for Iktinos Hellas S.A. Greek Marble Industry Technical and Touristic Company (ATH:IKTIN) shareholders, since the share price has fallen 19% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 165% in that time. We think it's more important to dwell on the long term returns than the short term returns. Of course, that doesn't necessarily mean it's cheap now. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 47% decline over the last three years: that's a long time to wait for profits.

While the stock has fallen 10% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Iktinos Hellas Greek Marble Industry Technical and Touristic

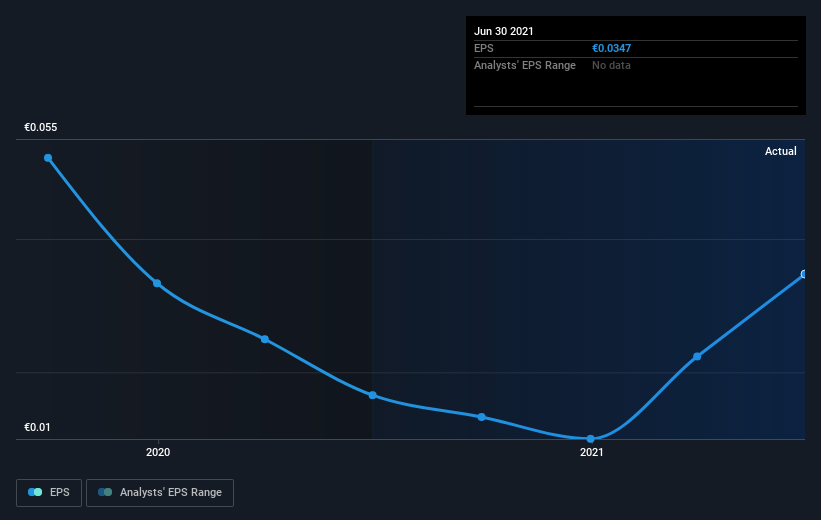

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Iktinos Hellas Greek Marble Industry Technical and Touristic achieved compound earnings per share (EPS) growth of 18% per year. So the EPS growth rate is rather close to the annualized share price gain of 22% per year. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Iktinos Hellas Greek Marble Industry Technical and Touristic's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Iktinos Hellas Greek Marble Industry Technical and Touristic, it has a TSR of 232% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Iktinos Hellas Greek Marble Industry Technical and Touristic shares lost 4.7% throughout the year, that wasn't as bad as the market loss of 12%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 27% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Iktinos Hellas Greek Marble Industry Technical and Touristic has 6 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Iktinos Hellas Greek Marble Industry Technical and Touristic is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:IKTIN

Iktinos Hellas Greek Marble Industry Technical and Touristic

Engages in the quarrying, processing, and trading in marbles and granites in Greece, the Euro Area, and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives