- Greece

- /

- Metals and Mining

- /

- ATSE:ELHA

Despite delivering investors losses of 12% over the past 1 year, Elvalhalcor Hellenic Copper and Aluminium Industry (ATH:ELHA) has been growing its earnings

Elvalhalcor Hellenic Copper and Aluminium Industry S.A. (ATH:ELHA) shareholders should be happy to see the share price up 15% in the last quarter. But in truth the last year hasn't been good for the share price. In fact, the price has declined 13% in a year, falling short of the returns you could get by investing in an index fund.

While the stock has risen 9.4% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out the opportunities and risks within the GR Metals and Mining industry.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Elvalhalcor Hellenic Copper and Aluminium Industry share price fell, it actually saw its earnings per share (EPS) improve by 41%. Of course, the situation might betray previous over-optimism about growth.

The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

With a low yield of 1.8% we doubt that the dividend influences the share price much. Elvalhalcor Hellenic Copper and Aluminium Industry managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

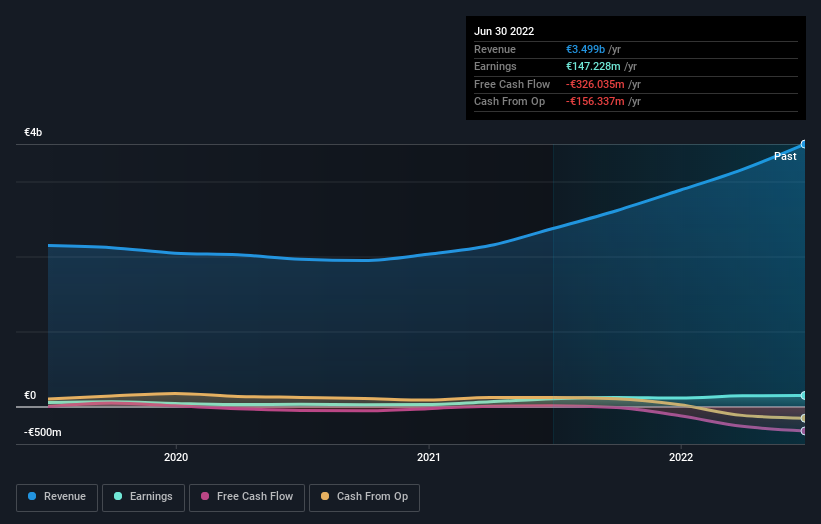

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for Elvalhalcor Hellenic Copper and Aluminium Industry shares, which performed worse than the market, costing holders 12%, including dividends. Meanwhile, the broader market slid about 0.5%, likely weighing on the stock. The three-year loss of 1.5% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Elvalhalcor Hellenic Copper and Aluminium Industry better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Elvalhalcor Hellenic Copper and Aluminium Industry you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

If you're looking to trade Elvalhalcor Hellenic Copper and Aluminium Industry, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elvalhalcor Hellenic Copper and Aluminium Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:ELHA

Elvalhalcor Hellenic Copper and Aluminium Industry

Elvalhalcor Hellenic Copper and Aluminium Industry S.A.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives