- Greece

- /

- Personal Products

- /

- ATSE:PAP

Did You Participate In Any Of Papoutsanis' (ATH:PAP) Incredible 530% Return?

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. To wit, the Papoutsanis S.A. (ATH:PAP) share price has soared 498% over five years. If that doesn't get you thinking about long term investing, we don't know what will. And in the last week the share price has popped 5.8%.

View our latest analysis for Papoutsanis

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

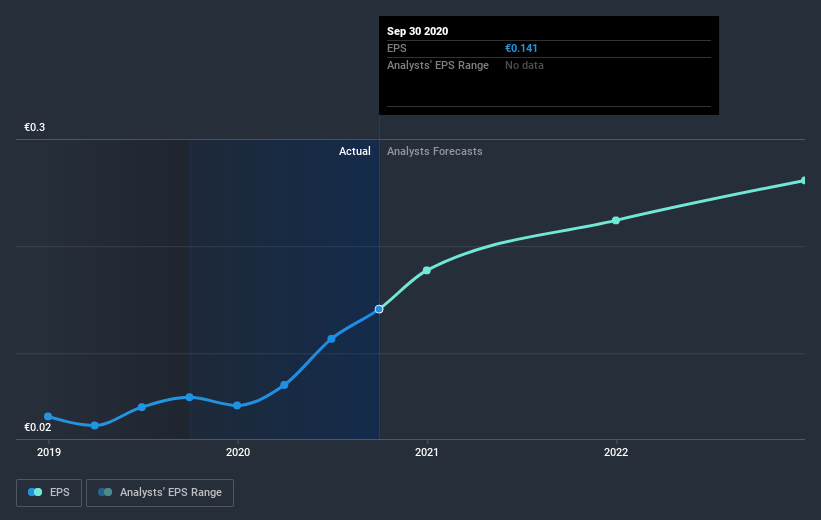

During the five years of share price growth, Papoutsanis moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Papoutsanis share price is up 296% in the last three years. Meanwhile, EPS is up 169% per year. This EPS growth is higher than the 58% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Papoutsanis has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Papoutsanis' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Papoutsanis hasn't been paying dividends, but its TSR of 530% exceeds its share price return of 498%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Papoutsanis shareholders have received a total shareholder return of 58% over one year. That's better than the annualised return of 44% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Papoutsanis that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

If you decide to trade Papoutsanis, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Papoutsanis, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ATSE:PAP

Papoutsanis

Engages in the production and sale of soaps and liquid cosmetics in Greece.

Undervalued with solid track record.

Market Insights

Community Narratives