- Greece

- /

- Healthcare Services

- /

- ATSE:IATR

Did Athens Medical Center's (ATH:IATR) Share Price Deserve to Gain 92%?

Athens Medical Center S.A. (ATH:IATR) shareholders might be concerned after seeing the share price drop 11% in the last month. On the other hand the returns over the last half decade have not been bad. The share price is up 92%, which is better than the market return of 80%. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 37% drop, in the last year.

View our latest analysis for Athens Medical Center

Given that Athens Medical Center didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Athens Medical Center saw its revenue grow at 5.3% per year. That's not a very high growth rate considering the bottom line. The modest growth is probably broadly reflected in the share price, which is up 14%, per year over 5 years. We'd be looking for the underlying business to grow revenue a bit faster.

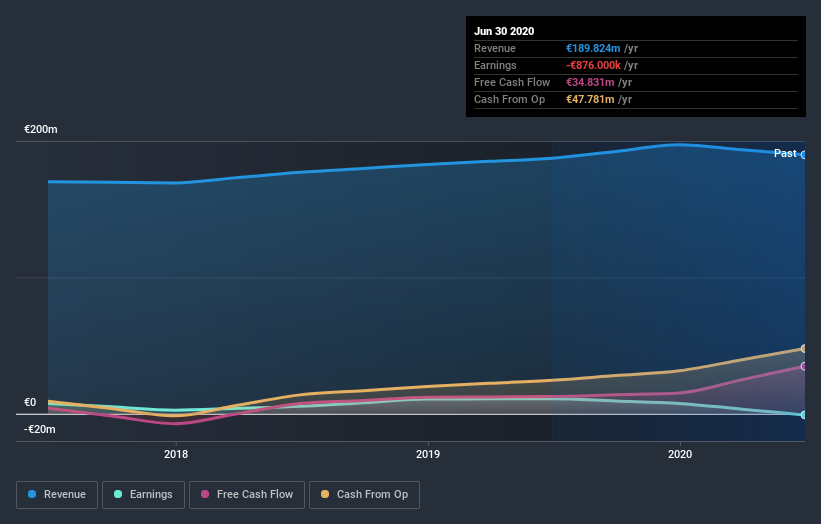

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Athens Medical Center's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 15% in the twelve months, Athens Medical Center shareholders did even worse, losing 37%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 14% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

If you’re looking to trade Athens Medical Center, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Athens Medical C.S.A, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ATSE:IATR

Athens Medical C.S.A

Offers healthcare services in Greece and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives