- Greece

- /

- Infrastructure

- /

- ATSE:OLTH

Why Investors Shouldn't Be Surprised By Thessaloniki Port Authority Societe Anonyme's (ATH:OLTH) 31% Share Price Surge

Thessaloniki Port Authority Societe Anonyme (ATH:OLTH) shareholders have had their patience rewarded with a 31% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 29%.

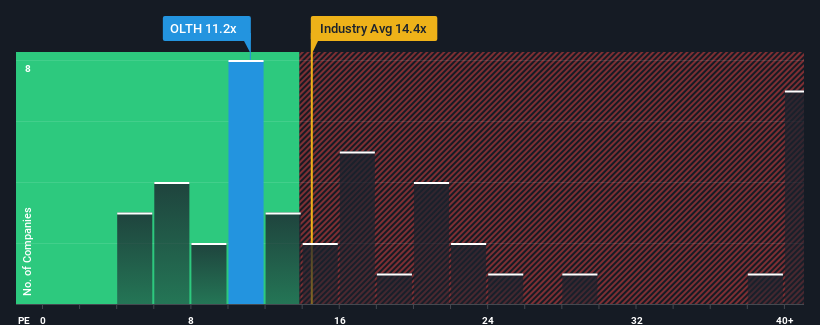

Although its price has surged higher, there still wouldn't be many who think Thessaloniki Port Authority Societe Anonyme's price-to-earnings (or "P/E") ratio of 11.2x is worth a mention when the median P/E in Greece is similar at about 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Thessaloniki Port Authority Societe Anonyme certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Thessaloniki Port Authority Societe Anonyme

Is There Some Growth For Thessaloniki Port Authority Societe Anonyme?

In order to justify its P/E ratio, Thessaloniki Port Authority Societe Anonyme would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 46%. EPS has also lifted 26% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

It's interesting to note that the rest of the market is similarly expected to grow by 8.9% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Thessaloniki Port Authority Societe Anonyme's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

Thessaloniki Port Authority Societe Anonyme's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Thessaloniki Port Authority Societe Anonyme revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Thessaloniki Port Authority Societe Anonyme that you need to be mindful of.

If you're unsure about the strength of Thessaloniki Port Authority Societe Anonyme's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Thessaloniki Port Authority Societe Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:OLTH

Thessaloniki Port Authority Societe Anonyme

Offers transportation services in Greece.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives