- Greece

- /

- Capital Markets

- /

- ATSE:PVMEZZ

The one-year returns for Phoenix Vega Mezz's (ATH:PVMEZZ) shareholders have been , yet its earnings growth was even better

It's nice to see the Phoenix Vega Mezz Plc (ATH:PVMEZZ) share price up 13% in a week. But that doesn't change the fact that the returns over the last year have been less than pleasing. After all, the share price is down 11% in the last year, significantly under-performing the market.

The recent uptick of 13% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Our free stock report includes 2 warning signs investors should be aware of before investing in Phoenix Vega Mezz. Read for free now.In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Phoenix Vega Mezz saw its earnings per share increase strongly. We don't think the growth guide to the sustainable growth rate in this case, but we do think this sort of increase is impressive. As you can imagine, the share price action therefore perturbs us. So it's worth taking a look at some other metrics.

We don't see any weakness in the Phoenix Vega Mezz's dividend so the steady payout can't really explain the share price drop. The revenue trend doesn't seem to explain why the share price is down. Of course, it could simply be that it simply fell short of the market consensus expectations.

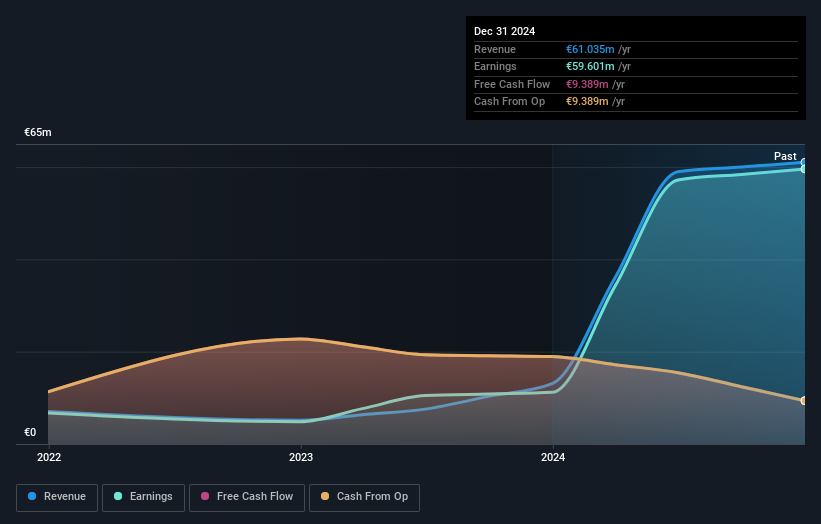

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Phoenix Vega Mezz, it has a TSR of 4.0% for the last 1 year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Phoenix Vega Mezz shareholders are up 4.0% for the year (even including dividends). Unfortunately this falls short of the market return of around 17%. At least the longer term returns (running at about 29% a year, are better. We prefer focus on longer term returns, as they are usually a more meaningful indication of the underlying business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Phoenix Vega Mezz is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:PVMEZZ

Phoenix Vega Mezz

Phoenix Vega Mezz Plc holds and manages mezzanine and junior notes of Phoenix and Vega portfolios.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026