- Greece

- /

- Hospitality

- /

- ATSE:OPAP

We Ran A Stock Scan For Earnings Growth And Organization of Football Prognostics (ATH:OPAP) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Organization of Football Prognostics (ATH:OPAP). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Organization of Football Prognostics

How Fast Is Organization of Football Prognostics Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Organization of Football Prognostics has grown EPS by 60% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

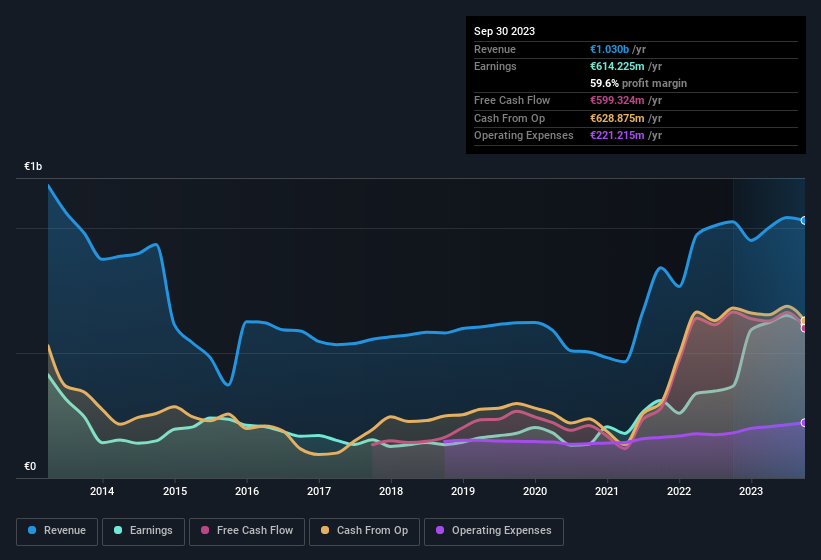

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It seems Organization of Football Prognostics is pretty stable, since revenue and EBIT margins are pretty flat year on year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Organization of Football Prognostics' forecast profits?

Are Organization of Football Prognostics Insiders Aligned With All Shareholders?

Since Organization of Football Prognostics has a market capitalisation of €5.9b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. To be specific, they have €20m worth of shares. This considerable investment should help drive long-term value in the business. Despite being just 0.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Organization of Football Prognostics Deserve A Spot On Your Watchlist?

Organization of Football Prognostics' earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, Organization of Football Prognostics is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Even so, be aware that Organization of Football Prognostics is showing 3 warning signs in our investment analysis , and 2 of those are potentially serious...

Although Organization of Football Prognostics certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Greek companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:OPAP

Organization of Football Prognostics

Engages in the operation and management of numerical lottery and sports betting games in Greece and Cyprus.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives