Here's Why We Think Nafpaktos Textile Industry (ATH:NAYP) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Nafpaktos Textile Industry (ATH:NAYP). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Nafpaktos Textile Industry with the means to add long-term value to shareholders.

Check out our latest analysis for Nafpaktos Textile Industry

Nafpaktos Textile Industry's Improving Profits

In the last three years Nafpaktos Textile Industry's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Nafpaktos Textile Industry's EPS shot from €0.051 to €0.088, over the last year. It's not often a company can achieve year-on-year growth of 73%.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Nafpaktos Textile Industry is growing revenues, and EBIT margins improved by 4.8 percentage points to 15%, over the last year. Both of which are great metrics to check off for potential growth.

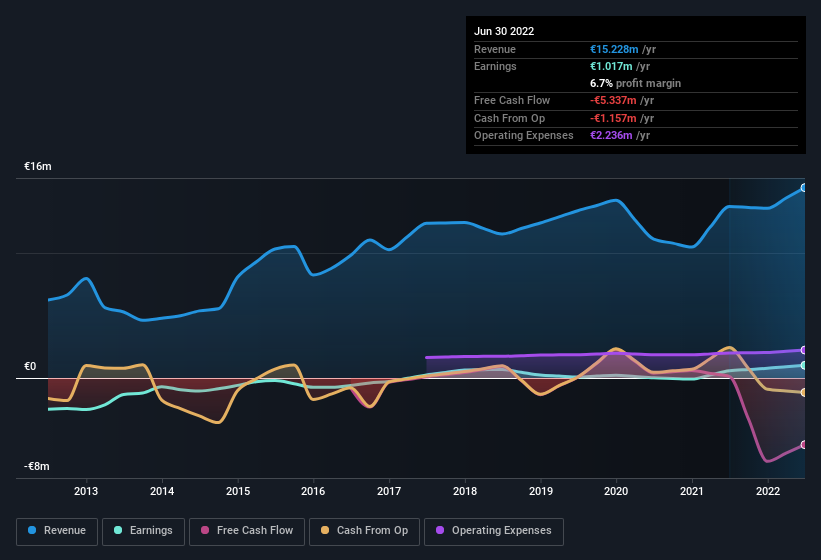

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Nafpaktos Textile Industry isn't a huge company, given its market capitalisation of €13m. That makes it extra important to check on its balance sheet strength.

Are Nafpaktos Textile Industry Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to Nafpaktos Textile Industry, with market caps under €186m is around €126k.

The Nafpaktos Textile Industry CEO received total compensation of only €55k in the year to December 2021. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Nafpaktos Textile Industry To Your Watchlist?

Nafpaktos Textile Industry's earnings have taken off in quite an impressive fashion. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Nafpaktos Textile Industry (at least 1 which is concerning) , and understanding them should be part of your investment process.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Nafpaktos Textile Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:NAYP

Nafpaktos Textile Industry

Engages in the cotton ginning and production of cotton yarns in Greece.

Adequate balance sheet low.

Market Insights

Community Narratives