- Greece

- /

- Trade Distributors

- /

- ATSE:ELTON

Should You Be Adding Elton International Trading (ATH:ELTON) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Elton International Trading (ATH:ELTON). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Elton International Trading

How Fast Is Elton International Trading Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Elton International Trading's EPS has grown 34% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

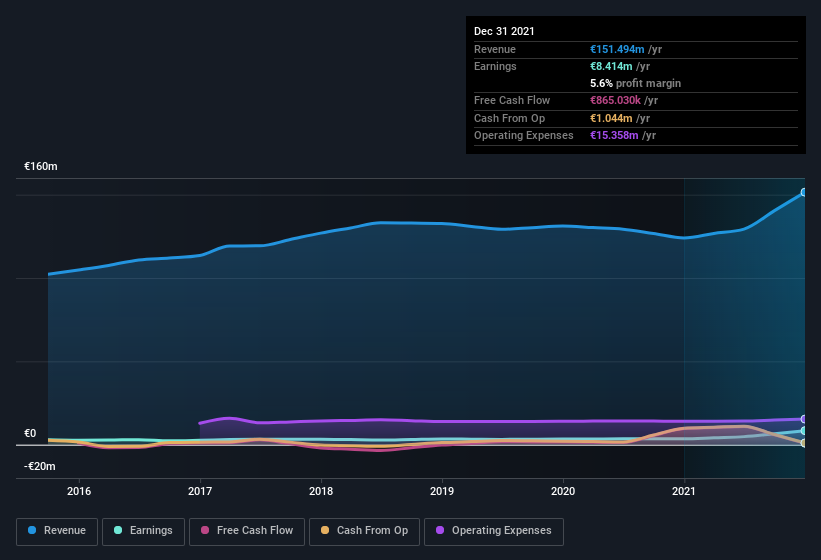

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Elton International Trading shareholders can take confidence from the fact that EBIT margins are up from 5.3% to 8.0%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Elton International Trading is no giant, with a market capitalisation of €52m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Elton International Trading Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Elton International Trading insiders spent €82k on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future. We also note that it was the Founder, Nestor Papathanasiou, who made the biggest single acquisition, paying €24k for shares at about €1.75 each.

On top of the insider buying, we can also see that Elton International Trading insiders own a large chunk of the company. To be exact, company insiders hold 94% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. To give you an idea, the value of insiders' holdings in the business are valued at €49m at the current share price. That's nothing to sneeze at!

Should You Add Elton International Trading To Your Watchlist?

For growth investors, Elton International Trading's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Before you take the next step you should know about the 2 warning signs for Elton International Trading that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Elton International Trading, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Elton International Trading, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elton International Trading might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:ELTON

Elton International Trading

Engages in trading raw materials, additives, chemicals, and other specialized products in Greece, Romania, Turkey, Serbia, Bulgaria, and Ukraine.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives