- United Kingdom

- /

- Water Utilities

- /

- LSE:UU.

United Utilities Group (LSE:UU.) Reports Earnings Decline Despite Dividend Increase and Growth Prospects

Reviewed by Simply Wall St

United Utilities Group (LSE:UU.) has recently announced its half-year earnings, reporting sales of GBP 1,082 million, an increase from the previous year, though net income saw a decline. The company declared a 4.2% increase in its interim dividend, aligning with its policy to match CPIH inflation, showcasing its commitment to shareholder returns. Despite challenges such as a high net debt to equity ratio and operational inefficiencies, the company is focusing on innovation and expansion, with investments in AI and automation expected to enhance profitability. The report covers key areas including financial performance, dividend strategy, and growth opportunities amidst external threats.

Unlock comprehensive insights into our analysis of United Utilities Group stock here.

Unique Capabilities Enhancing United Utilities Group's Market Position

United Utilities Group has demonstrated a strong capacity for growth, with earnings projected to increase by 26.1% annually over the next three years. This anticipated growth is supported by a forecasted return on equity of 22.7%, indicating strong future profitability. The company's recent profitability and stable dividend history over the past decade reinforce its financial health. The interim dividend increase of 4.2% aligns with its policy to match CPIH inflation, reflecting a commitment to shareholder returns. Louise Beardmore, during the recent earnings call, emphasized the success of new product launches that have significantly boosted revenue, showcasing the company's innovative edge.

Vulnerabilities Impacting United Utilities Group

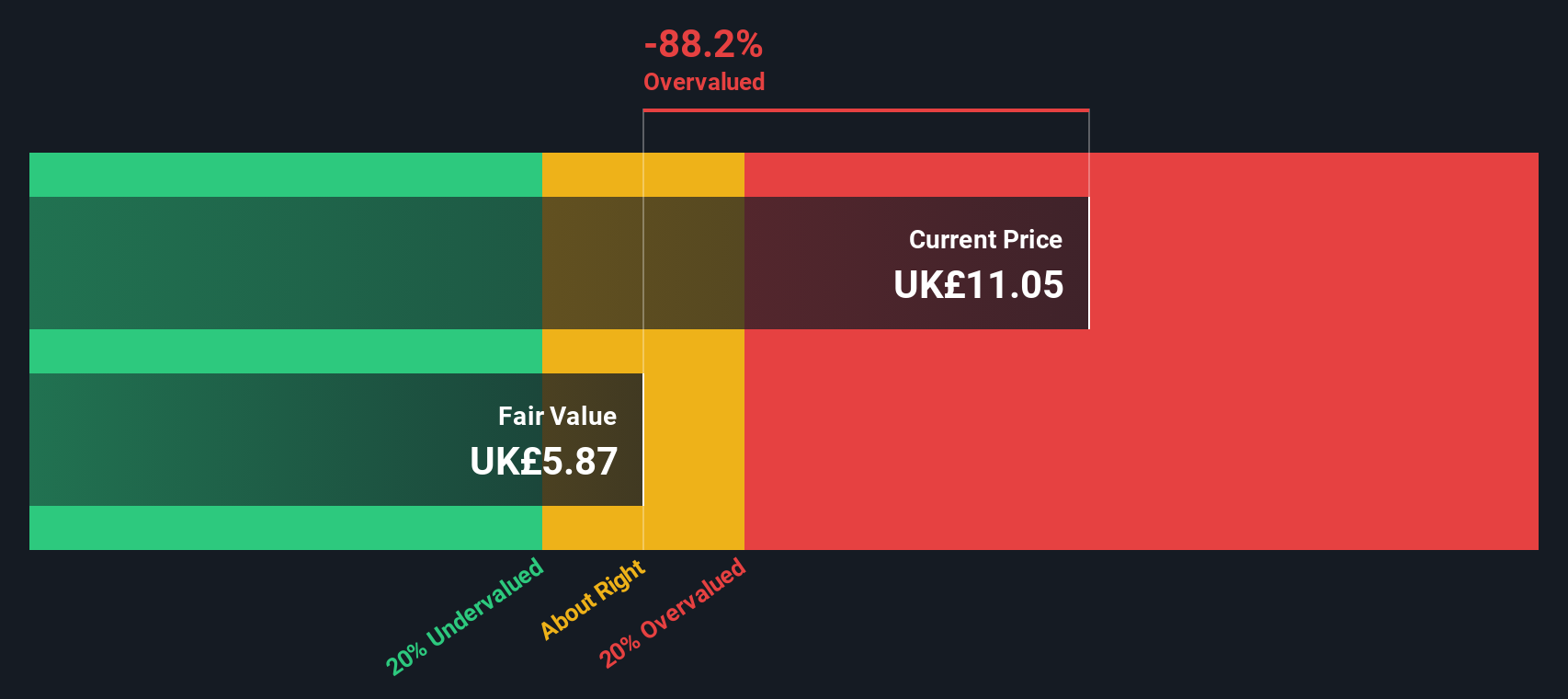

However, the company faces challenges with a 12.8% annual decline in earnings over the past five years, highlighting potential operational inefficiencies. The current return on equity stands at a modest 5.8%, and the high net debt to equity ratio of 454.8% suggests financial risks. Dividend payments are not fully covered by earnings or cash flows, with a payout ratio of 304%, which could strain financial resources. The company's trading above its estimated fair value, with a high Price-To-Earnings Ratio of 65.4x, suggests potential overvaluation, which may not be sustainable if growth targets are not met.

Areas for Expansion and Innovation for United Utilities Group

Opportunities abound as revenue is expected to grow at 8.1%, outpacing the UK market's 3.6% growth rate. The company is well-positioned to enhance its profitability and financial health. Philip Aspin noted the effectiveness of marketing initiatives in expanding the customer base, a crucial factor for sustained growth. Investments in AI and automation are anticipated to yield significant efficiencies, bolstering operational capabilities and competitive positioning.

External Factors Threatening United Utilities Group

Nonetheless, external threats persist, including economic headwinds that could impact consumer spending, as highlighted by Aspin. Regulatory changes pose potential operational challenges, requiring close monitoring and adaptation. Supply chain disruptions remain a concern, potentially affecting product availability and customer satisfaction. The dividend yield of 4.59% is lower than the top 25% of UK dividend payers, which could affect investor appeal if not addressed.

Conclusion

United Utilities Group is poised for significant growth with projected earnings increases of 26.1% annually over the next three years, driven by innovative product launches and a strong return on equity of 22.7%. However, the company must address its operational inefficiencies, as evidenced by a 12.8% annual decline in earnings over the past five years, and manage its high net debt to equity ratio of 454.8%, which presents financial challenges. Despite these vulnerabilities, the company's strategic investments in AI and automation, along with effective marketing initiatives, position it well to capitalize on a revenue growth rate of 8.1%, surpassing the UK market average. Yet, trading at a Price-To-Earnings Ratio of 65.4x, the company appears to be priced higher than its industry peers, suggesting that sustaining this valuation will depend on meeting growth targets and maintaining financial discipline amidst external economic and regulatory pressures.

Where To Now?

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:UU.

United Utilities Group

Provides water and wastewater services in the United Kingdom.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives