- United Kingdom

- /

- Software

- /

- LSE:PINE

Undervalued Small Caps With Insider Action In UK For January 2025

Reviewed by Simply Wall St

In recent months, the UK market has faced challenges as evidenced by the FTSE 100's decline following weak trade data from China, highlighting global economic uncertainties that have impacted investor sentiment. As larger indices grapple with these pressures, small-cap stocks present unique opportunities for investors seeking potential growth amidst broader market volatility. Identifying promising small-cap stocks often involves examining those with insider activity and strong fundamentals, which can indicate confidence in their potential despite current economic headwinds.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 15.0x | 1.2x | 42.00% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.17% | ★★★★★☆ |

| NCC Group | NA | 1.4x | 23.20% | ★★★★★☆ |

| Sabre Insurance Group | 11.9x | 1.6x | 8.33% | ★★★★☆☆ |

| iomart Group | 25.3x | 0.7x | 30.72% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 49.92% | ★★★★☆☆ |

| Warpaint London | 24.2x | 4.2x | 1.21% | ★★★☆☆☆ |

| Telecom Plus | 18.3x | 0.7x | 29.29% | ★★★☆☆☆ |

| Breedon Group | 15.7x | 1.0x | 45.01% | ★★★☆☆☆ |

| THG | NA | 0.3x | -613.63% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

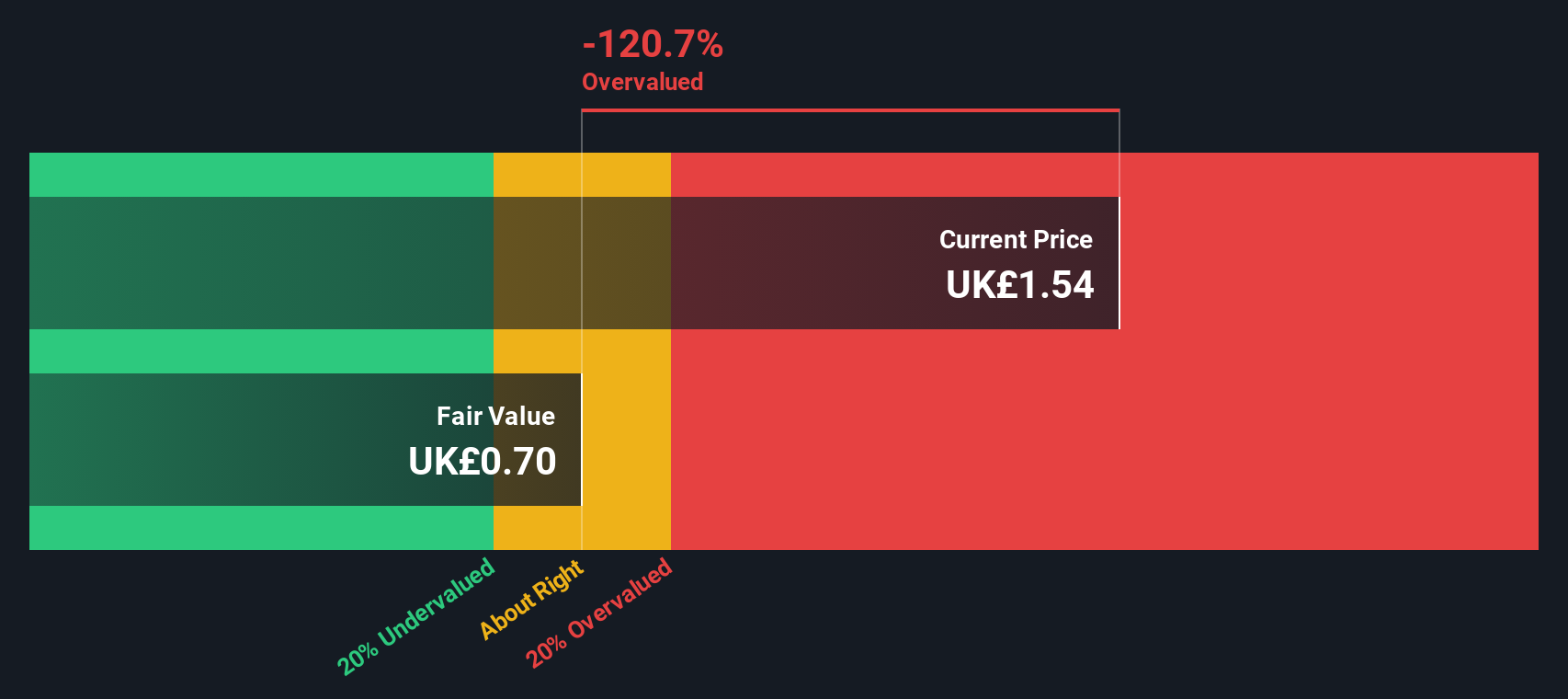

Gym Group (LSE:GYM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gym Group operates a network of high-quality health and fitness facilities, with a market capitalization of £0.15 billion.

Operations: The company's revenue primarily comes from providing high-quality health and fitness facilities, totaling £216.3 million in the latest period. Cost of goods sold is minimal at £2.9 million, leading to a gross profit margin of 98.66%. Operating expenses are significant, with general and administrative expenses alone reaching £133.6 million, contributing to a net income loss of £2.1 million for the same period.

PE: -133.1x

Gym Group, a UK-based fitness chain with 241 locations, is expanding rapidly under new leadership. Recently appointing Hamish Latchem as chief property officer in December 2024, they plan to open four more gyms by year-end and target an additional 50 by 2026. Despite relying solely on external borrowing for funding, earnings are projected to grow at an impressive rate of 113% annually. This growth potential positions Gym Group as a compelling opportunity within the small-cap sector.

- Click here to discover the nuances of Gym Group with our detailed analytical valuation report.

Assess Gym Group's past performance with our detailed historical performance reports.

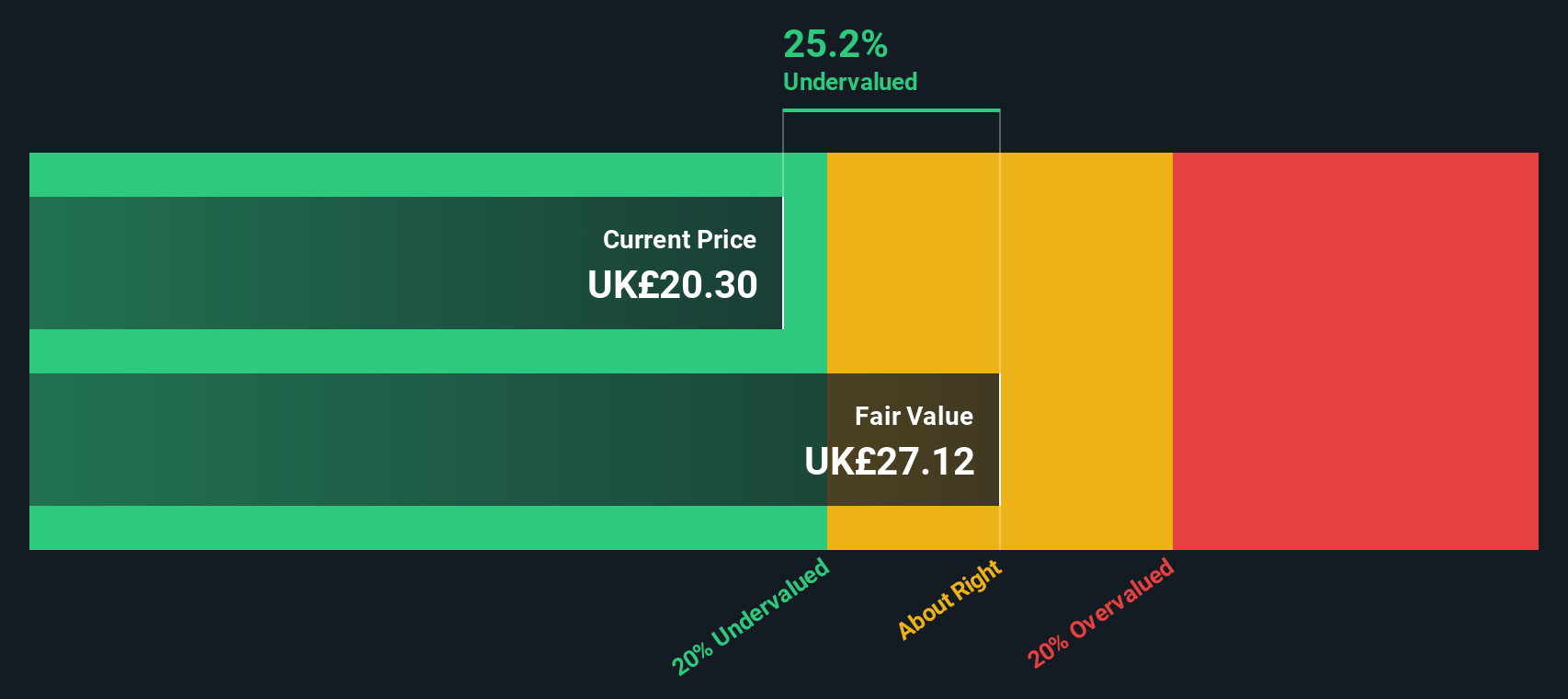

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pinewood Technologies Group is a company that specializes in software solutions, with operations focused on providing innovative technology services.

Operations: Pinewood Technologies Group's revenue primarily stems from its software segment, with recent figures showing a gross profit margin of 88.98%. The company's cost structure includes operating expenses and non-operating expenses, which impact its net income.

PE: 37.7x

Pinewood Technologies Group, a smaller player in the UK market, recently secured a significant 5-year contract with Marshall Motor Group to implement its systems across 120 dealerships. This expansion into major dealership groups highlights potential growth opportunities. Insider confidence is evident as Ollie Mann acquired 31,498 shares for £102,452 in October 2024, boosting their holdings by over 2,500%. Earnings are projected to grow by approximately 25% annually despite reliance on external borrowing for funding.

- Dive into the specifics of Pinewood Technologies Group here with our thorough valuation report.

Learn about Pinewood Technologies Group's historical performance.

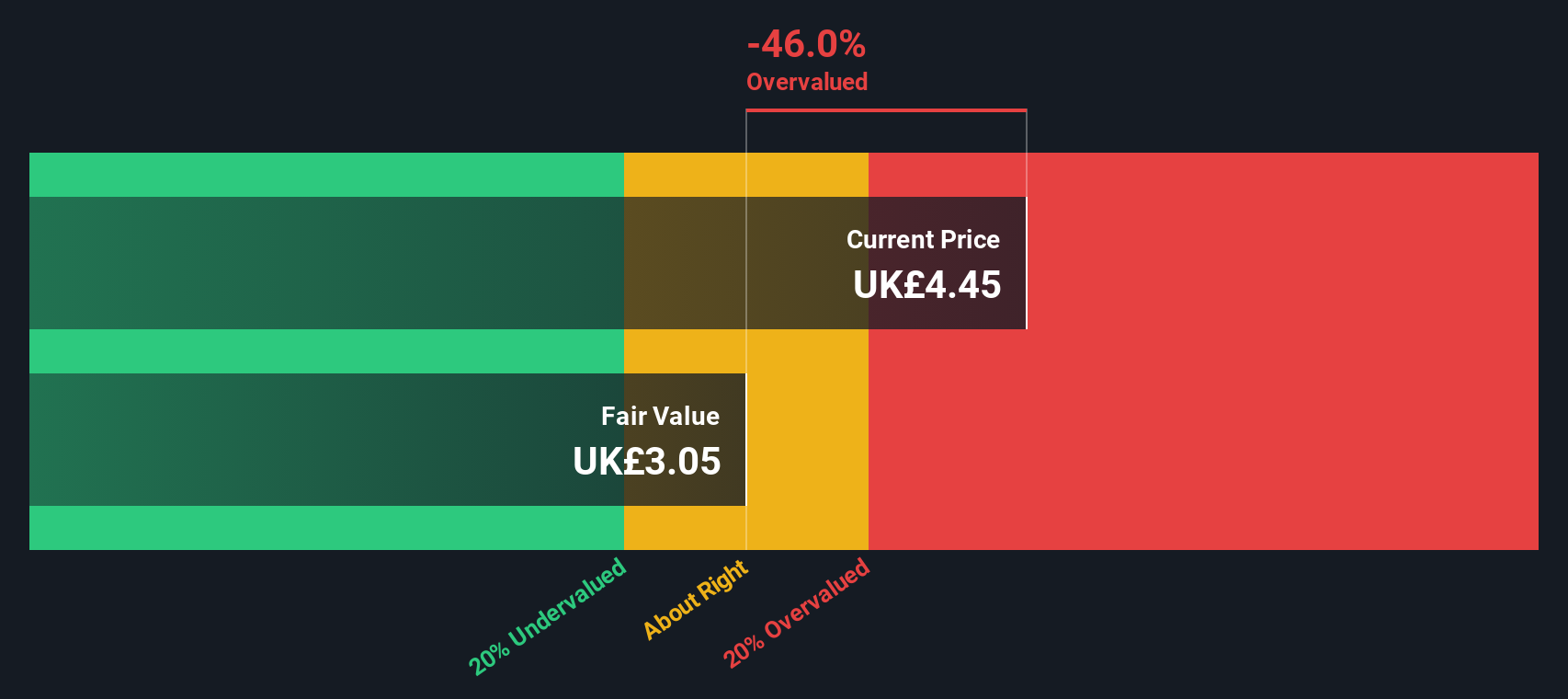

Telecom Plus (LSE:TEP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Telecom Plus is a UK-based multi-utility provider offering bundled services such as energy, broadband, and mobile, with a market cap of £1.47 billion.

Operations: Telecom Plus primarily generates revenue from its non-regulated utility segment, with recent figures showing £1.85 billion in this area. The company's gross profit margin has shown variability, reaching 19.32% as of the latest period. Operating expenses include significant allocations to general and administrative costs, which were £184.78 million recently, alongside sales and marketing expenditures of £50.36 million for the same period.

PE: 18.3x

Telecom Plus, a small UK company, recently reported half-year sales of £697.75 million, down from £883.63 million the previous year, yet net income rose to £27.63 million from £23.37 million. Their earnings per share also improved slightly. Notably, insider confidence is evident as Non-Executive Chairman Charles Wigoder purchased 200,000 shares for approximately £3.54 million in late 2024, suggesting belief in potential growth despite high external debt reliance and no customer deposits for funding stability. Earnings are projected to grow annually by nearly 12%, indicating optimism for future performance amidst financial challenges.

- Click to explore a detailed breakdown of our findings in Telecom Plus' valuation report.

Gain insights into Telecom Plus' past trends and performance with our Past report.

Next Steps

- Click through to start exploring the rest of the 34 Undervalued UK Small Caps With Insider Buying now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider in the United Kingdom, rest of Europe, Africa, Asia, the Middle East, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives