Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that SSE plc (LON:SSE) is about to go ex-dividend in just 4 days. If you purchase the stock on or after the 14th of January, you won't be eligible to receive this dividend, when it is paid on the 11th of March.

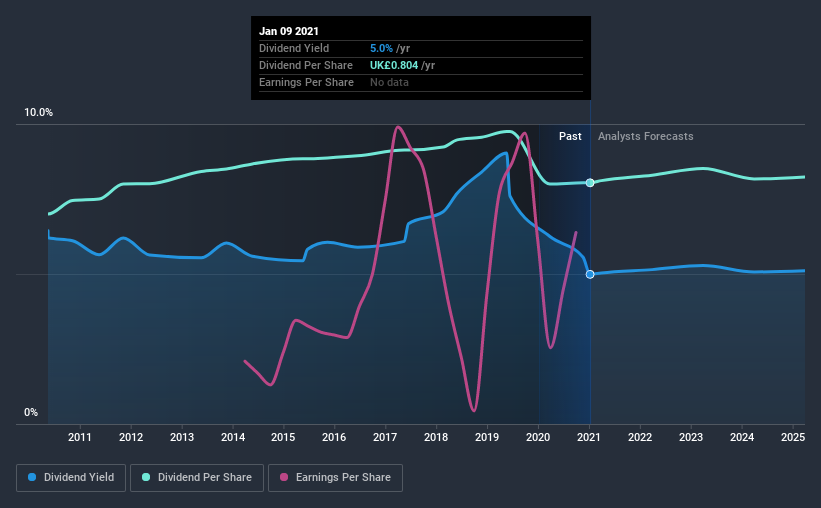

SSE's next dividend payment will be UK£0.24 per share, and in the last 12 months, the company paid a total of UK£0.80 per share. Calculating the last year's worth of payments shows that SSE has a trailing yield of 5.0% on the current share price of £16.12. If you buy this business for its dividend, you should have an idea of whether SSE's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for SSE

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. It paid out 79% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the past year it paid out 163% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

While SSE's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Were this to happen repeatedly, this would be a risk to SSE's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Fortunately for readers, SSE's earnings per share have been growing at 13% a year for the past five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last 10 years, SSE has lifted its dividend by approximately 1.4% a year on average. It's good to see both earnings and the dividend have improved - although the former has been rising much quicker than the latter, possibly due to the company reinvesting more of its profits in growth.

To Sum It Up

Is SSE an attractive dividend stock, or better left on the shelf? Earnings per share growth is a positive, and the company's payout ratio looks normal. However, we note SSE paid out a much higher percentage of its free cash flow, which makes us uncomfortable. All things considered, we are not particularly enthused about SSE from a dividend perspective.

However if you're still interested in SSE as a potential investment, you should definitely consider some of the risks involved with SSE. For instance, we've identified 2 warning signs for SSE (1 is a bit concerning) you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade SSE, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:SSE

SSE

Engages in the generation, transmission, distribution, and supply of electricity.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)