- United Kingdom

- /

- Electric Utilities

- /

- LSE:JEL

These 4 Measures Indicate That Jersey Electricity (LON:JEL) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Jersey Electricity plc (LON:JEL) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Jersey Electricity

What Is Jersey Electricity's Debt?

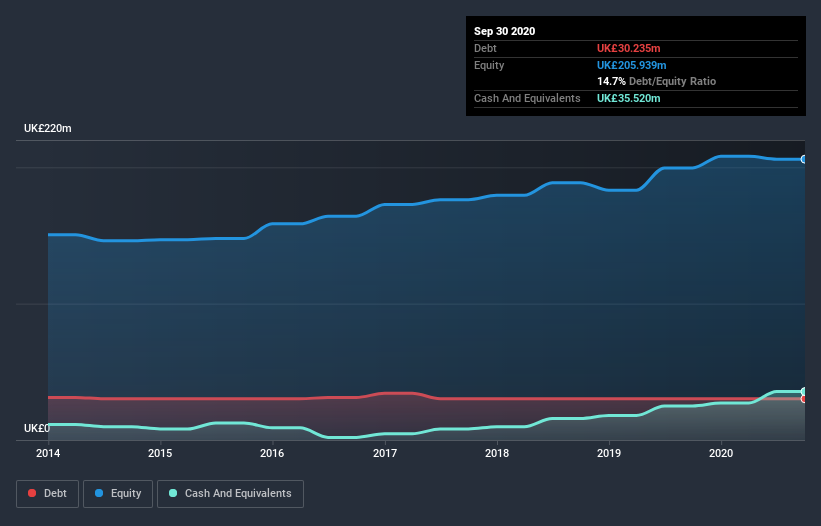

The chart below, which you can click on for greater detail, shows that Jersey Electricity had UK£30.2m in debt in September 2020; about the same as the year before. However, it does have UK£35.5m in cash offsetting this, leading to net cash of UK£5.29m.

How Healthy Is Jersey Electricity's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Jersey Electricity had liabilities of UK£21.1m due within 12 months and liabilities of UK£83.0m due beyond that. On the other hand, it had cash of UK£35.5m and UK£16.6m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£52.0m.

Jersey Electricity has a market capitalization of UK£158.6m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Despite its noteworthy liabilities, Jersey Electricity boasts net cash, so it's fair to say it does not have a heavy debt load!

Jersey Electricity's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. There's no doubt that we learn most about debt from the balance sheet. But it is Jersey Electricity's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Jersey Electricity has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Jersey Electricity recorded free cash flow worth a fulsome 88% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Summing up

While Jersey Electricity does have more liabilities than liquid assets, it also has net cash of UK£5.29m. The cherry on top was that in converted 88% of that EBIT to free cash flow, bringing in UK£16m. So is Jersey Electricity's debt a risk? It doesn't seem so to us. Given Jersey Electricity has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Jersey Electricity or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:JEL

Jersey Electricity

Engages in the generation, transmission, distribution, and supply of electricity in Jersey.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026