- United Kingdom

- /

- Renewable Energy

- /

- AIM:YU.

Discovering Undiscovered Gems in the United Kingdom This January 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices recently closing lower due to weak trade data from China, highlighting the global interconnectedness of markets and the challenges faced by economies still recovering from pandemic-related disruptions. Despite these broader market pressures, there remain opportunities to identify promising small-cap stocks that demonstrate resilience and potential growth in niche sectors, offering investors a chance to explore lesser-known companies that could thrive amidst economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration and development of mineral properties, with a market cap of £289.56 million.

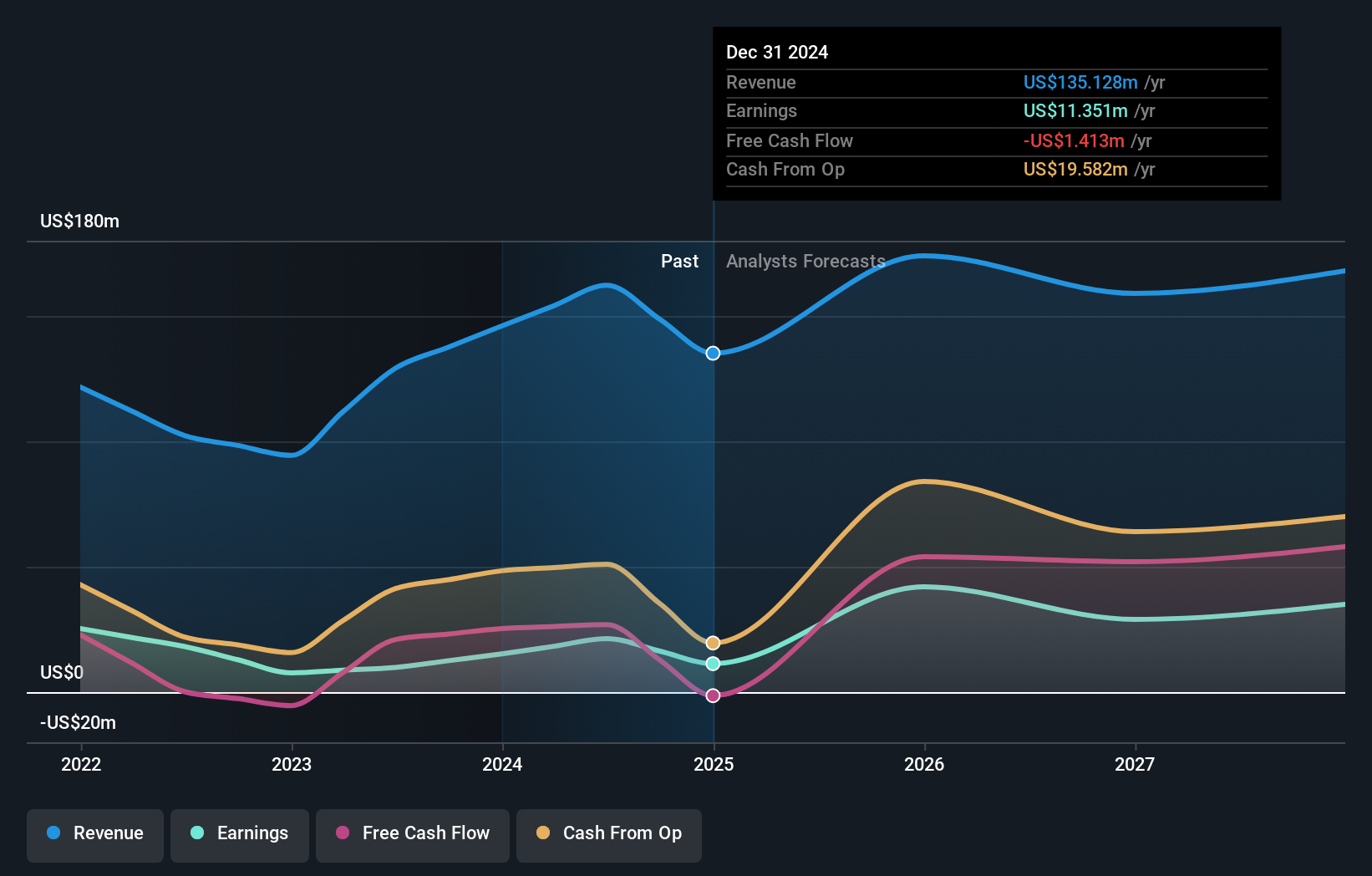

Operations: Griffin Mining's primary revenue stream is derived from the Caijiaying Zinc Gold Mine, generating $162.25 million.

Griffin Mining, a nimble player in the UK market, has been making waves with its recent operational restart at the Caijiaying Mine. The company reported a robust 116.5% earnings growth over the past year, outpacing the industry average of 13%. Despite being debt-free for five years, Griffin's future earnings are expected to dip by an average of 3.8% annually over the next three years. Recent production figures show increased silver and lead output compared to last year, hinting at potential operational efficiencies. Trading at 67% below estimated fair value suggests room for appreciation amidst high-quality earnings and positive free cash flow.

- Navigate through the intricacies of Griffin Mining with our comprehensive health report here.

Gain insights into Griffin Mining's historical performance by reviewing our past performance report.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across various regions including the United Kingdom, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £746.05 million.

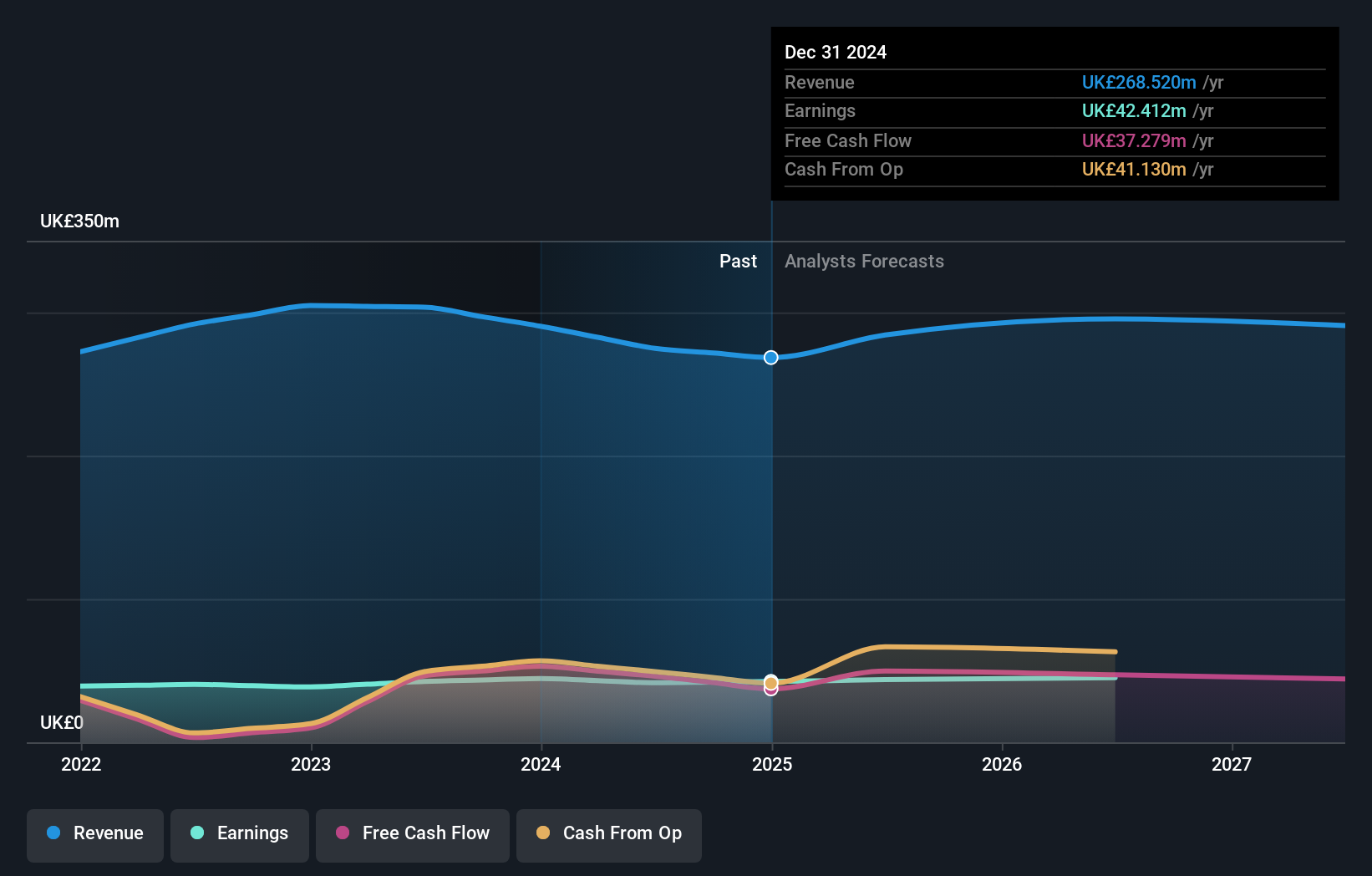

Operations: The primary revenue stream for James Halstead comes from the manufacture and distribution of flooring products, generating £274.88 million.

With earnings forecasted to grow 4.12% annually, James Halstead seems poised for steady progress despite recent leadership changes. Trading at 5.8% below its estimated fair value, the company appears attractively priced for potential investors. Over the past five years, JHD has successfully reduced its debt-to-equity ratio from 0.2 to 0.1, highlighting prudent financial management and maintaining more cash than total debt ensures a robust balance sheet position. Although recent earnings growth was negative at -2.1%, indicating challenges in outpacing industry averages, high-quality past earnings and positive free cash flow provide a solid foundation for future stability and growth prospects in the building sector.

- Get an in-depth perspective on James Halstead's performance by reading our health report here.

Evaluate James Halstead's historical performance by accessing our past performance report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

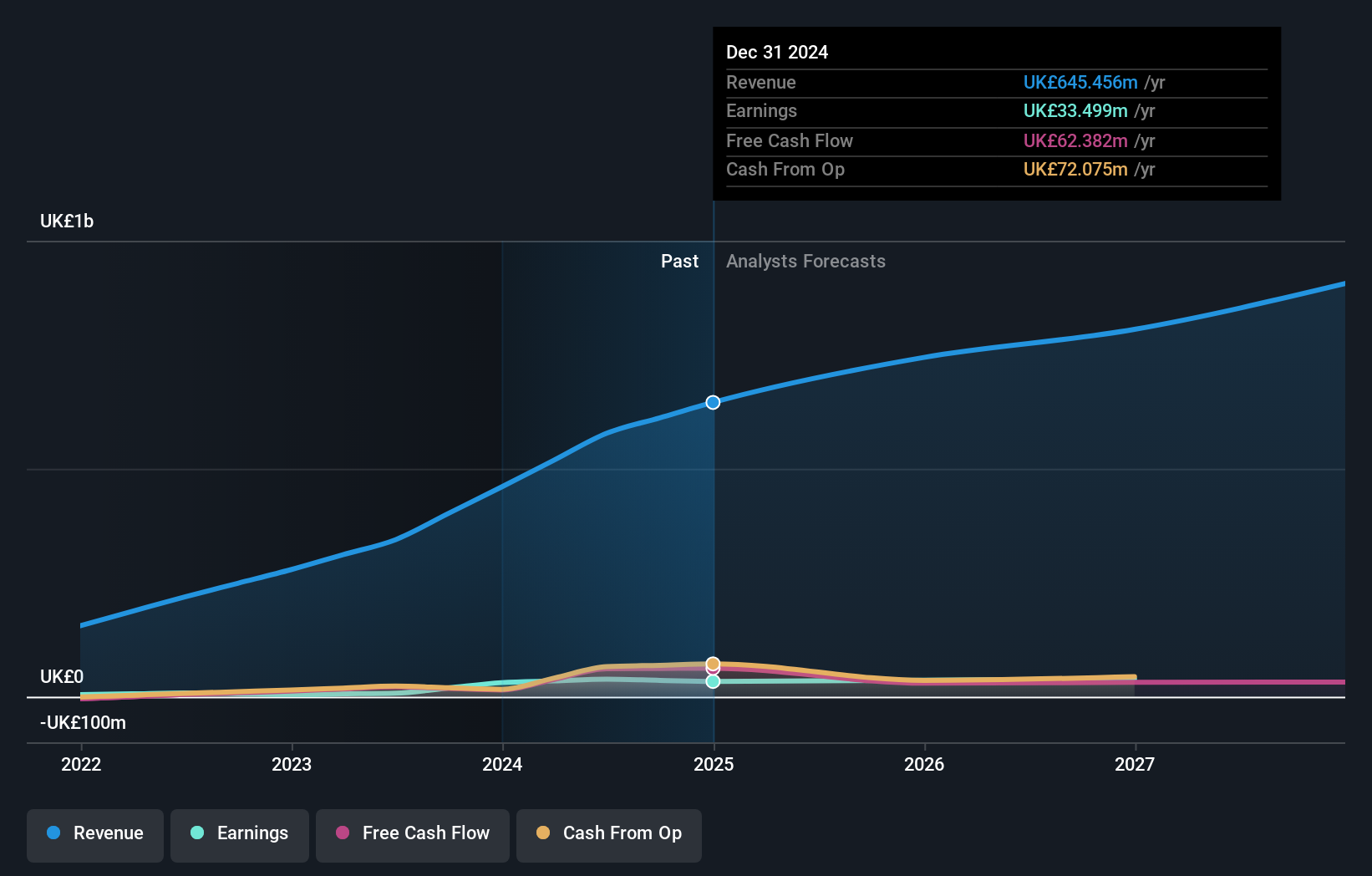

Overview: Yü Group PLC, with a market cap of £327.29 million, supplies energy and utility solutions primarily in the United Kingdom through its subsidiaries.

Operations: The company generates revenue through the supply of energy and utility solutions in the UK. It focuses on optimizing its cost structure to enhance profitability, with a notable emphasis on managing operating expenses. Over recent periods, there has been a trend in its net profit margin, reflecting changes in operational efficiency and market conditions.

Yü Group, a notable player in the UK market, has seen impressive earnings growth of 400% over the past year, outpacing its industry peers. Despite this surge, future earnings are expected to decrease by an average of 1.7% annually over the next three years. The company trades at a substantial discount of 55% below estimated fair value and boasts positive free cash flow with more cash than total debt. However, recent significant insider selling might raise eyebrows among investors. Yü's revenue is forecasted to grow by about 16% per year, suggesting potential for continued expansion despite challenges ahead.

- Click to explore a detailed breakdown of our findings in Yü Group's health report.

Understand Yü Group's track record by examining our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 68 UK Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YU.

Yü Group

Through its subsidiaries, supplies energy and utility solutions primarily in the United Kingdom.

Outstanding track record and undervalued.