The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interconnections. Despite these broader market uncertainties, certain investment opportunities remain intriguing for those willing to explore beyond the usual suspects. Penny stocks, though an older term, continue to offer potential for growth when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.968 | £152.69M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.085 | £785.66M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.274 | £196.49M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.715 | £369.48M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.44 | $255.78M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.96 | £453.67M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.52 | £321.99M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.0875 | £92.91M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Equals Group (AIM:EQLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Equals Group plc develops and sells payment platforms, including prepaid currency cards, international money transfers, and current accounts in the UK, with a market cap of £255.62 million.

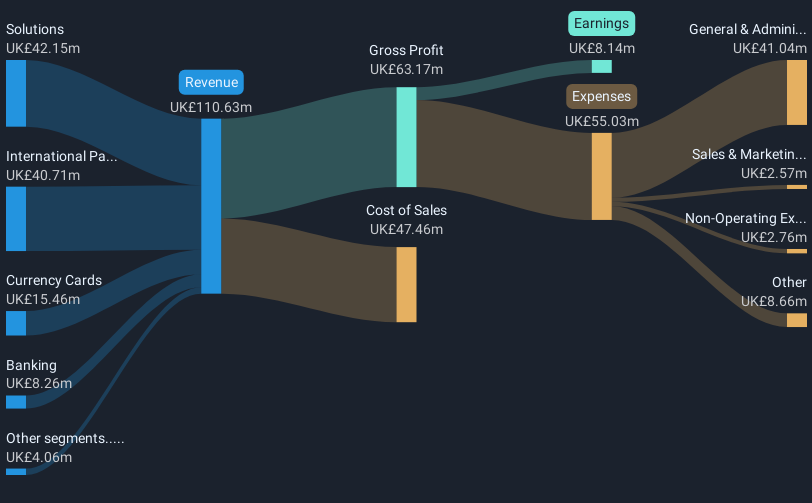

Operations: The company's revenue is primarily derived from its Solutions segment (£42.15 million), International Payments excluding Solutions (£40.71 million), Currency Cards (£15.46 million), Banking (£8.26 million), and Travel Cash (£0.02 million).

Market Cap: £255.62M

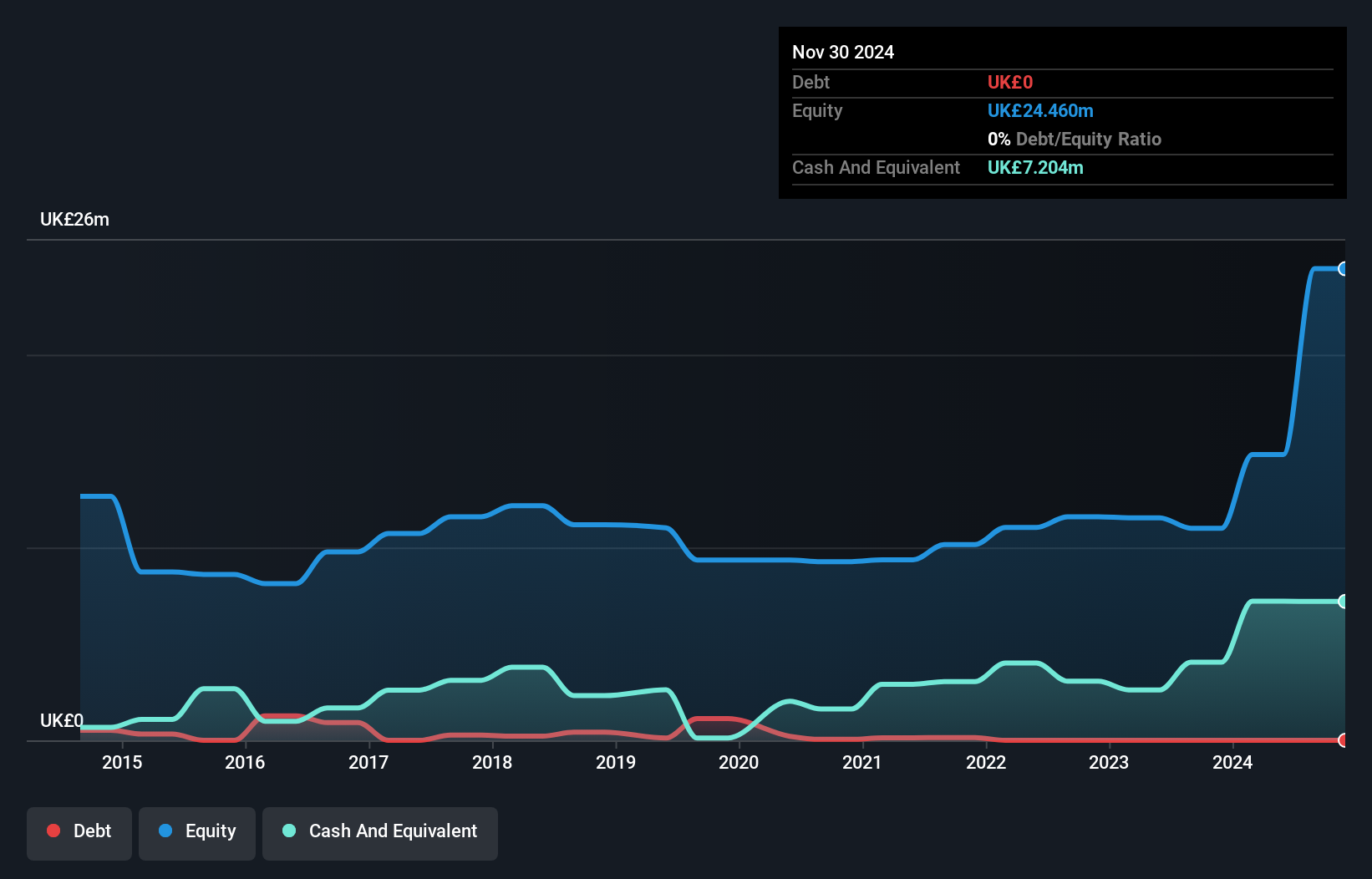

Equals Group plc, with a market cap of £255.62 million, is set to be acquired and delisted from AIM following an all-cash acquisition agreement. The company has shown strong financial growth, becoming profitable over the past five years with earnings increasing by 61.8% annually. Despite a recent slowdown in earnings growth to 10.8%, Equals remains debt-free and maintains high-quality earnings with short-term assets exceeding liabilities significantly. However, its return on equity is considered low at 13.1%. The management team and board are experienced, providing stability amidst these changes.

- Unlock comprehensive insights into our analysis of Equals Group stock in this financial health report.

- Review our growth performance report to gain insights into Equals Group's future.

Filtronic (AIM:FTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology globally, with a market cap of £166.43 million.

Operations: The company generates revenue of £25.43 million from its Wireless Communications Equipment segment.

Market Cap: £166.43M

Filtronic plc, with a market cap of £166.43 million, has demonstrated significant earnings growth, increasing by a very large 576.9% over the past year, surpassing its five-year average of 5.3%. The company is debt-free and maintains high-quality earnings with improved net profit margins from 2.9% to 12.4%. Filtronic's short-term assets cover both short- and long-term liabilities comfortably. Recent leadership changes include appointing Antonino Spatola as Chief Commercial Officer to drive growth in RF technology markets like Space and Defence. Additionally, the new engineering design centre at Cambridge Science Park enhances technical capabilities for future expansion.

- Click to explore a detailed breakdown of our findings in Filtronic's financial health report.

- Gain insights into Filtronic's future direction by reviewing our growth report.

Spectra Systems (AIM:SPSY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Spectra Systems Corporation invents, develops, and sells integrated optical systems both in the United States and internationally, with a market cap of £114.30 million.

Operations: The company's revenue is primarily derived from its Authentication Systems segment, excluding banknote cleaning, which accounts for $21.66 million, followed by Secure Transactions at $1.92 million.

Market Cap: £114.3M

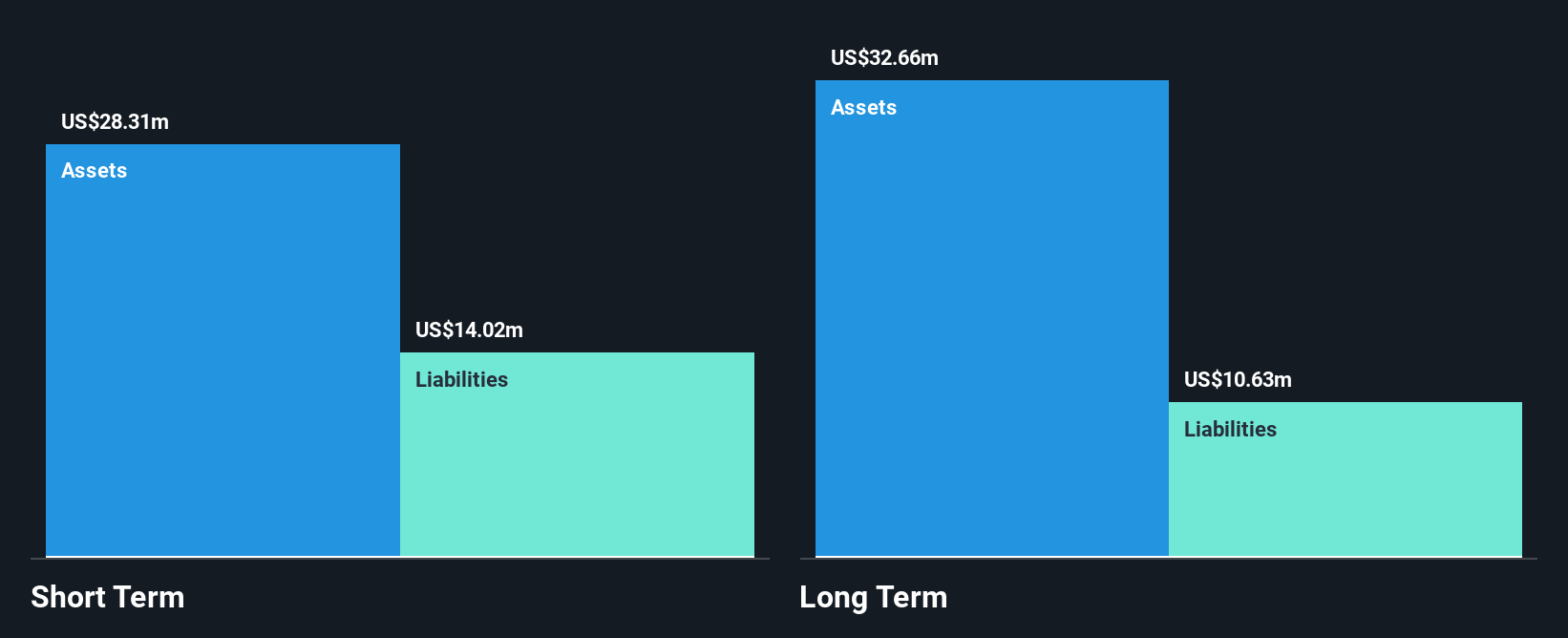

Spectra Systems Corporation, with a market cap of £114.30 million, derives substantial revenue from its Authentication Systems segment (US$21.66M). Despite a decline in profit margins to 21% from 37.3% last year and negative earnings growth of -19.8%, the company maintains financial stability with short-term assets (US$27.1M) exceeding liabilities and strong interest coverage by EBIT (76.9x). While debt levels have risen over five years, they remain satisfactory with net debt to equity at 1.1%. The board is experienced, and no significant shareholder dilution occurred recently, though dividend sustainability remains a concern due to insufficient free cash flow coverage.

- Take a closer look at Spectra Systems' potential here in our financial health report.

- Gain insights into Spectra Systems' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Explore the 465 names from our UK Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SPSY

Spectra Systems

Spectra Systems Corporation invents, develops, and sells integrated optical systems in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives