- Sweden

- /

- Life Sciences

- /

- OM:BICO

Exploring 3 Promising Undervalued Small Caps With Insider Activity In The European Market

Reviewed by Simply Wall St

As the European market navigates through a landscape marked by fluctuating trade dynamics and mixed economic signals, the pan-European STOXX Europe 600 Index has shown resilience with a recent uptick of 1.15%, despite looming tariff concerns from the U.S. In this environment, identifying promising small-cap stocks can be particularly rewarding, especially those that exhibit strong fundamentals and insider activity, which may suggest confidence in their potential amidst broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hoist Finance | 8.7x | 1.8x | 20.10% | ★★★★★☆ |

| A.G. BARR | 19.5x | 1.8x | 46.18% | ★★★★☆☆ |

| Yubico | 32.4x | 4.6x | 12.21% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 3.17% | ★★★★☆☆ |

| CVS Group | 44.4x | 1.3x | 39.97% | ★★★★☆☆ |

| Seeing Machines | NA | 2.7x | 47.71% | ★★★★☆☆ |

| Nyab | 23.4x | 1.0x | 32.11% | ★★★☆☆☆ |

| NOTE | 21.1x | 1.4x | -8.58% | ★★★☆☆☆ |

| Lords Group Trading | NA | 0.2x | -6.12% | ★★★☆☆☆ |

| Karnov Group | 227.7x | 4.8x | 28.97% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

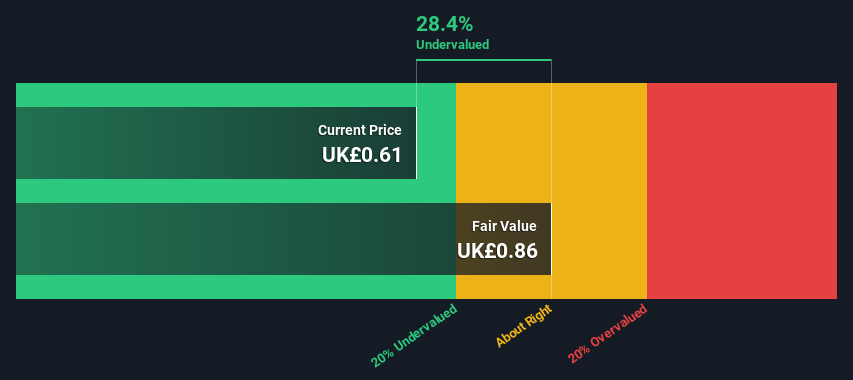

Foxtons Group (LSE:FOXT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Foxtons Group is a UK-based real estate agency specializing in property sales, lettings, and financial services with a market cap of approximately £0.12 billion.

Operations: Foxtons Group generates revenue primarily from Lettings (£106.03 million), Sales (£48.57 million), and Financial Services (£9.33 million). The company has experienced fluctuations in its net income margin, which was 24.76% in September 2014 but showed a decline to -15.42% by December 2018 before recovering to reach positive figures again, such as 8.54% by December 2024. Operating expenses have consistently been a significant portion of the company's costs, impacting overall profitability over time.

PE: 13.7x

Foxtons Group, a notable player in the European market, saw a revenue jump to £44.1 million for Q1 2025 from £35.7 million the previous year, highlighting its growth potential. Despite relying solely on external borrowing for funding, which poses higher risk, insider confidence is evident with recent share purchases by executives. The company also approved a final dividend of 0.95 pence per share in May 2025, indicating shareholder-friendly policies amidst projections of annual earnings growth at 12%.

- Take a closer look at Foxtons Group's potential here in our valuation report.

Gain insights into Foxtons Group's historical performance by reviewing our past performance report.

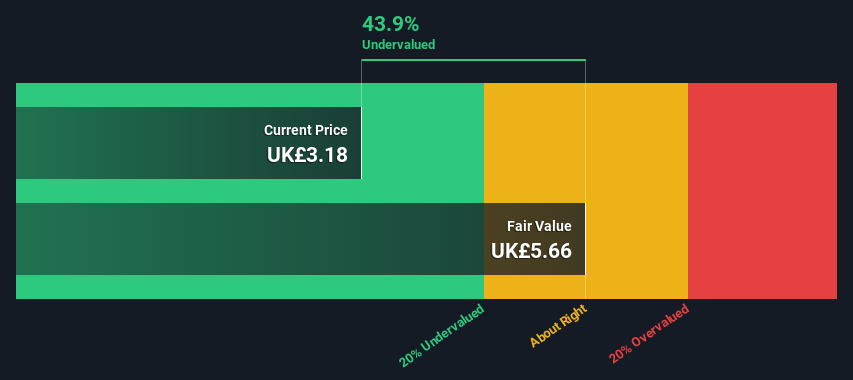

Zigup (LSE:ZIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zigup operates in the rental and claims services sectors, with a focus on the UK, Ireland, and Spain markets, and has a market capitalization of £1.75 billion.

Operations: Zigup generates revenue primarily from UK&I Rental, Spain Rental, and Claims & Services. The company's gross profit margin has shown fluctuations, peaking at 29.54% in late 2022 before declining to 21.95% by mid-2025. Operating expenses have steadily increased over time, impacting the overall profitability of the business.

PE: 9.5x

Zigup's recent earnings call on July 9, 2025, revealed a mixed financial landscape. Despite a decline in net income to £79.85 million from £125.02 million the previous year, sales rose to £682.89 million from £649.27 million, indicating potential for revenue growth. Insider confidence is evident with recent share purchases by executives over the past year, suggesting optimism about future prospects despite current challenges like lower profit margins and reliance on external borrowing for funding.

- Navigate through the intricacies of Zigup with our comprehensive valuation report here.

Understand Zigup's track record by examining our Past report.

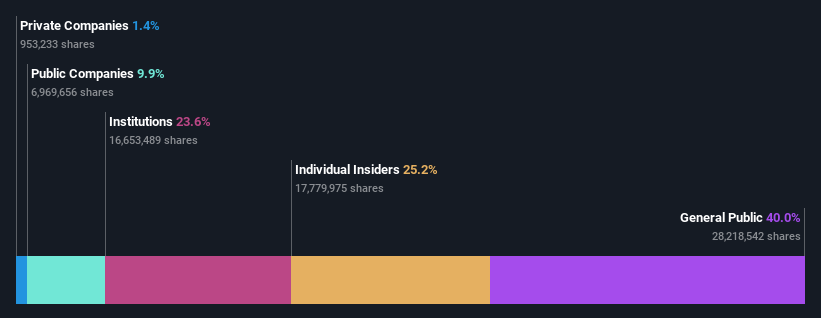

BICO Group (OM:BICO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BICO Group is a biotechnology company specializing in bioprinting, lab automation, and life science solutions with a market cap of SEK 6.15 billion.

Operations: The company's revenue is derived from three primary segments: Bioprinting (SEK 401.30 million), Lab Automation (SEK 447.20 million), and Life Science Solutions (SEK 1.02 billion). The gross profit margin has shown variability, with a notable decline to 49.25% in recent periods.

PE: -8.1x

BICO Group, a smaller European company, faces challenges with declining earnings and reliance on external borrowing. In the first quarter of 2025, sales dropped to SEK 388.6 million from SEK 470.2 million the previous year, while net losses widened significantly to SEK 234 million. Recent executive changes include appointing Lars Risberg as General Counsel and board reshuffles. These shifts may signal strategic realignment as BICO navigates its financial hurdles and explores future growth opportunities in its industry niche.

- Click here to discover the nuances of BICO Group with our detailed analytical valuation report.

Assess BICO Group's past performance with our detailed historical performance reports.

Taking Advantage

- Access the full spectrum of 53 Undervalued European Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BICO Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BICO

BICO Group

Provides hardware, laboratory automation, and software solutions in North America, Europe, Asia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)