- United Kingdom

- /

- Infrastructure

- /

- LSE:OCN

Undiscovered Gems in the United Kingdom for October 2024

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices both closing lower amid weak trade data from China. This challenging environment underscores the importance of identifying resilient companies that can thrive despite broader economic uncertainties. In this article, we explore three undiscovered gems in the UK market that have shown potential to stand out in these conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally with a market cap of £766.89 million.

Operations: The company generates revenue primarily through the sale of flooring products across various international markets. It has a market cap of £766.89 million.

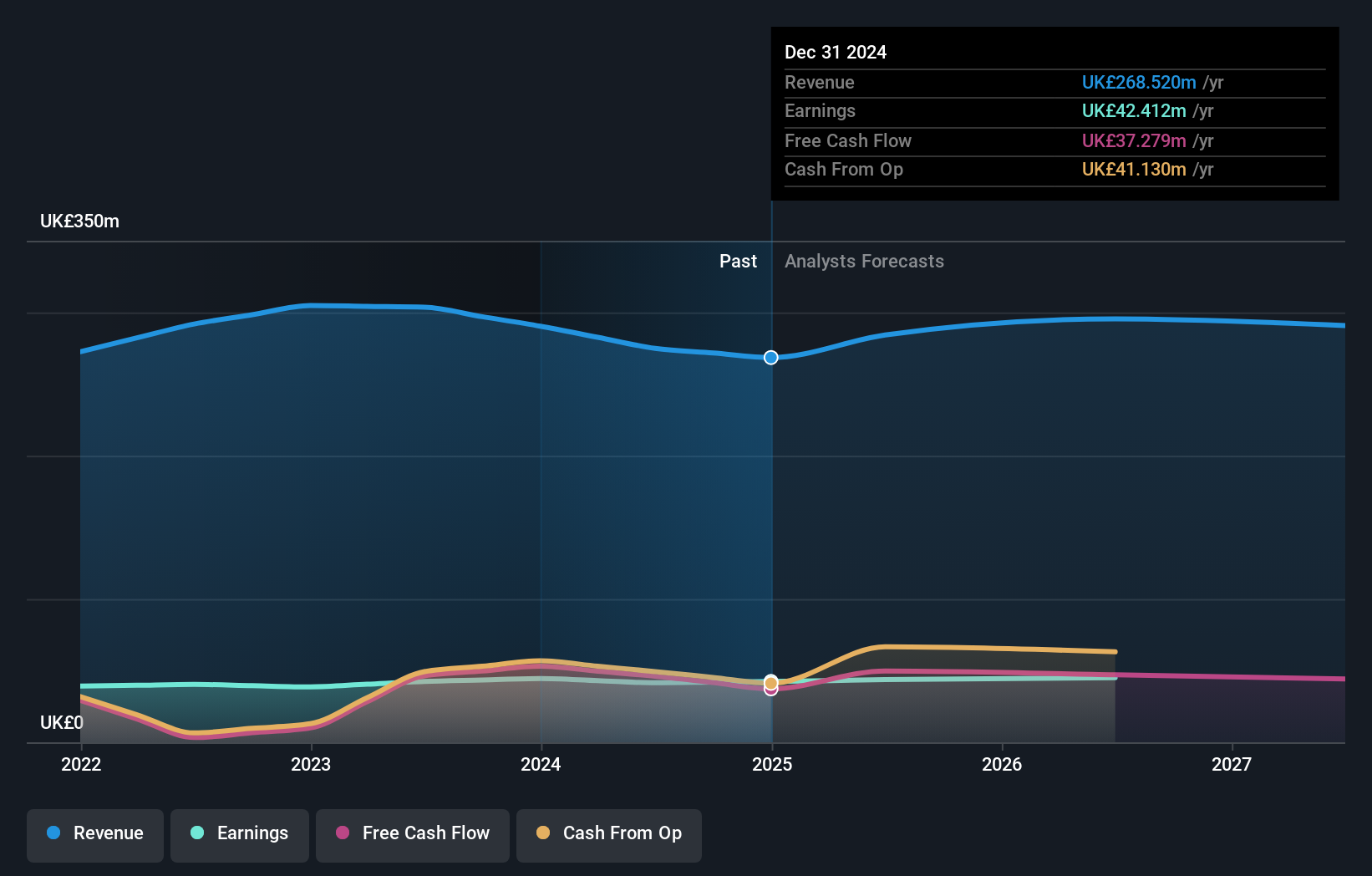

James Halstead, a small but resilient player in the UK market, reported GBP 274.88 million in sales for the year ending June 2024, down from GBP 303.56 million last year. Net income stood at GBP 41.52 million with basic earnings per share at GBP 0.1. Despite negative earnings growth of -2.1%, its debt-to-equity ratio has improved from 0.2 to 0.1 over five years and it trades at a value below fair estimate by about 5%.

- Unlock comprehensive insights into our analysis of James Halstead stock in this health report.

Gain insights into James Halstead's past trends and performance with our Past report.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc, a holding company with a market cap of £1.02 billion, operates as a home and community builder in Ireland.

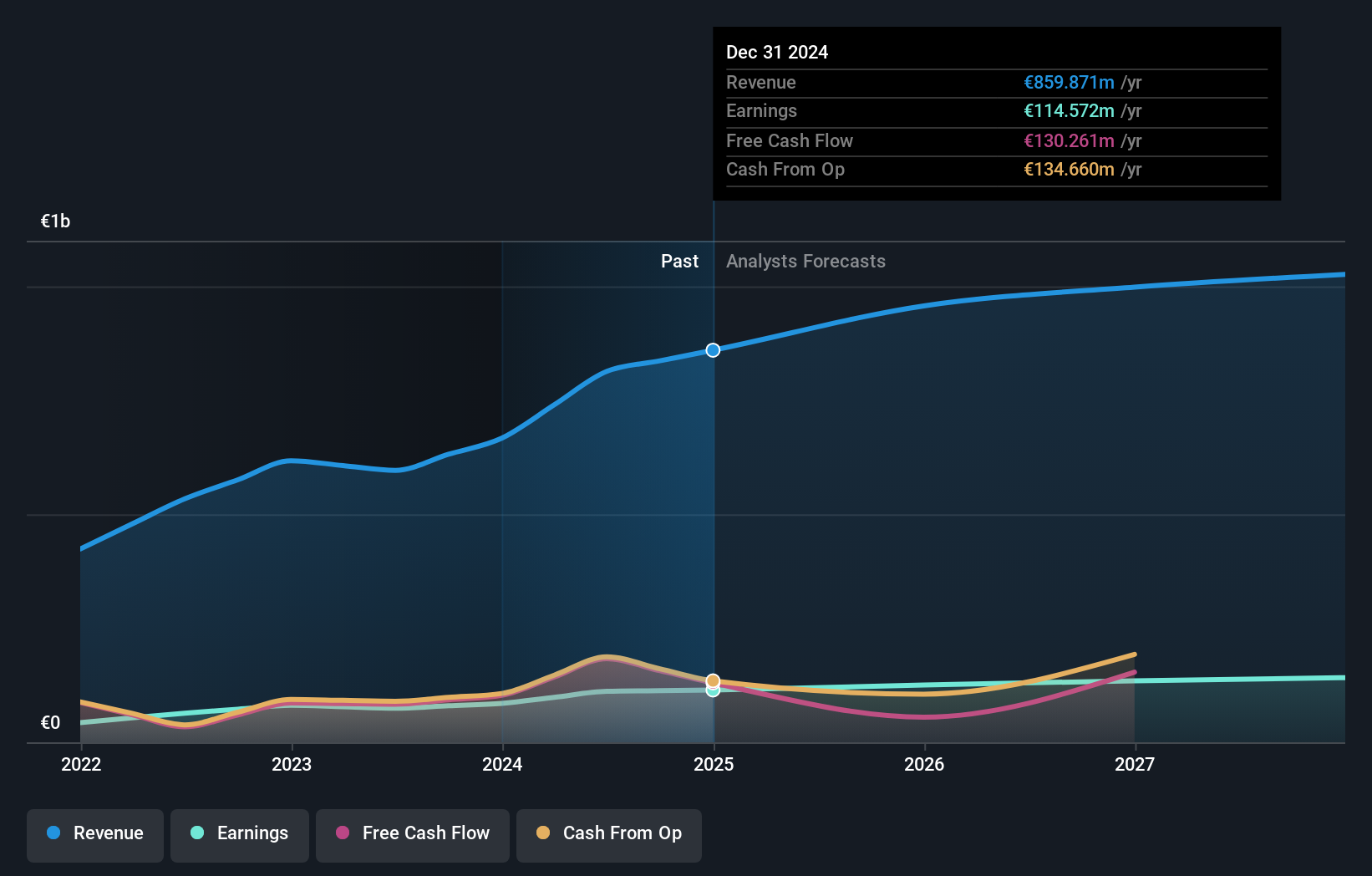

Operations: Cairn Homes generates its revenue primarily from building and property development, amounting to €813.40 million. The company's net profit margin is 12.5%.

Cairn Homes has shown impressive earnings growth of 49.5% over the past year, outpacing the Consumer Durables industry, which saw a -14.6% change. The company’s net debt to equity ratio stands at 20.7%, considered satisfactory, while its interest payments are well covered by EBIT with a 9.5x coverage. Cairn Homes repurchased 17,743,924 shares for €27.2 million in early 2024 and announced an interim dividend of €0.038 per share payable on October 4th, reflecting robust financial health and shareholder returns.

- Click here and access our complete health analysis report to understand the dynamics of Cairn Homes.

Examine Cairn Homes' past performance report to understand how it has performed in the past.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ocean Wilsons Holdings Limited, an investment holding company with a market cap of £514.53 million, provides maritime and logistics services in Brazil.

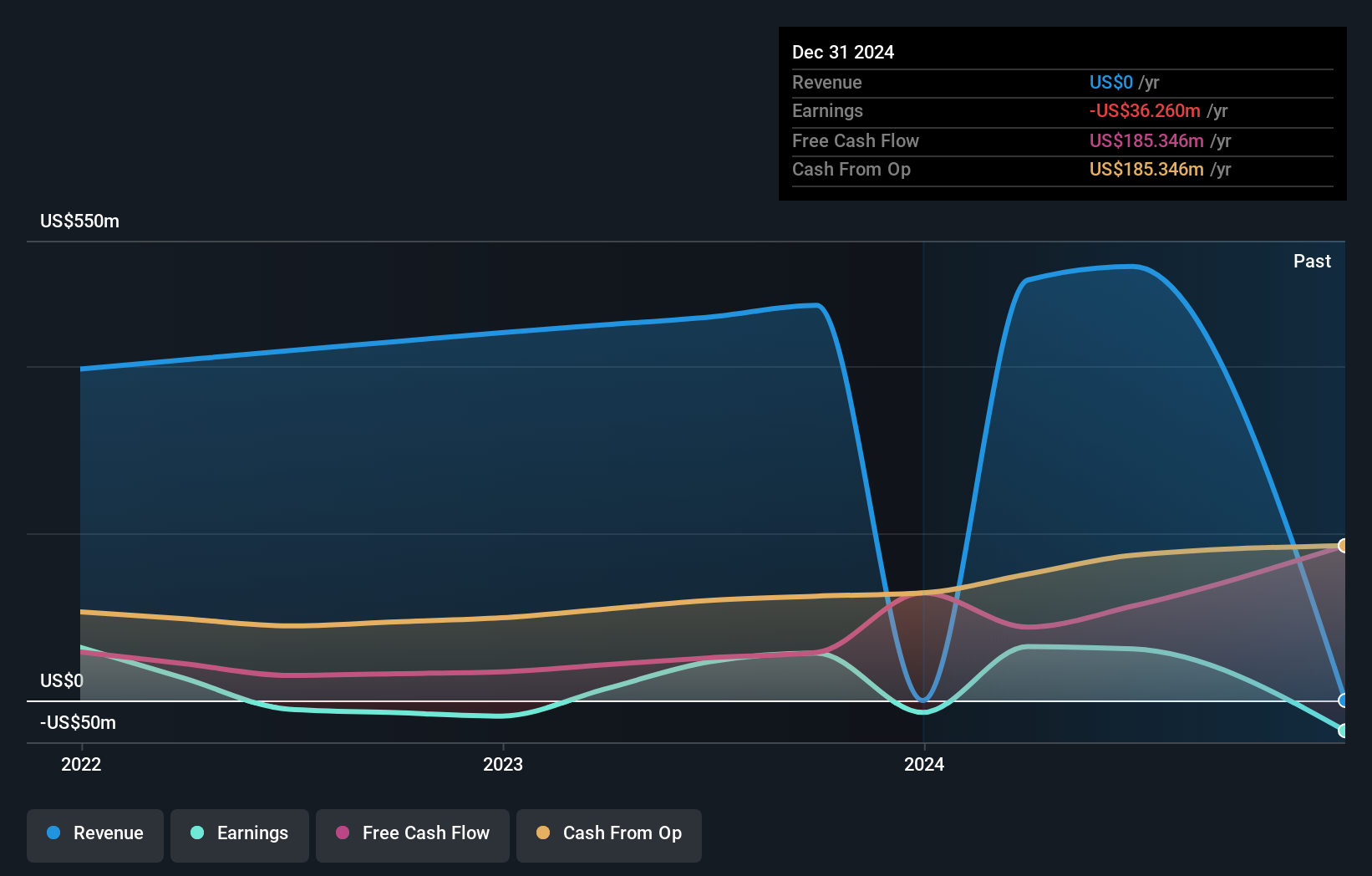

Operations: With a revenue of $519.35 million from its maritime services in Brazil, Ocean Wilsons Holdings Limited focuses on generating income through its specialized logistics operations.

Ocean Wilsons Holdings, a UK-based company, has seen notable financial performance with earnings growing 32.7% over the past year, surpassing the infrastructure industry’s 12% growth. The price-to-earnings ratio stands at 11.1x compared to the UK market's 16.8x, indicating potential undervaluation. Recent discussions about selling its subsidiary Wilson Sons S.A., which could impact future operations and valuation, add an element of uncertainty but also opportunity for strategic realignment and growth prospects in the coming years.

Next Steps

- Navigate through the entire inventory of 81 UK Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OCN

Ocean Wilsons Holdings

An investment holding company, offers maritime and logistics services in Brazil.

Flawless balance sheet established dividend payer.