- United Kingdom

- /

- Transportation

- /

- LSE:MCG

National Express Group (LON:NEX shareholders incur further losses as stock declines 7.2% this week, taking five-year losses to 68%

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. To wit, the National Express Group PLC (LON:NEX) share price managed to fall 72% over five long years. We certainly feel for shareholders who bought near the top. And we doubt long term believers are the only worried holders, since the stock price has declined 51% over the last twelve months. The falls have accelerated recently, with the share price down 18% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

If the past week is anything to go by, investor sentiment for National Express Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for National Express Group

SWOT Analysis for National Express Group

- No major strengths identified for NEX.

- Interest payments on debt are not well covered.

- Dividend is low compared to the top 25% of dividend payers in the Transportation market.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company is unprofitable.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

National Express Group has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

We note that the dividend has fallen in the last five years, so that may have contributed to the share price decline. The revenue decline of around 0.5% would not have helped the stock price. So it seems weak revenue and dividend trends may have influenced the share price.

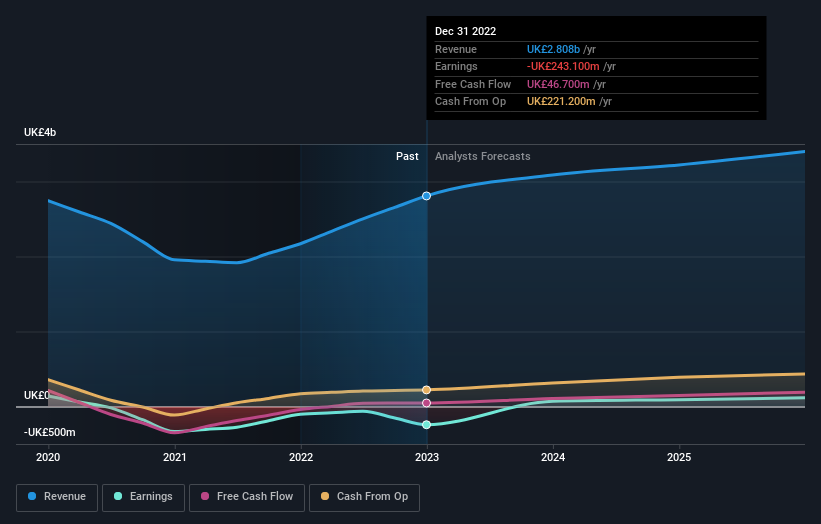

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on National Express Group

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, National Express Group's TSR for the last 5 years was -68%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 2.0% in the last year, National Express Group shareholders lost 49% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand National Express Group better, we need to consider many other factors. For instance, we've identified 1 warning sign for National Express Group that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

If you're looking to trade Mobico Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MCG

Mobico Group

Designs, mobilizes, and operates transport services worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives