- United Kingdom

- /

- Airlines

- /

- LSE:IAG

International Consolidated Airlines Group S.A.'s (LON:IAG) Low P/E No Reason For Excitement

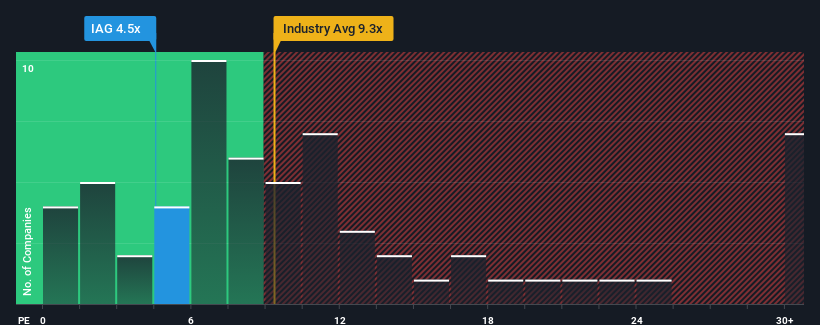

With a price-to-earnings (or "P/E") ratio of 4.5x International Consolidated Airlines Group S.A. (LON:IAG) may be sending very bullish signals at the moment, given that almost half of all companies in the United Kingdom have P/E ratios greater than 17x and even P/E's higher than 29x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, International Consolidated Airlines Group has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for International Consolidated Airlines Group

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as International Consolidated Airlines Group's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 32% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 2.5% per annum as estimated by the analysts watching the company. With the market predicted to deliver 14% growth each year, that's a disappointing outcome.

In light of this, it's understandable that International Consolidated Airlines Group's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that International Consolidated Airlines Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - International Consolidated Airlines Group has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

You might be able to find a better investment than International Consolidated Airlines Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IAG

International Consolidated Airlines Group

Engages in the provision of passenger and cargo transportation services in the United Kingdom, Spain, the United States, and rest of the world.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives