- United Kingdom

- /

- Marine and Shipping

- /

- LSE:CKN

Undervalued Small Caps With Insider Action In Global For June 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by geopolitical tensions and mixed economic signals, smaller-cap indexes have been outperforming, buoyed by hopes of easing Middle East tensions and potential interest rate cuts. Despite broader market volatility, the Federal Reserve's steady stance on rates and projected future cuts offer a cautiously optimistic backdrop for small-cap stocks, which often thrive in environments with stable or declining interest rates. In such conditions, investors may find opportunities in small-cap companies that demonstrate strong fundamentals and strategic insider activity.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.6x | 0.5x | 35.62% | ★★★★★☆ |

| AKVA group | 17.1x | 0.8x | 49.80% | ★★★★★☆ |

| Tristel | 28.4x | 4.0x | 11.86% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 38.46% | ★★★★☆☆ |

| Saturn Oil & Gas | 2.8x | 0.5x | -65.42% | ★★★★☆☆ |

| Italmobiliare | 11.3x | 1.5x | -202.79% | ★★★☆☆☆ |

| Fuller Smith & Turner | 11.9x | 0.9x | -31.48% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 10.0x | 0.6x | 9.82% | ★★★☆☆☆ |

| H+H International | 32.7x | 0.8x | 46.18% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.5x | 41.12% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

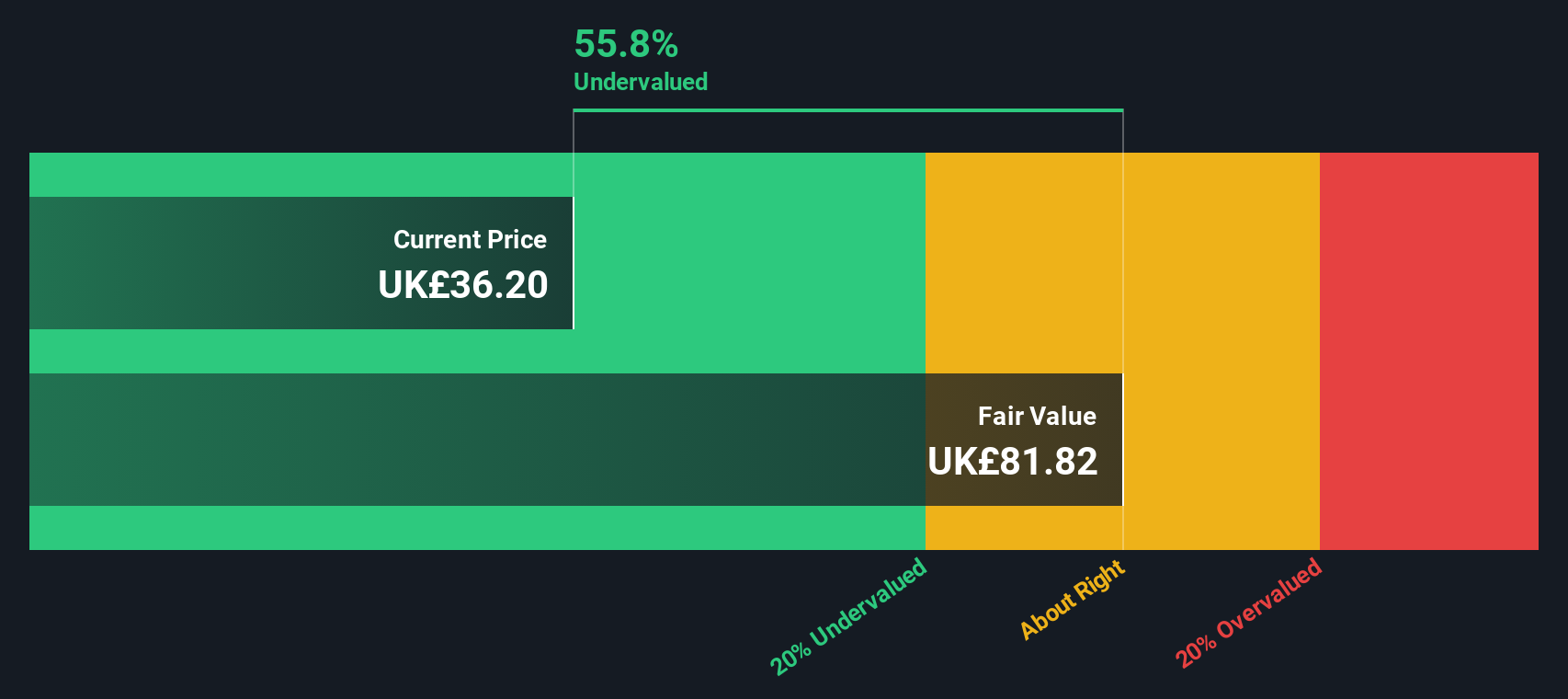

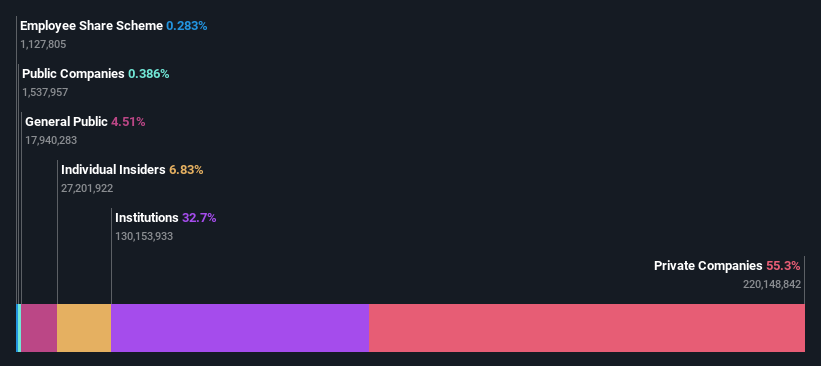

Clarkson (LSE:CKN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Clarkson is a leading provider of integrated shipping services, including broking, support, research, and financial services, with a market cap of approximately £1.31 billion.

Operations: Clarkson generates revenue primarily from Broking (£529.30 million), with additional contributions from Support (£65 million), Research (£24.50 million), and Financial services (£42.60 million). The company has experienced fluctuations in its net income margin, reaching 13.06% by the end of 2023, following a period of negative margins in 2019 and early 2020. Operating expenses represent a significant portion of costs, with general and administrative expenses consistently high across periods.

PE: 12.1x

Clarkson, a smaller company in the shipping services sector, has recently seen insider confidence with Laurence David Hollingworth purchasing 6,000 shares for approximately £178K. This move increased their holdings by 67%, suggesting belief in potential value despite earnings forecasts indicating a 2% annual decline over the next three years. The company's reliance on external borrowing instead of customer deposits adds risk. Upcoming meetings and calls may provide further insights into strategic directions and industry positioning.

- Delve into the full analysis valuation report here for a deeper understanding of Clarkson.

Examine Clarkson's past performance report to understand how it has performed in the past.

CLS Holdings (LSE:CLI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: CLS Holdings is a real estate investment company primarily engaged in managing and developing investment properties across the United Kingdom (£76.10 million), Germany (£51.60 million), and France (£18.10 million), with a market capitalization of £1 billion.

Operations: The company generates revenue primarily from investment properties in the United Kingdom, Germany, and France. Over recent periods, the gross profit margin has shown a declining trend from 84.13% in mid-2020 to 75.05% by late 2024. Operating expenses have remained significant, with general and administrative expenses consistently around £18 million recently contributing to overall costs.

PE: -2.8x

CLS Holdings, a smaller company in the market, faces challenges with its reliance on external borrowing for funding and concerns over its ability to continue as a going concern, as noted by auditors in April 2025. Despite these hurdles, the company is projected to grow earnings by 96% annually. Recent financials show sales of £151.9 million for 2024 with a reduced net loss of £93.6 million compared to the previous year. The board approved a final dividend of 2.68 pence per share for May 2025 payment, signaling potential resilience amidst financial scrutiny.

- Click to explore a detailed breakdown of our findings in CLS Holdings' valuation report.

Gain insights into CLS Holdings' historical performance by reviewing our past performance report.

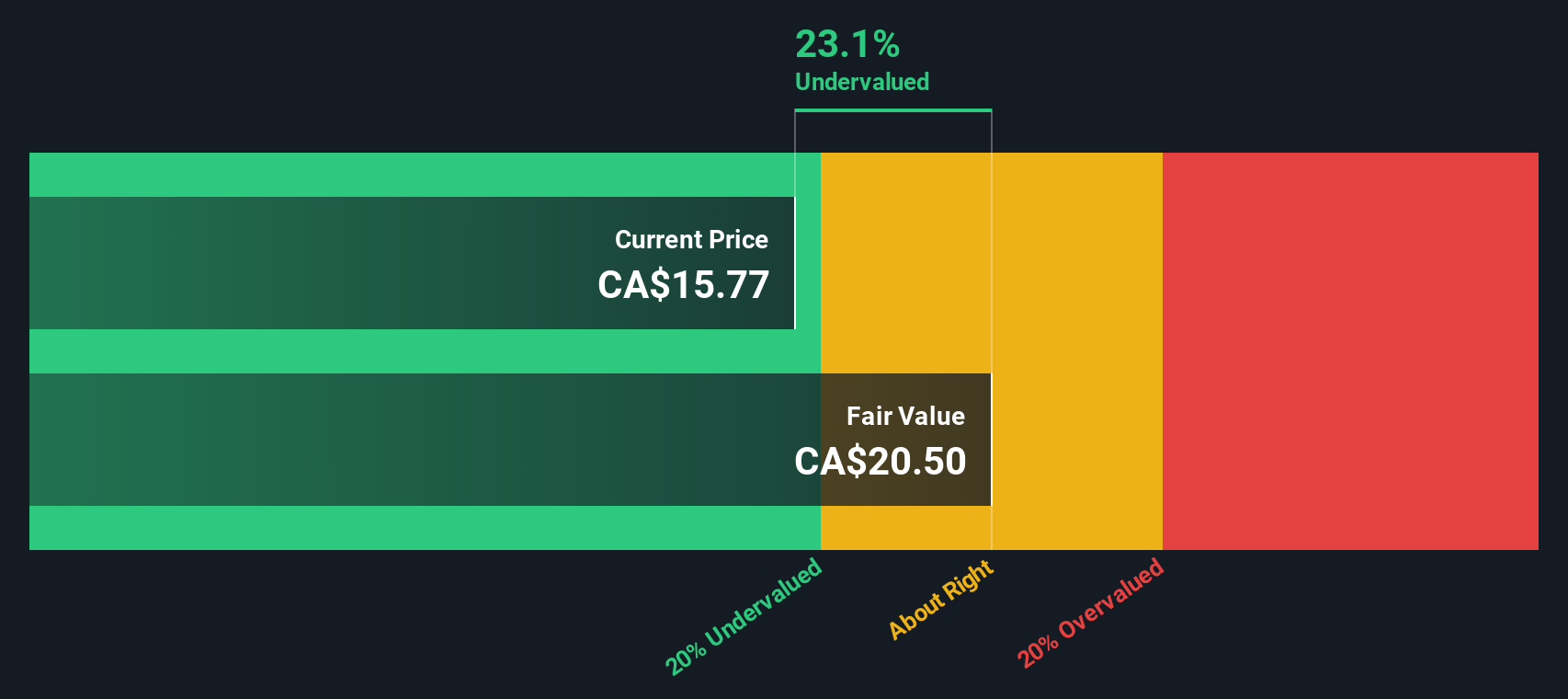

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: VersaBank is a Canadian digital banking institution that also provides cybersecurity services and financial technology development, with a market capitalization of CA$0.29 billion.

Operations: Digital Banking Canada is the primary revenue stream, contributing CA$96.26 million, while DRTC adds CA$9.24 million. The company consistently achieved a gross profit margin of 100% over the observed periods. Operating expenses are primarily driven by general and administrative costs, which reached approximately CA$66.11 million in recent data points. Net income margin showed fluctuations, peaking at 40.54% before declining to 28.42%.

PE: 16.0x

VersaBank, a smaller player in the financial sector, shows potential for growth with forecasted earnings to increase by 61.79% annually. Despite a decline in net income to CAD 8.53 million for Q2 2025 from CAD 11.83 million the previous year, insider confidence is evident through share purchases over recent months. The bank's strategic moves include a share repurchase program targeting up to 2 million shares and leadership changes aimed at structural realignment, suggesting proactive management amidst evolving market conditions.

- Unlock comprehensive insights into our analysis of VersaBank stock in this valuation report.

Assess VersaBank's past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 169 companies within our Undervalued Global Small Caps With Insider Buying screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CKN

Clarkson

Provides integrated shipping services in Europe, Middle East, Africa, Americas, Asia-Pacific, and worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives