- United Kingdom

- /

- Construction

- /

- LSE:KLR

Top UK Dividend Stocks To Consider

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, highlighting the interconnected nature of global markets and their impact on UK equities. In light of these fluctuations, investors often turn to dividend stocks as they can provide a steady income stream and potential stability during uncertain market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.13% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 5.73% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.98% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.40% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.06% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.73% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.34% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.65% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.49% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.66% | ★★★★★★ |

Click here to see the full list of 51 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

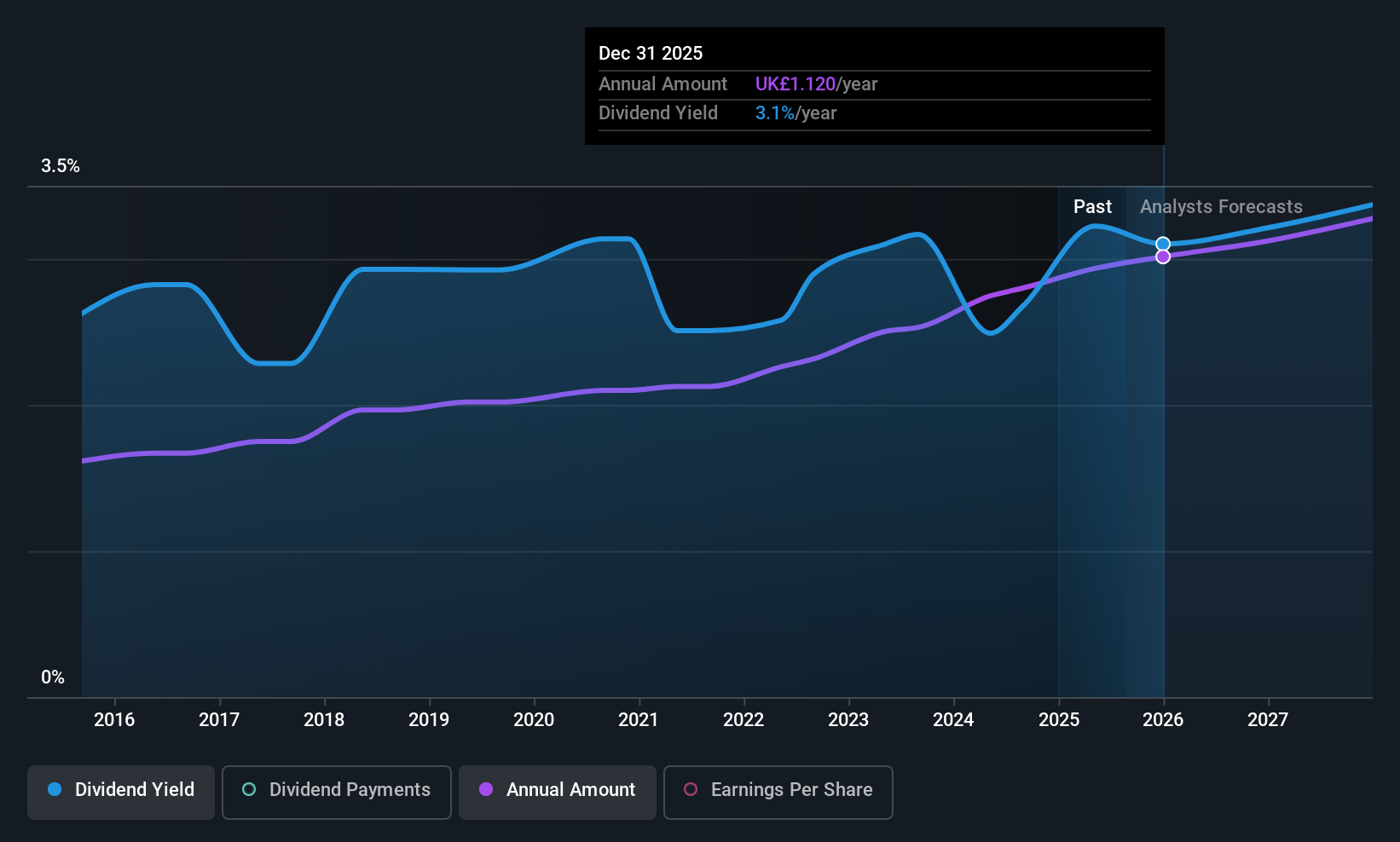

Clarkson (LSE:CKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clarkson PLC offers integrated shipping services across Europe, the Middle East, Africa, the Americas, Asia-Pacific and globally, with a market cap of £1.11 billion.

Operations: Clarkson PLC's revenue is primarily derived from its Broking segment (£503.80 million), with additional contributions from Support (£66.30 million), Research (£25.80 million), and Financial services (£53.20 million).

Dividend Yield: 3%

Clarkson PLC has demonstrated a commitment to dividends, recently increasing its interim payout to £0.33 per share. Despite a low dividend yield relative to top UK payers, Clarkson's dividends are well-covered by both earnings and cash flows, with payout ratios of 44.9% and 40.1%, respectively. However, the company's dividend history is marked by volatility and unreliability over the past decade. Recent executive changes may impact future strategies but ensure an orderly transition for continuity.

- Dive into the specifics of Clarkson here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Clarkson shares in the market.

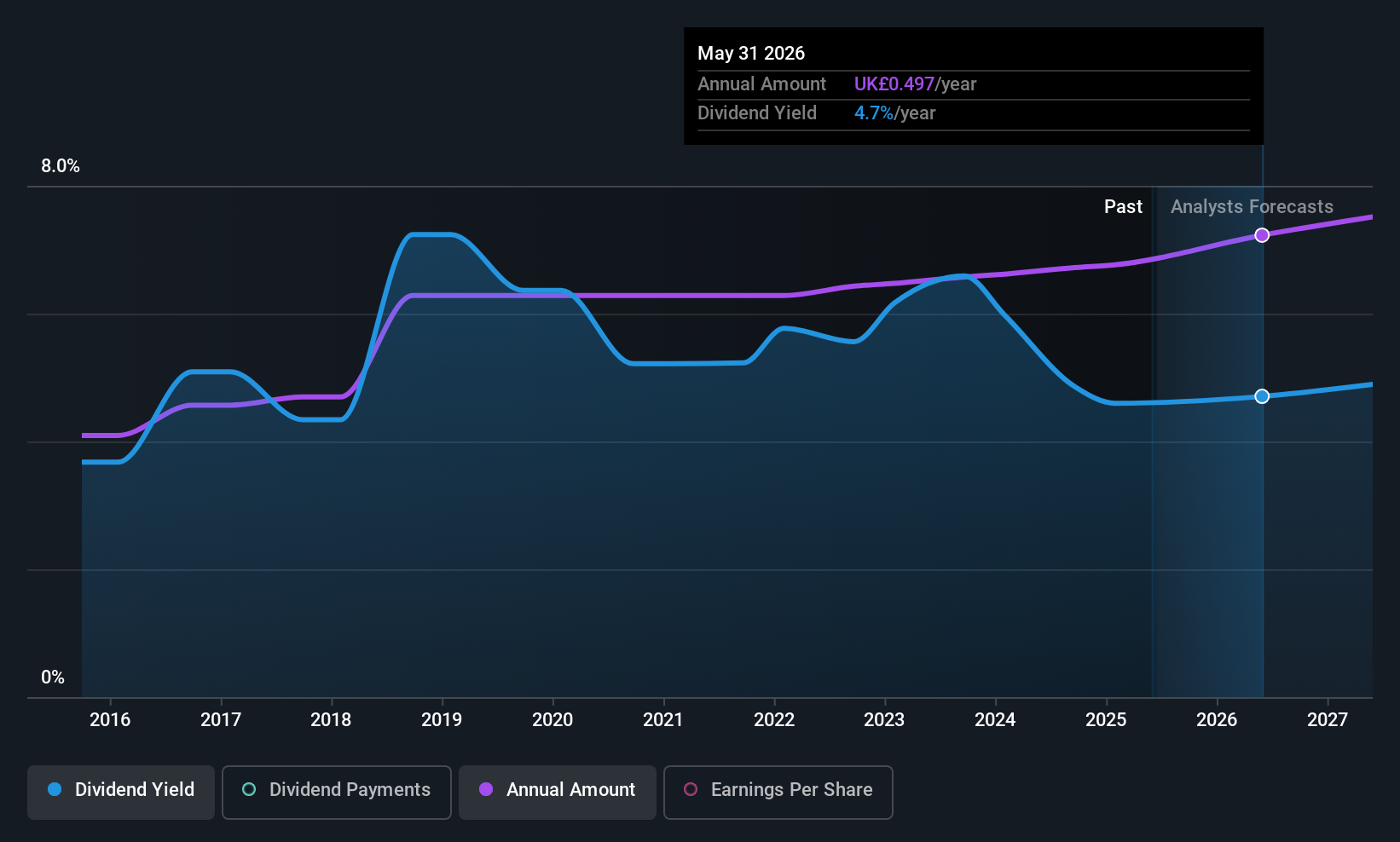

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company involved in online trading across the United Kingdom, Ireland, Asia-Pacific, the Middle East, the United States, Europe, and various institutional and emerging markets with a market cap of £3.65 billion.

Operations: IG Group Holdings generates revenue primarily from its brokerage segment, which amounts to £1.05 billion.

Dividend Yield: 4.5%

IG Group Holdings offers a stable dividend profile, with recent increases bringing the FY25 total to 47.20 pence per share. The dividends are well-covered by earnings and cash flows, with payout ratios of 44.4% and 33.7%, respectively. Despite a lower yield compared to top UK payers, IGG's dividends have been reliable over the past decade. The company is also engaging in significant share buybacks and remains committed to maintaining performance expectations for FY26 revenue and cash EPS targets.

- Unlock comprehensive insights into our analysis of IG Group Holdings stock in this dividend report.

- Our valuation report here indicates IG Group Holdings may be undervalued.

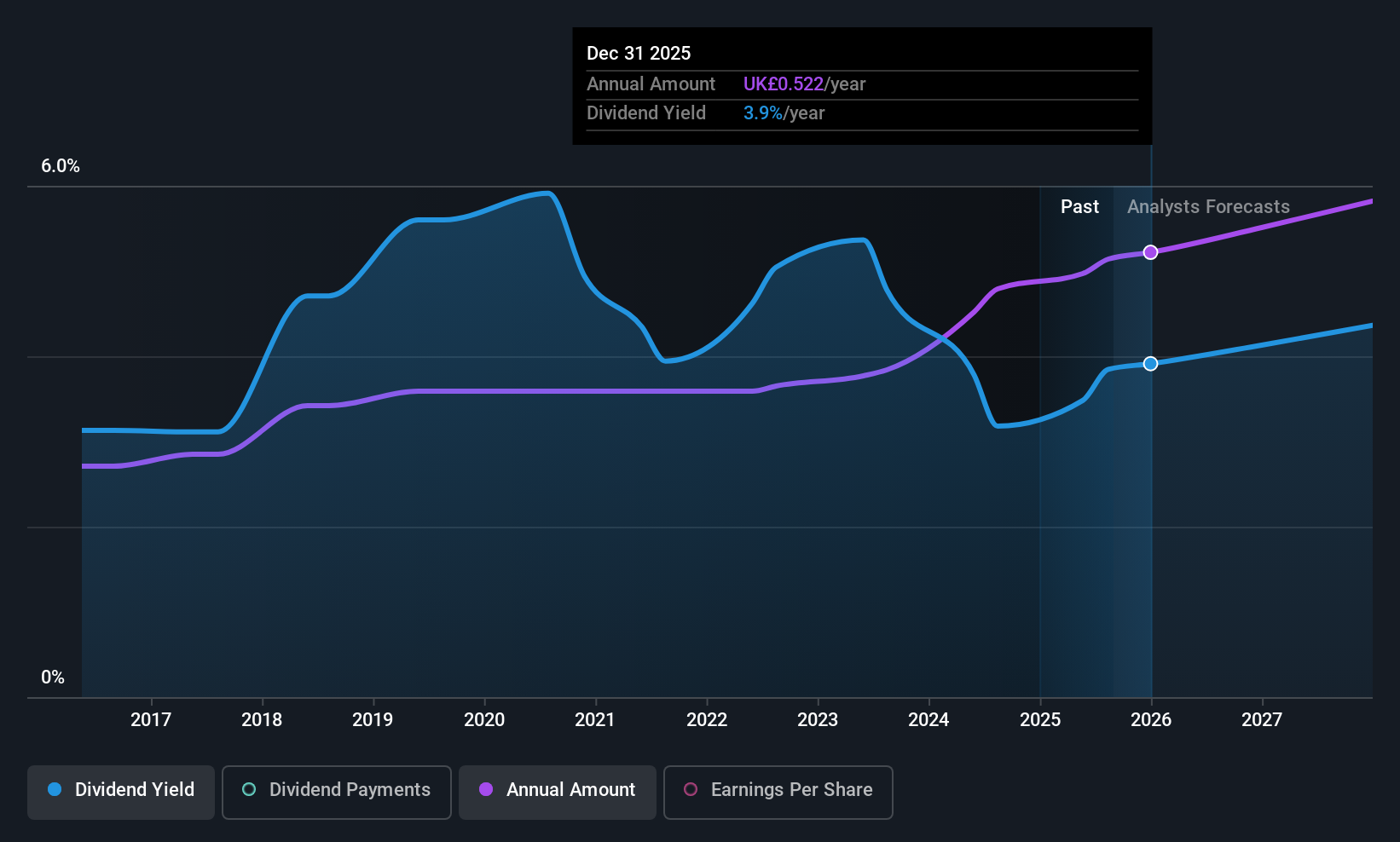

Keller Group (LSE:KLR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc offers specialist geotechnical services across North America, Europe, the Middle East, and the Asia-Pacific, with a market cap of approximately £988.76 million.

Operations: Keller Group plc generates its revenue primarily from specialist geotechnical services, amounting to £2.95 billion.

Dividend Yield: 3.6%

Keller Group's dividends are well-supported by earnings and cash flows, with payout ratios of 26.4% and 35.7%, respectively. Despite a lower yield of 3.65% compared to top UK payers, dividends have shown stability and growth over the past decade. Recent buybacks worth £25.2 million enhance shareholder value, while the interim dividend increased to 18.3 pence per share signals a return to progressive policy amidst stable earnings performance in H1 2025 despite slight revenue decline.

- Get an in-depth perspective on Keller Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Keller Group shares in the market.

Key Takeaways

- Discover the full array of 51 Top UK Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keller Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KLR

Keller Group

Provides specialist geotechnical services in North America, Europe, the Middle East, and the Asia-Pacific.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives