BT Group plc (LON:BT.A) Soars 25% But It's A Story Of Risk Vs Reward

BT Group plc (LON:BT.A) shareholders have had their patience rewarded with a 25% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

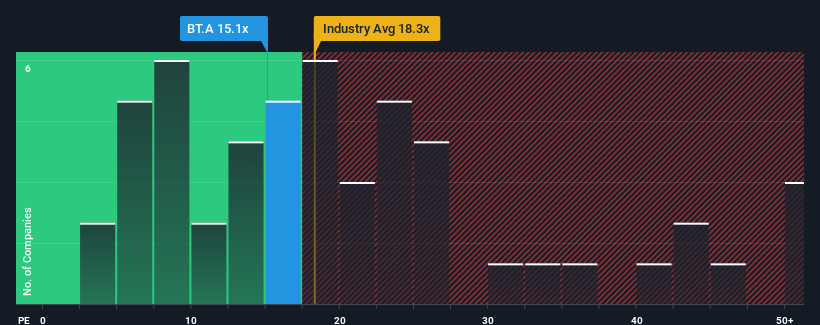

Even after such a large jump in price, BT Group's price-to-earnings (or "P/E") ratio of 15.1x might still make it look like a buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 18x and even P/E's above 30x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for BT Group as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for BT Group

What Are Growth Metrics Telling Us About The Low P/E?

BT Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 55% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 41% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 20% per year as estimated by the analysts watching the company. With the market only predicted to deliver 15% per year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that BT Group's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On BT Group's P/E

BT Group's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that BT Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for BT Group that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BT Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BT.A

BT Group

Provides communications products and services in the United Kingdom, Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Good value slight.

Similar Companies

Market Insights

Community Narratives