- United Kingdom

- /

- Wireless Telecom

- /

- LSE:AAF

We Ran A Stock Scan For Earnings Growth And Airtel Africa (LON:AAF) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Airtel Africa (LON:AAF). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Airtel Africa

How Quickly Is Airtel Africa Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Airtel Africa has grown EPS by 11% per year. That's a good rate of growth, if it can be sustained.

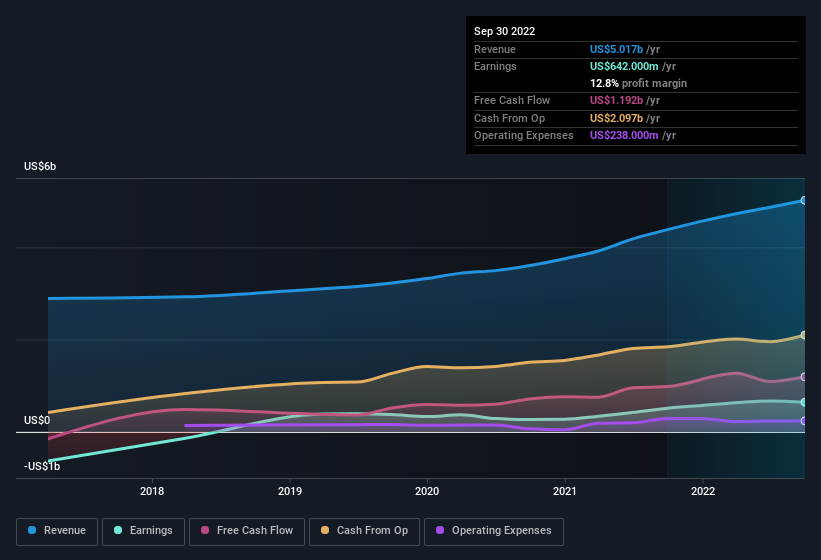

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Airtel Africa shareholders is that EBIT margins have grown from 32% to 34% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Airtel Africa?

Are Airtel Africa Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Airtel Africa will be more than happy to see insiders committing themselves to the company, spending US$248k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Director John Danilovich for UK£100k worth of shares, at about UK£1.13 per share.

It's commendable to see that insiders have been buying shares in Airtel Africa, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Airtel Africa with market caps between US$4.0b and US$12b is about US$3.2m.

Airtel Africa offered total compensation worth US$1.9m to its CEO in the year to March 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Airtel Africa Deserve A Spot On Your Watchlist?

As previously touched on, Airtel Africa is a growing business, which is encouraging. And that's not all. We've also seen insiders buying stock, and noted modest executive pay. All things considered, Airtel Africa is certainly displaying its merits and is worthy of taking research to the next step. Even so, be aware that Airtel Africa is showing 1 warning sign in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Airtel Africa, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AAF

Airtel Africa

Provides telecommunications and mobile money services in Nigeria, East Africa, and Francophone Africa.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives