- United Kingdom

- /

- Wireless Telecom

- /

- LSE:AAF

The 5.1% return this week takes Airtel Africa's (LON:AAF) shareholders five-year gains to 62%

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Airtel Africa share price has climbed 32% in five years, easily topping the market return of 6.0% (ignoring dividends).

The past week has proven to be lucrative for Airtel Africa investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Airtel Africa

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Airtel Africa's earnings per share are down 15% per year, despite strong share price performance over five years. This was, in part, due to extraordinary items impacting earning in the last twelve months.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that the dividend has not increased, so that doesn't seem to explain the increase, either. But it's reasonably likely that the 9.5% annual compound revenue growth is considered evidence that Airtel Africa has plenty of growth ahead of it. Indeed, revenue growth, rather than EPS, might be the current focus of the business.

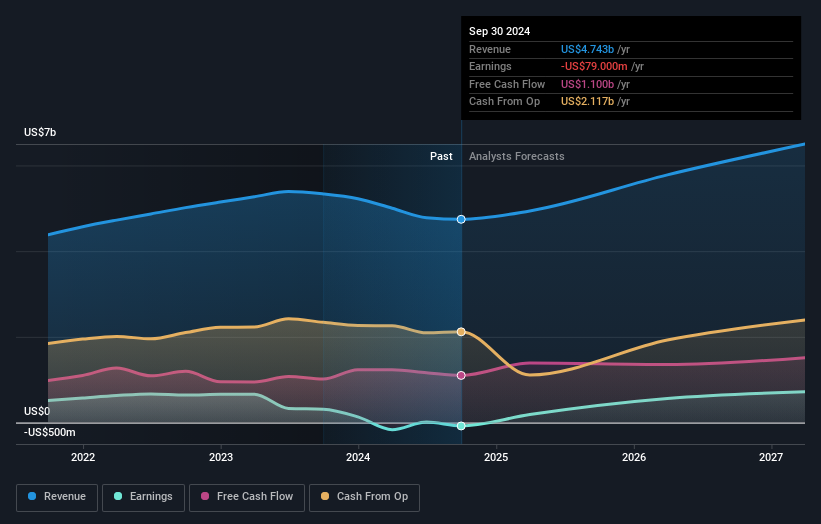

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Airtel Africa is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Airtel Africa in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Airtel Africa the TSR over the last 5 years was 62%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 14% in the last year, Airtel Africa shareholders lost 1.5% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Airtel Africa that you should be aware of.

We will like Airtel Africa better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AAF

Airtel Africa

Provides telecommunications and mobile money services in Nigeria, East Africa, and Francophone Africa.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives