- United Kingdom

- /

- Wireless Telecom

- /

- LSE:AAF

Here's Why We Think Airtel Africa (LON:AAF) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Airtel Africa (LON:AAF). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Airtel Africa

Airtel Africa's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Airtel Africa has managed to grow EPS by 20% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

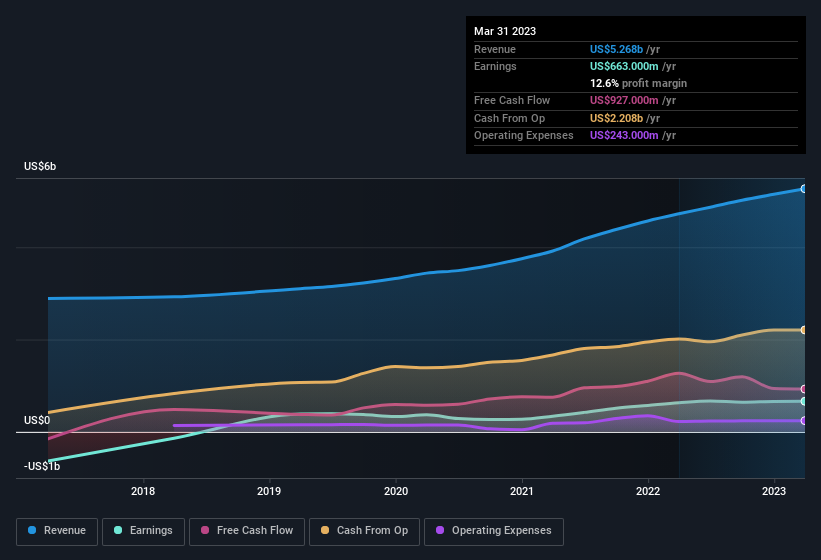

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Airtel Africa maintained stable EBIT margins over the last year, all while growing revenue 12% to US$5.3b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Airtel Africa's forecast profits?

Are Airtel Africa Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first, there weren't any reports of insiders selling shares in Airtel Africa in the last 12 months. But the really good news is that Independent Non-Executive Director John Danilovich spent US$198k buying stock, at an average price of around US$1.32. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

Should You Add Airtel Africa To Your Watchlist?

For growth investors, Airtel Africa's raw rate of earnings growth is a beacon in the night. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. So on this analysis, Airtel Africa is probably worth spending some time on. You should always think about risks though. Case in point, we've spotted 1 warning sign for Airtel Africa you should be aware of.

The good news is that Airtel Africa is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AAF

Airtel Africa

Provides telecommunications and mobile money services in Nigeria, East Africa, and Francophone Africa.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives