- United Kingdom

- /

- Tech Hardware

- /

- LSE:XAR

Here's Why We're Not At All Concerned With Xaar's (LON:XAR) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. By way of example, Xaar (LON:XAR) has seen its share price rise 188% over the last year, delighting many shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given its strong share price performance, we think it's worthwhile for Xaar shareholders to consider whether its cash burn is concerning. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Xaar

How Long Is Xaar's Cash Runway?

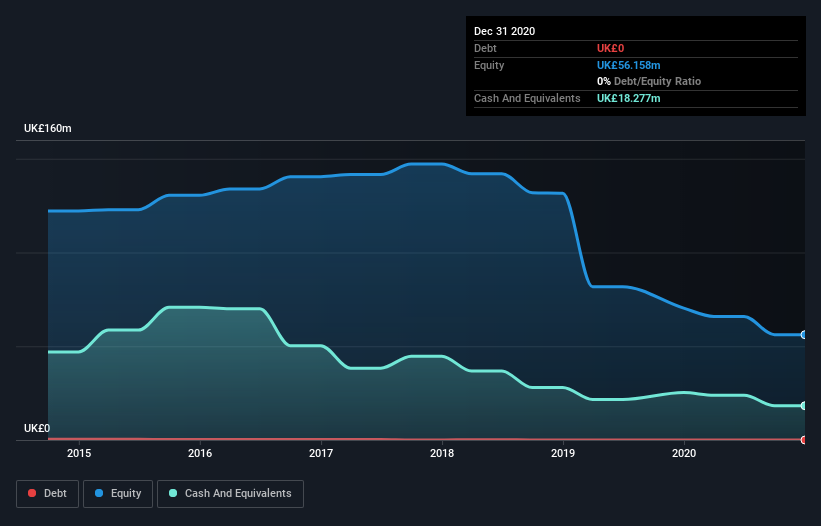

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at December 2020, Xaar had cash of UK£18m and no debt. Looking at the last year, the company burnt through UK£3.9m. Therefore, from December 2020 it had 4.7 years of cash runway. Importantly, though, analysts think that Xaar will reach cashflow breakeven before then. In that case, it may never reach the end of its cash runway. The image below shows how its cash balance has been changing over the last few years.

How Well Is Xaar Growing?

Happily, Xaar is travelling in the right direction when it comes to its cash burn, which is down 70% over the last year. But it was a bit disconcerting to see operating revenue down 2.8% in that time. Considering the factors above, the company doesn’t fare badly when it comes to assessing how it is changing over time. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Xaar Raise Cash?

While Xaar seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Xaar has a market capitalisation of UK£183m and burnt through UK£3.9m last year, which is 2.1% of the company's market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Xaar's Cash Burn?

As you can probably tell by now, we're not too worried about Xaar's cash burn. For example, we think its cash runway suggests that the company is on a good path. Although its falling revenue does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Taking an in-depth view of risks, we've identified 1 warning sign for Xaar that you should be aware of before investing.

Of course Xaar may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Xaar or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:XAR

Xaar

Designs, develops, manufactures, markets, and sells industrial printheads and print systems in Europe, the Middle East, Africa, Asia, and the Americas.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.