- United Kingdom

- /

- Communications

- /

- LSE:SPT

High Growth Tech Stocks in the United Kingdom to Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, affecting companies closely tied to the Chinese economy. In this environment, identifying high-growth tech stocks in the UK involves looking for companies that can navigate global economic uncertainties while leveraging innovation and technology to drive growth.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ENGAGE XR Holdings | 22.08% | 84.46% | ★★★★★★ |

| Audioboom Group | 8.49% | 59.18% | ★★★★★☆ |

| YouGov | 3.98% | 64.42% | ★★★★★☆ |

| ActiveOps | 14.40% | 43.34% | ★★★★★☆ |

| Oxford Biomedica | 18.08% | 68.63% | ★★★★★☆ |

| Trustpilot Group | 15.07% | 38.95% | ★★★★★☆ |

| Quantum Base Holdings | 132.55% | 92.87% | ★★★★★☆ |

| Windar Photonics | 36.00% | 48.66% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 53.95% | 53.30% | ★★★★★☆ |

| SRT Marine Systems | 45.43% | 91.35% | ★★★★★★ |

Click here to see the full list of 43 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

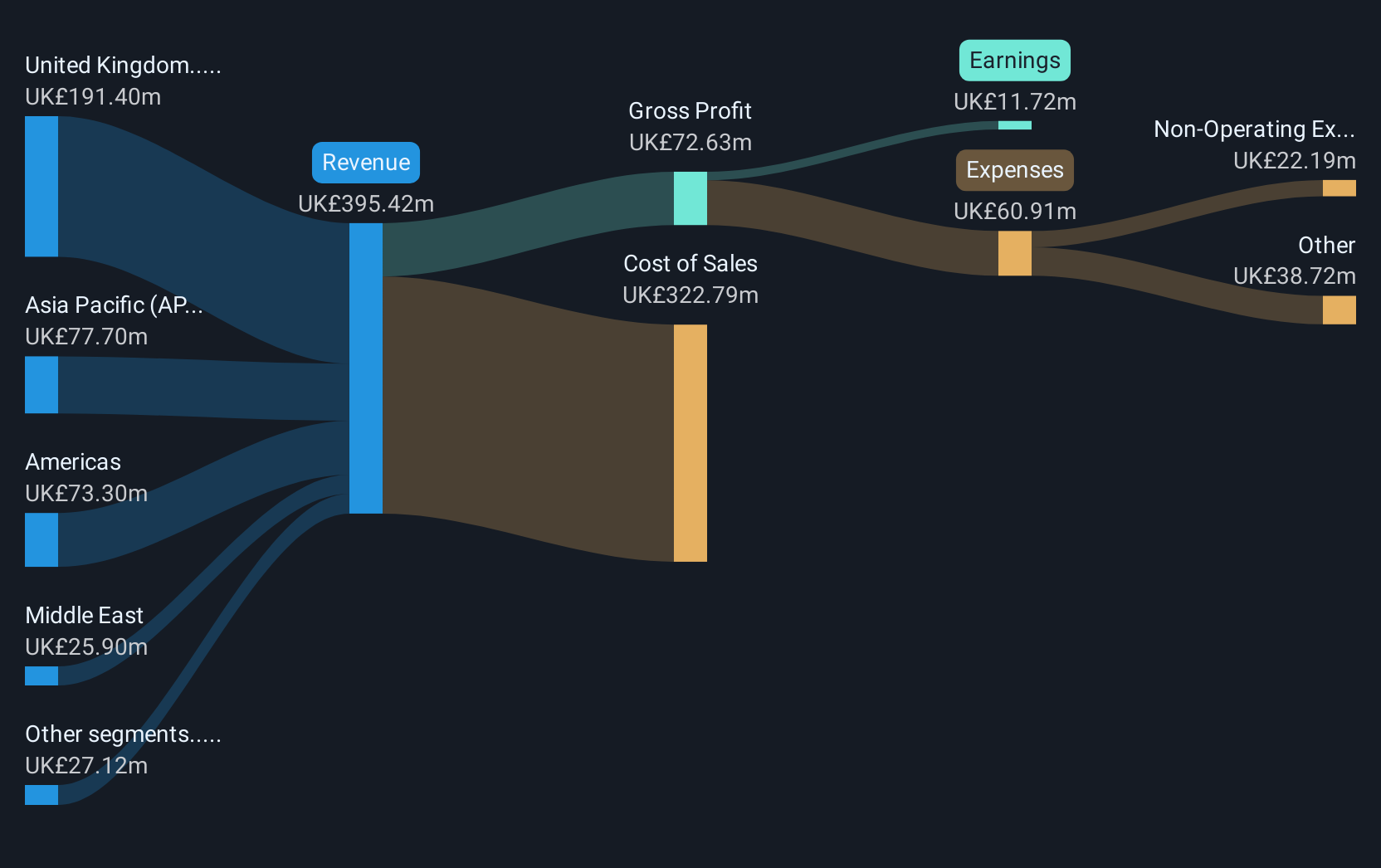

Overview: M&C Saatchi plc offers advertising and marketing communications services across various regions, including the United Kingdom, Europe, the Middle East, the Asia Pacific, and the Americas, with a market cap of £232.12 million.

Operations: The company generates revenue primarily from its advertising and marketing communications services, operating across diverse regions. Its cost structure includes expenses related to creative talent and operational overheads. The net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

M&C Saatchi, amidst a dynamic leadership reshuffle, has shown resilience with its recent dividend increase to 1.95 pence per share and promising earnings growth forecast at 25.2% annually. Despite a projected revenue decline of -9.7% annually over the next three years, the company's strategic adjustments and robust return on equity forecast at 32% suggest a potential for significant operational improvements and financial health stabilization. These elements collectively highlight M&C Saatchi's adaptive strategies in navigating market challenges while maintaining shareholder value through consistent dividends and strong governance changes.

- Dive into the specifics of M&C Saatchi here with our thorough health report.

Evaluate M&C Saatchi's historical performance by accessing our past performance report.

YouGov (AIM:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YouGov plc is a company that offers online market research services across various regions, including the United Kingdom, the Americas, the Middle East, Mainland Europe, Africa, and the Asia Pacific, with a market capitalization of £443.25 million.

Operations: The company generates revenue through three primary segments: Research (£177.50 million), Data Products (£84.70 million), and Consumer Panel Services (£121.70 million).

YouGov, navigating through a complex market landscape, has demonstrated notable financial agility with an expected earnings surge of 64.4% annually. Despite a modest annual revenue growth forecast at 4%, the company outpaces the broader UK market's 3.6% projection, showcasing its competitive edge in data analytics and survey technologies. However, challenges persist as evidenced by a significant one-off loss of £28.8 million impacting recent financials and slim profit margins at 0.3%. Moving forward, YouGov's robust earnings growth trajectory juxtaposed against its revenue performance and recent fiscal hurdles paints a mixed but cautiously optimistic future in the tech sector.

- Unlock comprehensive insights into our analysis of YouGov stock in this health report.

Assess YouGov's past performance with our detailed historical performance reports.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across multiple regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market capitalization of £1.12 billion.

Operations: With a focus on automated test and assurance solutions, Spirent Communications generates revenue primarily from two segments: Networks & Security, contributing $279.20 million, and Lifecycle Service Assurance at $181 million.

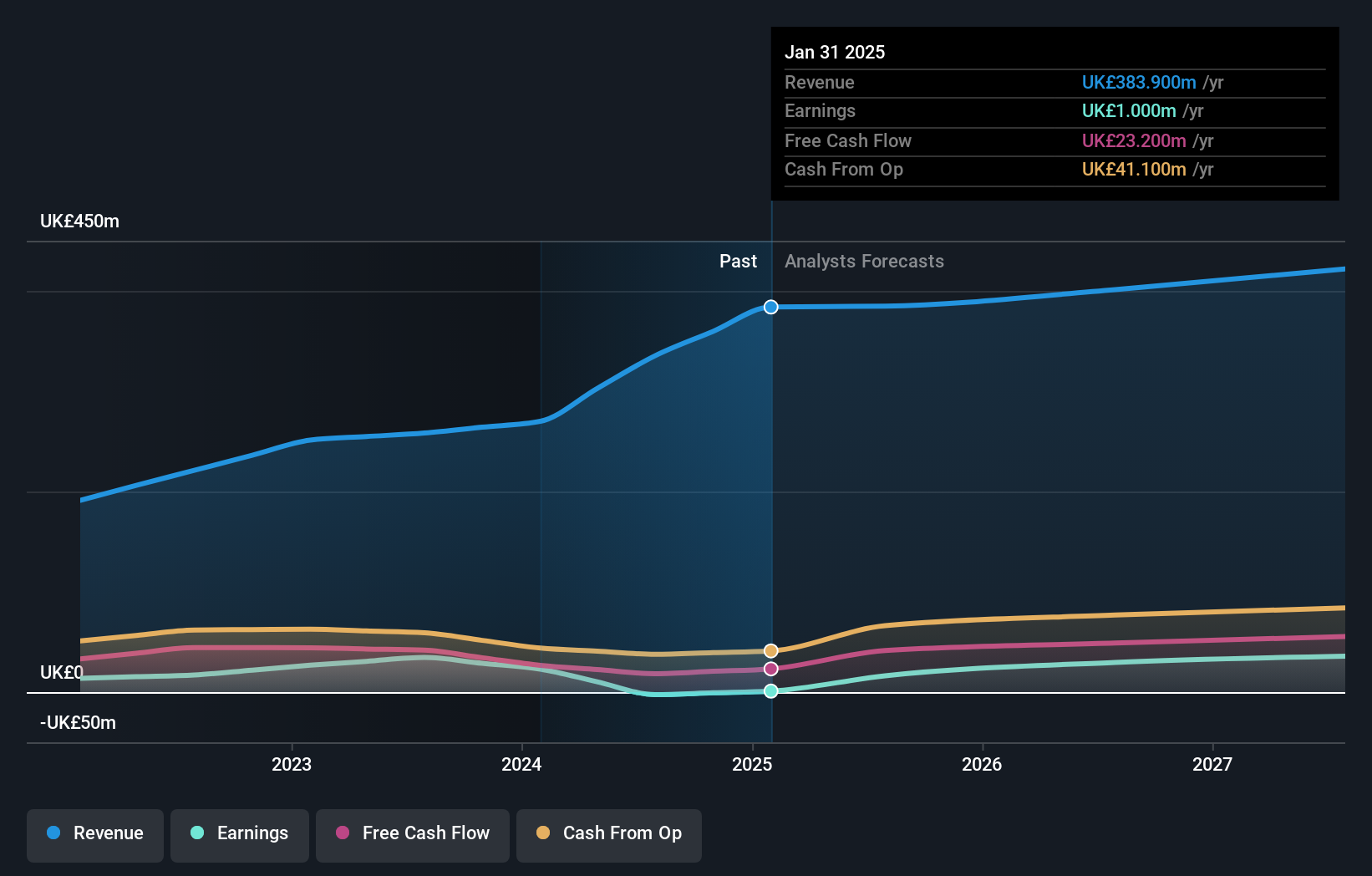

Spirent Communications is carving a niche in the high-growth tech sector, particularly with its recent Ultra Ethernet Transport (UET) demonstration alongside Juniper Networks, which underscores its strategic focus on next-gen network solutions. This initiative is pivotal as AI and HPC applications demand more robust back-end networks. Financially, Spirent's trajectory appears promising with an annual revenue growth rate of 6.8% and an impressive earnings growth forecast at 29.3% annually. Despite a substantial one-off loss of $21.1M last year impacting financials, the firm's commitment to innovation and market adaptation through rigorous real-world validation positions it well for future industry demands. The company's R&D expenditure trends reflect its strategic priorities; however specific figures were not provided in the brief for a detailed analysis here. The recent dividend declarations also signal confidence in Spirent’s financial health and commitment to shareholder returns, further bolstering its profile amidst competitive pressures in the telecommunications testing market.

- Click to explore a detailed breakdown of our findings in Spirent Communications' health report.

Gain insights into Spirent Communications' past trends and performance with our Past report.

Where To Now?

- Explore the 43 names from our UK High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SPT

Spirent Communications

As of October 15, 2025, operates as a subsidiary of Keysight Technologies, Inc..

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives