- United Kingdom

- /

- Software

- /

- LSE:SGE

High Growth Tech Stocks In The United Kingdom October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has remained flat, yet it is up 6.5% over the past year with earnings forecasted to grow by 14% annually. In this context of steady growth, identifying high growth tech stocks involves looking for companies that not only demonstrate strong innovation and adaptability but also have solid fundamentals to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc is an international company specializing in events, digital services, and academic research with operations across the UK, Continental Europe, the US, China, and other global markets; it has a market cap of £10.90 billion.

Operations: Informa generates revenue primarily from four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company's operations span events, digital services, and academic research across multiple international markets.

Despite a challenging year with a 11.3% decline in earnings, Informa's commitment to growth is evident with its R&D investments and strategic partnerships aimed at expanding its influence in luxury and lifestyle markets. The company's revenue is expected to grow by 6.9% annually, outpacing the UK market average of 3.5%, while projected earnings growth stands at an impressive 22.5% per year. Recent acquisitions, such as Ascential plc, alongside extended partnerships like that with Monaco, underscore Informa’s strategy to diversify and strengthen its portfolio—a move that could reshape its future trajectory in high-growth sectors despite current financial volatilities marked by significant one-off losses of £213.5 million affecting the last fiscal period.

- Unlock comprehensive insights into our analysis of Informa stock in this health report.

Examine Informa's past performance report to understand how it has performed in the past.

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

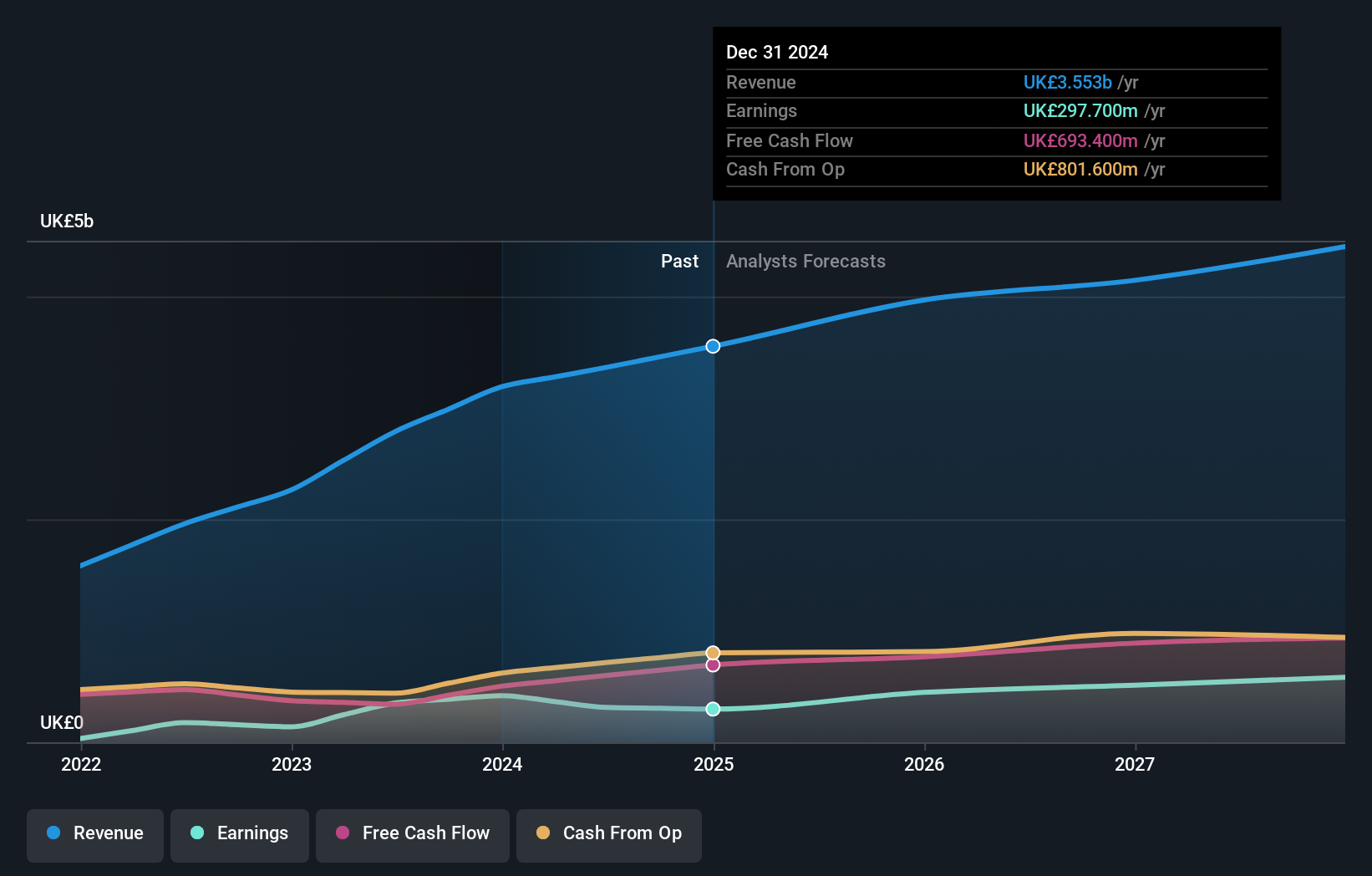

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium businesses across the United States, the United Kingdom, France, and globally, with a market capitalization of approximately £10.09 billion.

Operations: Sage Group focuses on providing technology solutions and services to small and medium businesses, generating significant revenue from North America (£1.01 billion) and Europe (£595 million). The company's operational focus spans multiple regions, with a notable presence in the United Kingdom & Ireland (£488 million).

Sage Group's strategic focus on enhancing its software solutions is evident from its robust R&D spending, which underpins the firm's commitment to innovation in the competitive tech landscape. With a significant 15.1% forecasted annual earnings growth and an expected revenue increase of 7.7% per year, Sage is outpacing the UK market average growth of 3.5%. The recent integration of VoPay’s payment technology into Sage Business Cloud enhances product functionality, addressing efficiency challenges faced by SMBs and positioning Sage favorably within digital financial solutions. This move not only streamlines operations for clients but also reinforces Sage's growth trajectory in cloud-based business management solutions, reflecting a forward-thinking approach amidst evolving market demands.

- Dive into the specifics of Sage Group here with our thorough health report.

Evaluate Sage Group's historical performance by accessing our past performance report.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of £1.01 billion.

Operations: The company generates revenue primarily from its Networks & Security segment, totaling $258.50 million.

Spirent Communications, amid a challenging financial period with a reported net loss of $6.7 million for the first half of 2024, contrasts sharply against its innovative strides in technology, particularly in 5G and Wi-Fi testing solutions. The company's recent launch of 5G Fixed Wireless Access (FWA) services and enhancements to its Octobox Wi-Fi solutions underscore its commitment to advancing communication technologies despite fiscal setbacks. These developments are critical as they not only enhance user experience but also position Spirent to capitalize on the rapid adoption of 5G and the rollout of Wi-Fi 7 technologies. With expected revenue growth at 5.1% per year outpacing the UK market’s average and earnings anticipated to surge by an impressive 40.5%, Spirent is poised for recovery by leveraging high-demand sectors within tech innovation.

- Delve into the full analysis health report here for a deeper understanding of Spirent Communications.

Explore historical data to track Spirent Communications' performance over time in our Past section.

Taking Advantage

- Delve into our full catalog of 47 UK High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SGE

Sage Group

Provides technology solutions and services for small and medium businesses in North America, Europe, the United Kingdom, Ireland, Africa and Asia-Pacific.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives