- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Exploring Three High Growth Tech Stocks in the United Kingdom

Reviewed by Simply Wall St

The United Kingdom's stock market has recently been impacted by weak trade data from China, causing the FTSE 100 to close lower as global economic concerns weigh heavily on investor sentiment. Amidst these challenges, identifying high growth tech stocks in the UK requires a focus on companies that demonstrate resilience and innovation, particularly those capable of navigating fluctuating international markets and adapting to changing economic conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 93.64% | ★★★★★☆ |

| Beeks Financial Cloud Group | 21.56% | 36.94% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Capita (LSE:CPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capita plc is a company that offers consulting, digital, and software products and services to both private and public sector clients in the UK and internationally, with a market capitalization of £337.37 million.

Operations: Capita generates revenue primarily from two segments: Capita Experience (£1.12 billion) and Capita Public Service (£1.49 billion).

Capita, navigating a challenging landscape with a modest 1.5% annual revenue growth forecast, contrasts sharply with the UK market's 3.6% expansion rate. Despite this slower growth trajectory, Capita is poised for profitability within the next three years, outpacing broader market expectations with an anticipated earnings surge of 52.09% annually. The firm's commitment to innovation and service enhancement is underscored by its recent £135 million contract extension to manage the UK’s smart meter communications platform until September 2027—a testament to its integral role in national infrastructure projects and potential for future revenue streams in a tech-driven ecosystem. This strategic move not only stabilizes Capita’s position in technology services but also aligns with industry shifts towards sustainable and secure digital solutions. With R&D expenses earmarked for further development of such high-stakes projects, Capita invests in future-proofing its offerings against an increasingly competitive backdrop. Although current financial health shows volatility—evidenced by a highly fluctuating share price—the strategic focus on essential public service technologies could foster long-term stability and growth as it continues to connect millions of smart devices across Britain.

- Unlock comprehensive insights into our analysis of Capita stock in this health report.

Assess Capita's past performance with our detailed historical performance reports.

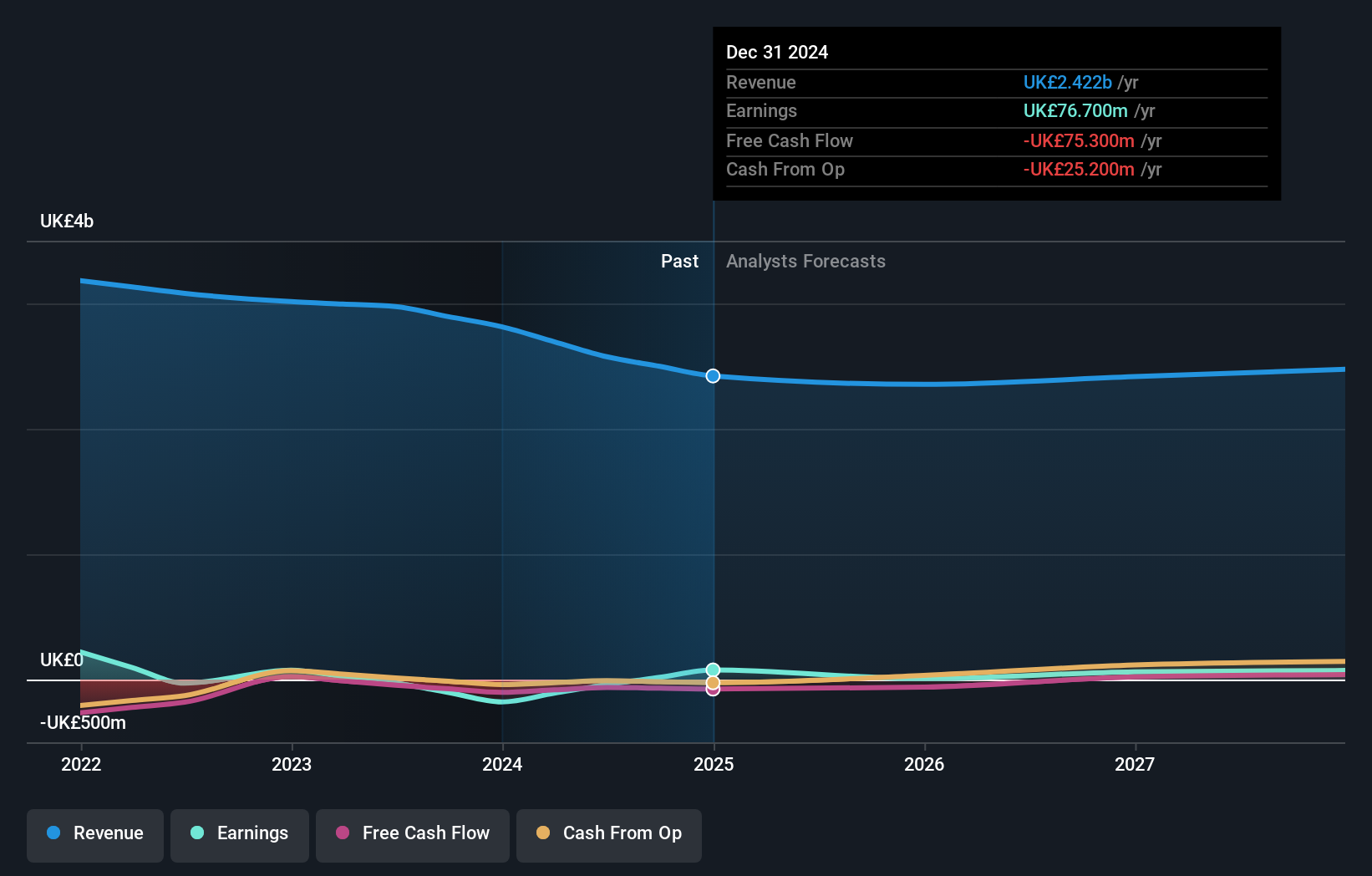

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia, and it has a market cap of £1.36 billion.

Operations: Genus plc generates revenue primarily through its two main segments: Genus ABS, contributing £314.90 million, and Genus PIC, contributing £352.50 million. The company's operations are geographically diverse, covering multiple regions across the globe.

Genus plc, amid a challenging fiscal landscape with a revenue growth of 3.7% per year, is modestly outpacing the broader UK market's expansion rate of 3.6%. This growth is underpinned by significant projected earnings increases of 37.4% annually, positioning it favorably against the market forecast of 14.2%. Despite recent setbacks marked by a substantial one-off loss of £47.4 million affecting last year's financials and a dip in net profit margins to 1.2%, Genus continues to invest in innovation, as evidenced by its strategic R&D expenditures aimed at enhancing long-term profitability and market position in biotechnologies—a sector poised for rapid evolution with increasing demands for genetic research and applications.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market capitalization of approximately £992.01 million.

Operations: Spirent Communications generates revenue primarily from its Networks & Security segment, which reported $258.50 million. The company operates on a global scale, providing specialized solutions in automated testing and assurance.

Spirent Communications, navigating a challenging fiscal landscape with a 5.1% annual revenue growth, slightly outpaces the broader UK market's expansion of 3.6%. Despite experiencing a significant one-off loss of $18M impacting its financial results as of June 30, 2024, the company remains committed to innovation through strategic R&D investments. These expenditures are crucial for maintaining competitiveness in the rapidly evolving communications sector. Notably, Spirent's earnings are expected to surge by an impressive 40.5% annually, showcasing its potential resilience and adaptability in a fluctuating market environment. This growth trajectory is further supported by recent advancements in their 5G Fixed Wireless Access testing services aimed at enhancing network performance and customer satisfaction across global markets.

Next Steps

- Embark on your investment journey to our 46 UK High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential and slightly overvalued.