- United Kingdom

- /

- Communications

- /

- LSE:SPT

Exploring 3 High Growth Tech Stocks in the United Kingdom

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting the global interconnectedness impacting domestic indices. In such a climate, identifying high-growth tech stocks requires focusing on companies that demonstrate resilience and innovation amidst broader economic pressures, making them potential standouts in an otherwise volatile market environment.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| Pinewood Technologies Group | 24.99% | 42.22% | ★★★★★☆ |

| YouGov | 4.12% | 64.42% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Oxford Biomedica | 16.52% | 82.05% | ★★★★★☆ |

| Windar Photonics | 37.17% | 46.73% | ★★★★★☆ |

| Trustpilot Group | 15.02% | 40.20% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 55.41% | 56.79% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 38 stocks from our UK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

YouGov (AIM:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YouGov plc is a global online market research company operating across the UK, the Americas, the Middle East, Mainland Europe, Africa, and the Asia Pacific with a market cap of £357.09 million.

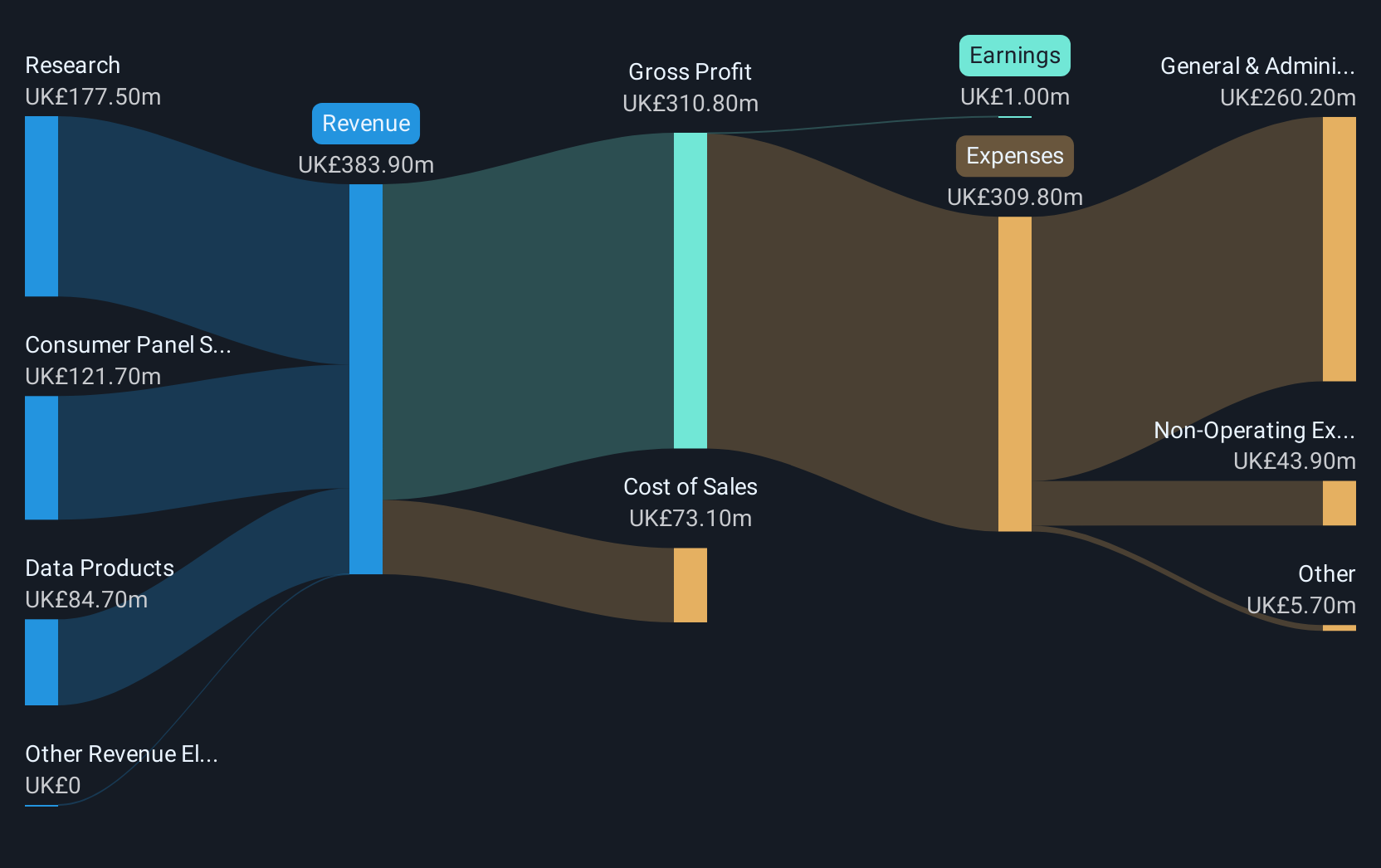

Operations: The company generates revenue primarily through its Research segment (£177.50 million), Data Products (£84.70 million), and Consumer Panel Services (£121.70 million). The gross profit margin shows a notable trend, reflecting the company's ability to efficiently manage its cost structure in delivering these services across various regions.

Despite recent challenges, YouGov's strategic focus on data analytics within the tech sector is noteworthy. With an annual revenue growth of 4.1%, slightly outpacing the UK market average of 3.9%, and a robust forecast for earnings growth at 64.4% per year, the company demonstrates potential in a competitive landscape. However, its profit margins have dipped to 0.3% from last year’s 8.5%, reflecting some operational hurdles amidst high expectations for future performance based on their innovative approaches to market research and data intelligence services.

- Delve into the full analysis health report here for a deeper understanding of YouGov.

Examine YouGov's past performance report to understand how it has performed in the past.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Baltic Classifieds Group PLC operates online classifieds platforms across automotive, real estate, jobs and services, and general merchandise sectors in Estonia, Latvia, and Lithuania with a market cap of £1.70 billion.

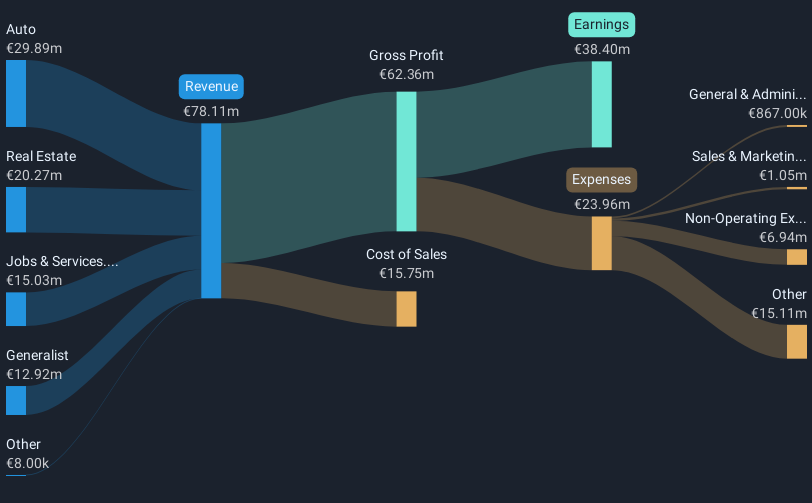

Operations: The group generates revenue through its online classifieds platforms, with key segments including automotive (€29.89 million), real estate (€20.27 million), jobs and services (€15.03 million), and general merchandise (€12.92 million) across the Baltic region.

Baltic Classifieds Group (BCG) showcases a dynamic trajectory within the Interactive Media and Services sector, with an impressive annual earnings growth of 42.1%, far surpassing the industry average of 3.4%. This performance is bolstered by robust revenue projections, expected to increase by 13.6% annually, outpacing the UK market's growth rate of 3.9%. The company's commitment to innovation is evident in its R&D investments, aligning with its strategic initiatives to expand digital services and enhance user engagement across platforms. With earnings forecasted to grow at a rate of 20.8% per year, BCG is positioned for significant advancements in technology and market reach, despite facing intense competition and rapidly changing consumer preferences within the tech landscape.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market capitalization of £1.10 billion.

Operations: Spirent Communications generates revenue primarily through its Networks & Security segment, which accounts for $279.20 million, and its Lifecycle Service Assurance segment, contributing $181 million.

Spirent Communications, a key innovator in the tech sector, has demonstrated its commitment to advancing wireless technology with the recent launch of the Octobox STA Automation Package. This pioneering solution automates Wi-Fi station testing, enhancing efficiency and reliability in an industry where Wi-Fi 6/6E and 7 technologies are rapidly gaining market share. Despite facing a challenging year with net profit margins dropping to 2.8% from last year's 5.3%, Spirent's strategic focus on R&D has positioned it for future growth in high-demand sectors. The company's revenue is expected to grow at an annual rate of 7.2%, outpacing the UK market projection of 3.9%. This growth trajectory is supported by significant product innovations like their Ethernet validation solutions showcased at OFC 2025, which are critical for AI-driven networking demands.

- Navigate through the intricacies of Spirent Communications with our comprehensive health report here.

Understand Spirent Communications' track record by examining our Past report.

Make It Happen

- Reveal the 38 hidden gems among our UK High Growth Tech and AI Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SPT

Spirent Communications

Provides automated test and assurance solutions in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives