- United Kingdom

- /

- Software

- /

- LSE:SGE

Exploring 3 High Growth Tech Stocks in the United Kingdom

Reviewed by Simply Wall St

The United Kingdom market has been flat over the last week but has shown a 7.5% rise over the past 12 months, with earnings forecasted to grow by 14% annually. In this context, identifying high growth tech stocks involves looking for companies that not only capitalize on technological advancements but also demonstrate strong potential to outperform in an improving earnings environment.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 98.44% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

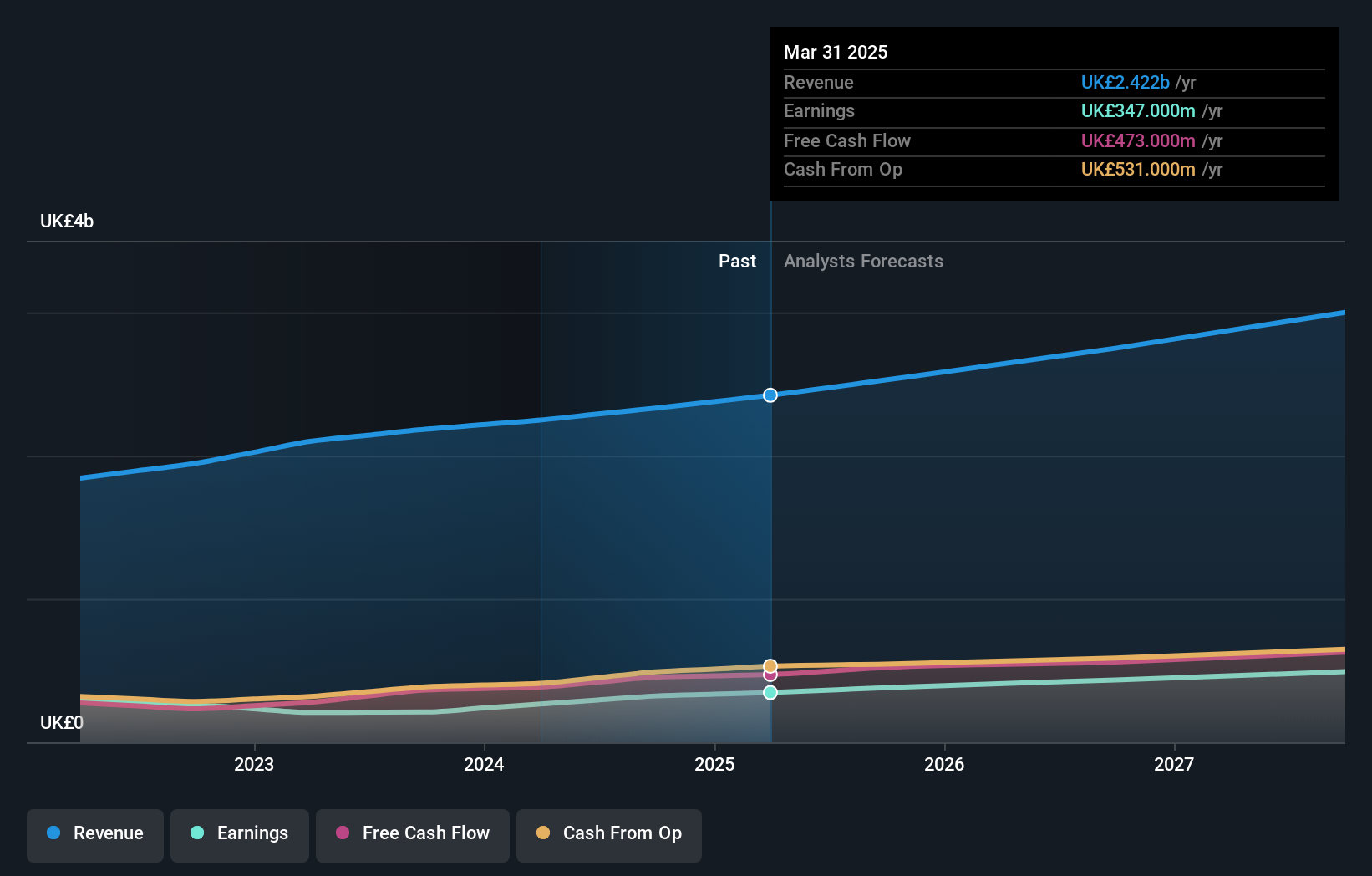

Overview: Informa plc is an international company that specializes in events, digital services, and academic research across the UK, Continental Europe, the US, China, and other regions with a market cap of approximately £10.90 billion.

Operations: Informa generates revenue primarily through its segments: Informa Markets (£1.67 billion), Informa Connect (£630.20 million), Taylor & Francis (£636.70 million), and Informa Tech (£426.70 million). The company focuses on providing international events, digital services, and academic research across various regions globally.

Informa's strategic expansions and partnerships, notably with Monaco and the acquisition of Ascential plc, underscore its commitment to enhancing its B2B events and digital business segments. This approach not only diversifies Informa's revenue streams but also solidifies its position in luxury and lifestyle markets globally. Financially, Informa has demonstrated a robust repurchase strategy, buying back 13.47% of its shares for £1.3 billion since March 2022, reflecting confidence in its operational stability and future prospects. Despite a recent dip in net income to £147.3 million from last year's £253.5 million, the company is poised for recovery with projected earnings growth of 22.5% annually over the next three years, outpacing the UK market forecast of 14%. This growth trajectory is supported by a steady revenue increase at an annual rate of 6.9%, suggesting a resilient business model amid evolving industry dynamics.

- Dive into the specifics of Informa here with our thorough health report.

Explore historical data to track Informa's performance over time in our Past section.

Sage Group (LSE:SGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services tailored for small and medium businesses across the United States, the United Kingdom, France, and other international markets; it has a market cap of £10.22 billion.

Operations: Sage Group generates revenue primarily through its technology solutions and services for small and medium businesses, with significant contributions from North America (£1.01 billion) and Europe (£595 million).

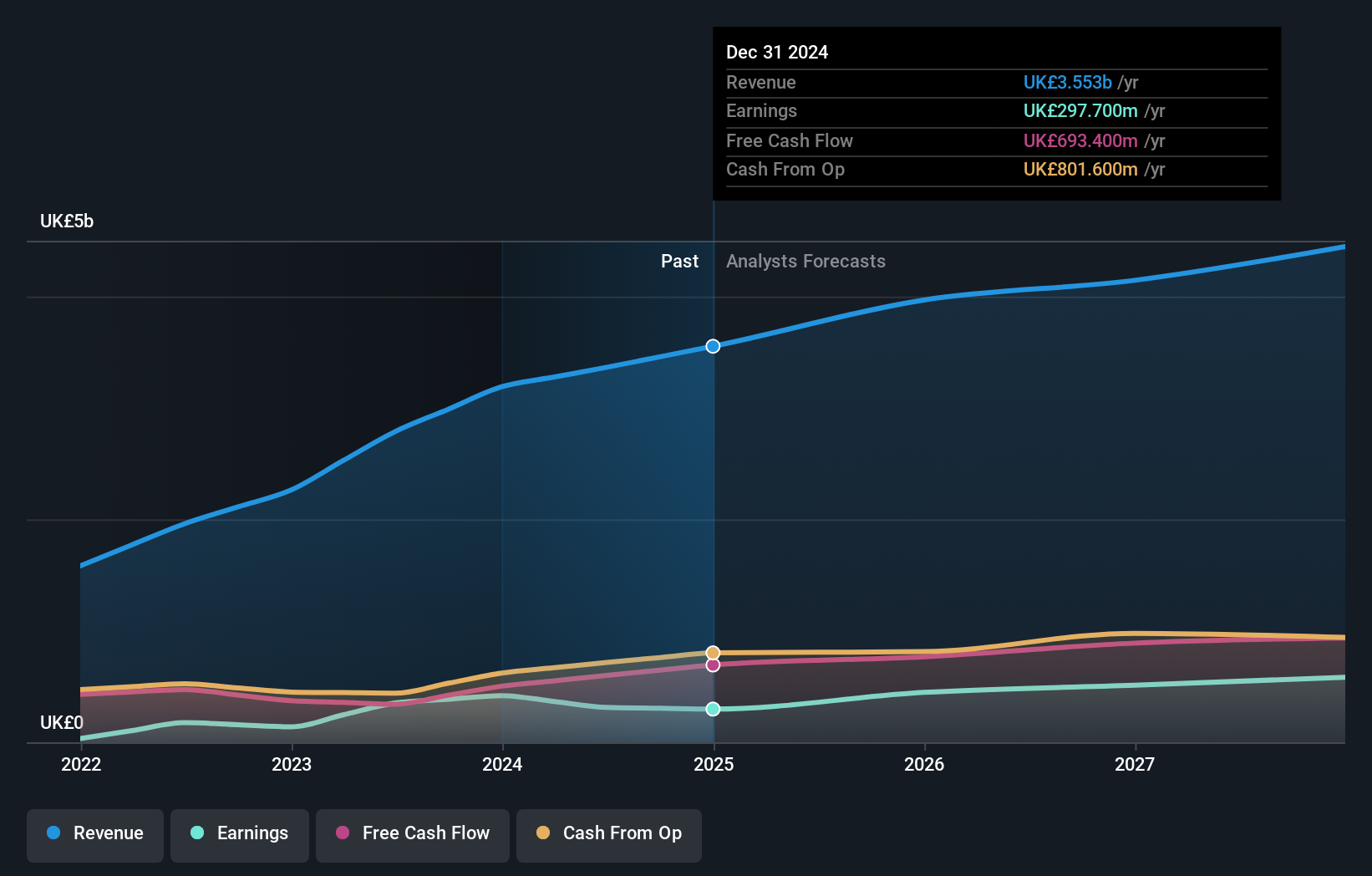

Sage Group's commitment to innovation is evident in its R&D investments, which have significantly contributed to its software solutions' evolution, particularly in cloud-based services. With a 7.7% annual revenue growth outpacing the UK market average of 3.5%, Sage is leveraging these developments to enhance its competitive edge. Moreover, the company's earnings are expected to grow by 15.1% annually, reflecting robust financial health and strategic positioning within the tech sector. Recent collaborations, like with VoPay, integrate advanced payment technologies into Sage’s platforms, streamlining operations for SMBs and reinforcing its market presence through enhanced service offerings.

- Delve into the full analysis health report here for a deeper understanding of Sage Group.

Gain insights into Sage Group's past trends and performance with our Past report.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions including the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market capitalization of £1.01 billion.

Operations: Spirent Communications focuses on automated test and assurance solutions, generating revenue primarily from its Networks & Security segment, which contributes $258.50 million.

Spirent Communications, navigating through a challenging fiscal period with a reported net loss of $6.7 million for the first half of 2024, contrasts sharply with its strategic advancements in high-growth sectors like 5G Fixed Wireless Access (FWA) and Wi-Fi 7 technologies. Despite these setbacks, the company's R&D focus remains robust, allocating funds to develop cutting-edge testing solutions that are pivotal for optimizing network performance and enhancing user experiences in telecommunications—a sector witnessing rapid expansion and technological evolution. With expected revenue growth at 5.1% annually, slightly outpacing the UK market average of 3.5%, and an ambitious forecast of earnings growth at 40.5% per year, Spirent is poised to recover and potentially excel by leveraging its innovative service offerings in emerging wireless technologies.

- Click here to discover the nuances of Spirent Communications with our detailed analytical health report.

Understand Spirent Communications' track record by examining our Past report.

Next Steps

- Investigate our full lineup of 47 UK High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SGE

Sage Group

Provides technology solutions and services for small and medium businesses in North America, Europe, the United Kingdom, Ireland, Africa and Asia-Pacific.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives