- United Kingdom

- /

- Capital Markets

- /

- LSE:FSG

UK Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a decline due to weak trade data from China, highlighting concerns about global economic recovery. Despite these broader market fluctuations, investors may still find opportunities in penny stocks, which represent smaller or less-established companies that can offer value and potential growth. By focusing on those with robust financials and clear growth trajectories, investors might uncover promising prospects among these often-overlooked stocks.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.605 | £516.67M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.86 | £311.84M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Vertu Motors (AIM:VTU) | £0.62 | £195.19M | ✅ 3 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.87 | £321.71M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.98 | £306.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £194.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.39 | £73.84M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.205 | £832.75M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 303 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bango (AIM:BGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bango PLC develops, markets, and sells technology for marketing and selling products and services to mobile phone users globally, with a market cap of £69.15 million.

Operations: The company generates revenue primarily from the monetization of its platform, amounting to $53.37 million.

Market Cap: £69.15M

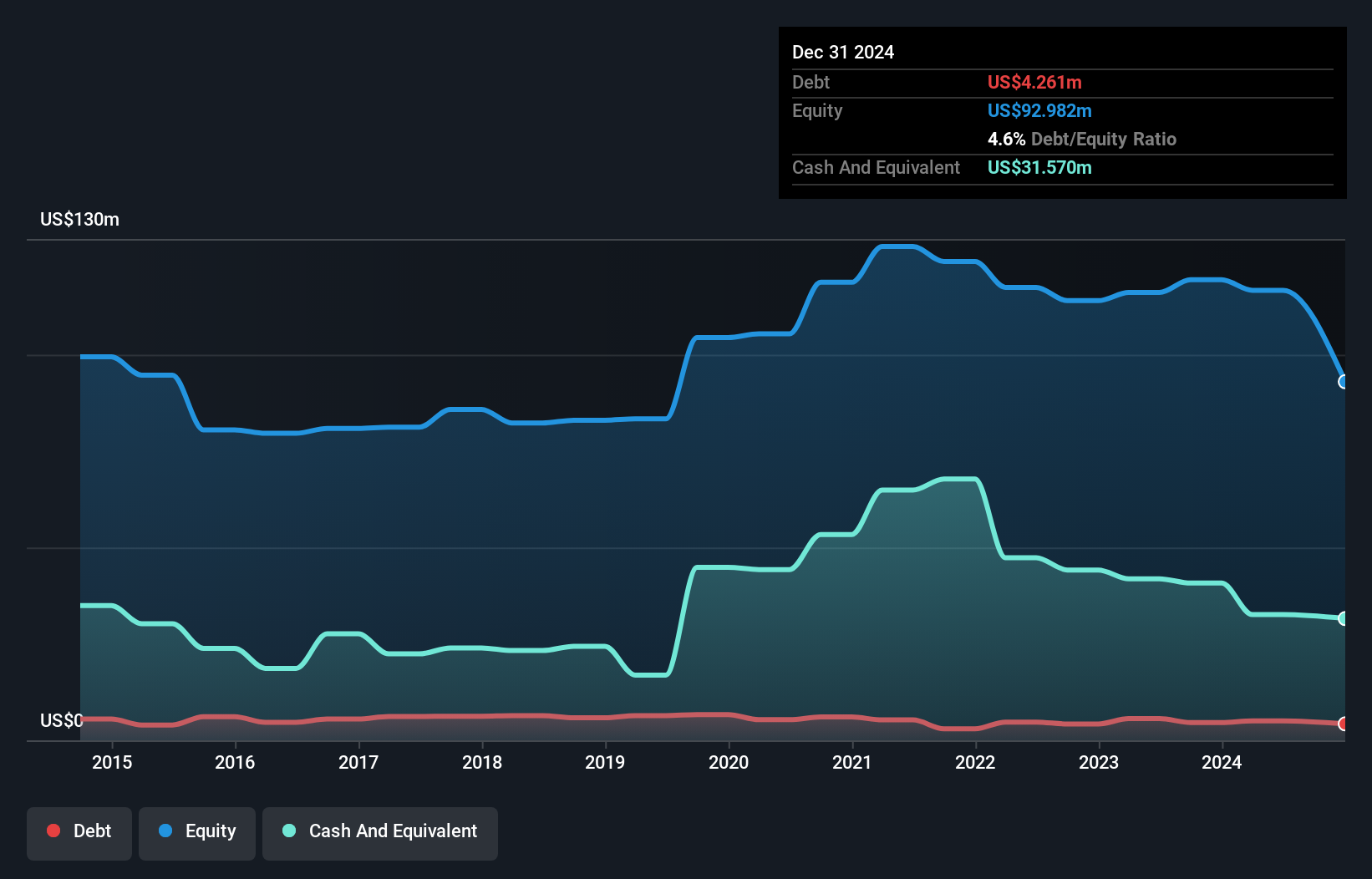

Bango PLC, with a market cap of £69.15 million, is leveraging its Digital Vending Machine (DVM™) to expand partnerships globally, including a strategic alliance with KT in Korea and Optimum in the US. Despite being unprofitable, Bango's revenue reached US$53.37 million for 2024, reducing net losses from the previous year. The company maintains a satisfactory net debt to equity ratio of 6.6%, supported by new financing agreements like a $15 million revolving credit facility with NatWest and an additional loan from NHN Corporation. Bango's stock remains highly volatile but offers potential growth through innovative subscription services integration.

- Jump into the full analysis health report here for a deeper understanding of Bango.

- Explore Bango's analyst forecasts in our growth report.

BATM Advanced Communications (LSE:BVC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BATM Advanced Communications Ltd., along with its subsidiaries, develops, produces, and supplies real-time technologies and services in Israel, the United States, and Europe with a market cap of £70.28 million.

Operations: The company's revenue is primarily derived from four segments: Cyber ($13.13 million), Non-Core ($57.04 million), Networking ($8.55 million), and Diagnostics ($38.62 million).

Market Cap: £70.28M

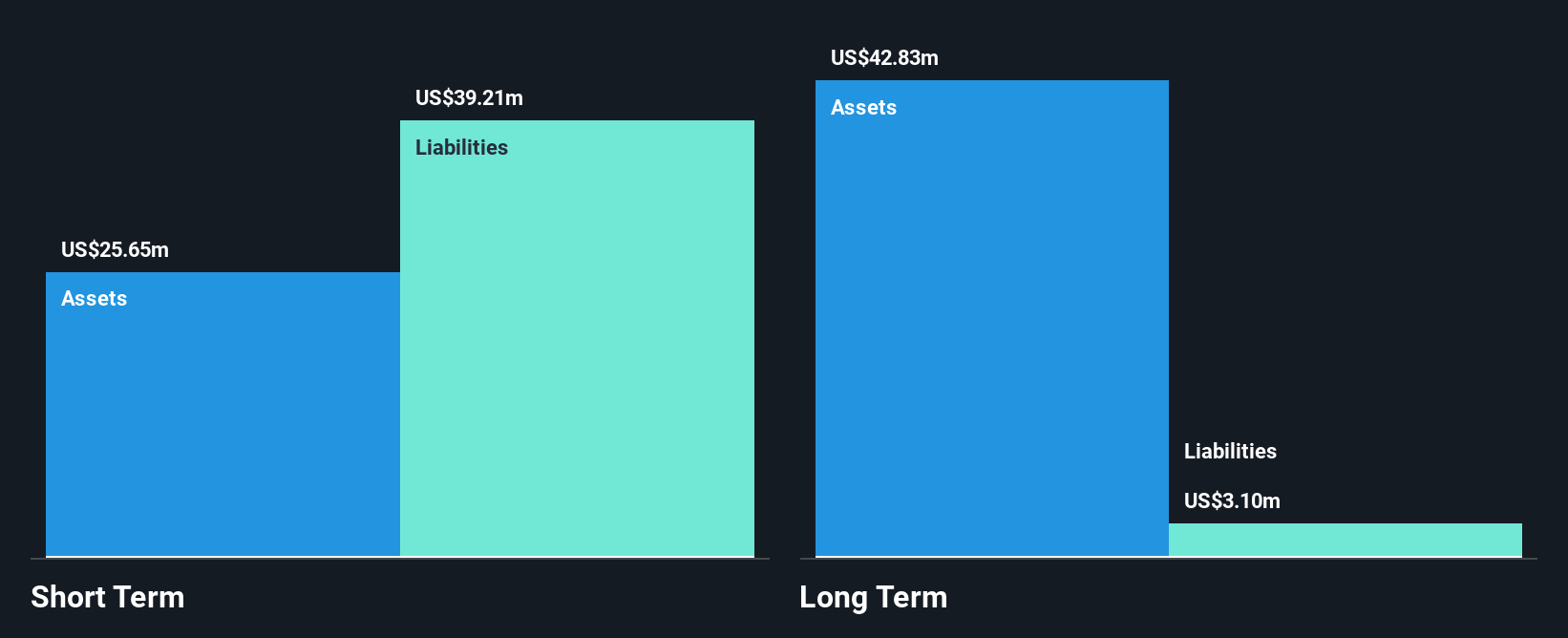

BATM Advanced Communications, with a market cap of £70.28 million, is navigating the penny stock landscape by leveraging its diverse revenue streams across Cyber, Non-Core, Networking, and Diagnostics segments. Despite being unprofitable and experiencing increased losses over five years, BATM's short-term assets significantly exceed both short- and long-term liabilities. The company recently secured a $1.5 million order for advanced encryption solutions addressing quantum computing risks, indicating potential future orders. Although management tenure is relatively new at 1.9 years on average, the board remains experienced with an average tenure of 7.8 years.

- Click to explore a detailed breakdown of our findings in BATM Advanced Communications' financial health report.

- Evaluate BATM Advanced Communications' prospects by accessing our earnings growth report.

Foresight Group Holdings (LSE:FSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £516.67 million.

Operations: The company's revenue is derived from three main segments: Infrastructure (£95.89 million), Private Equity (£50.52 million), and Foresight Capital Management (£7.58 million).

Market Cap: £516.67M

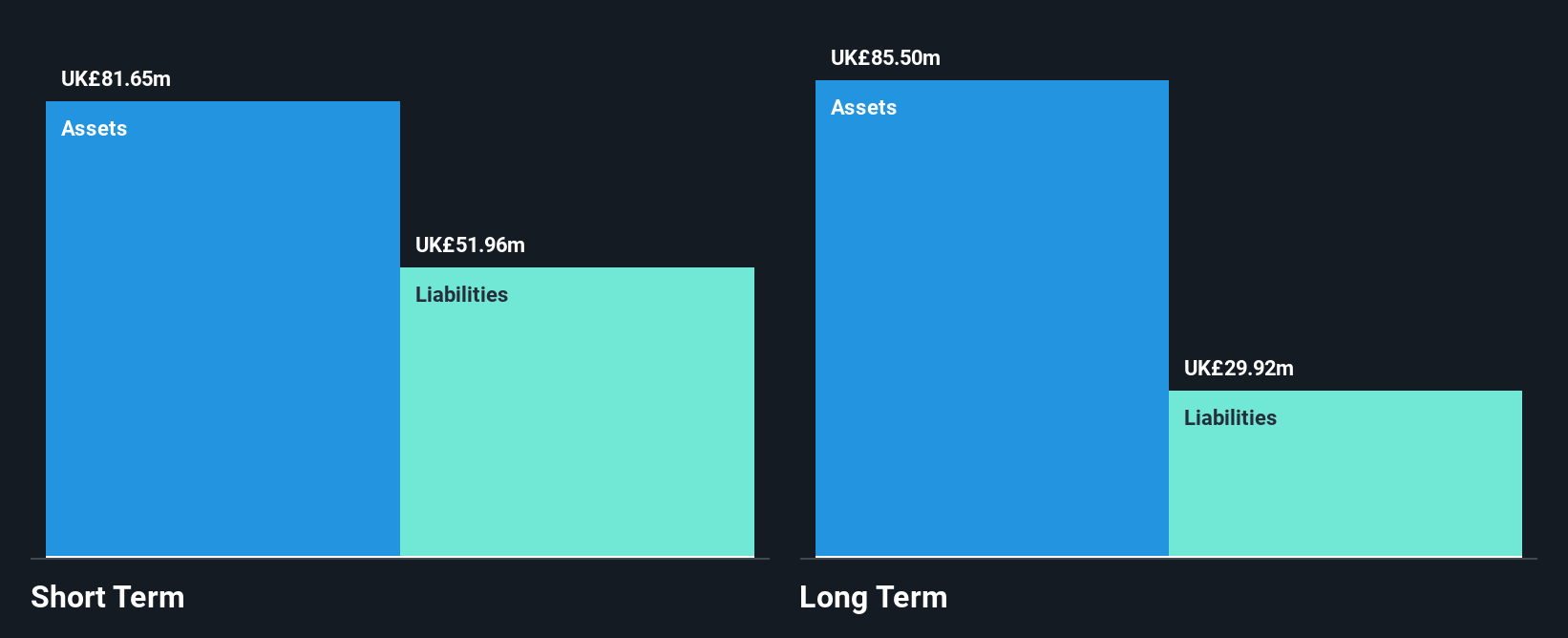

Foresight Group Holdings, with a market cap of £516.67 million, is showing robust financial health in the penny stock sector. Its revenue streams across Infrastructure (£95.89 million), Private Equity (£50.52 million), and Foresight Capital Management (£7.58 million) highlight diversified income sources. The company has demonstrated strong earnings growth, with a 25.8% increase over the past year, surpassing industry averages and maintaining high profit margins (21.6%). Recent strategic moves include seeking accretive M&A opportunities and appointing Gary Fraser as CEO to drive further growth initiatives while maintaining a solid debt position supported by ample cash reserves.

- Click here and access our complete financial health analysis report to understand the dynamics of Foresight Group Holdings.

- Gain insights into Foresight Group Holdings' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Explore the 303 names from our UK Penny Stocks screener here.

- Contemplating Other Strategies? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FSG

Foresight Group Holdings

Operates as an infrastructure and private equity manager in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives