- United Kingdom

- /

- Capital Markets

- /

- AIM:CAV

Spotlight On UK Penny Stocks For December 2024

Reviewed by Simply Wall St

Over the last 7 days, the UK market has remained flat, but it is up 7.8% over the past year, with earnings forecasted to grow by 15% annually. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still offer significant opportunities when built on solid financials. We explore three examples of penny stocks that combine balance sheet strength with potential for outsized gains, allowing investors to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £813.81M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.235 | £70.45M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.015 | £76.87M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.125 | £96.01M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.28 | £197.41M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.46 | £443.57M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.416 | $241.83M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Cavendish Financial (AIM:CAV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cavendish Financial plc offers a range of financial services to growth companies in the United Kingdom and has a market capitalization of £37.45 million.

Operations: The company generates £61.75 million in revenue from its Corporate Advisory and Broking, M&A Advisory, and Institutional Stockbroking services.

Market Cap: £37.45M

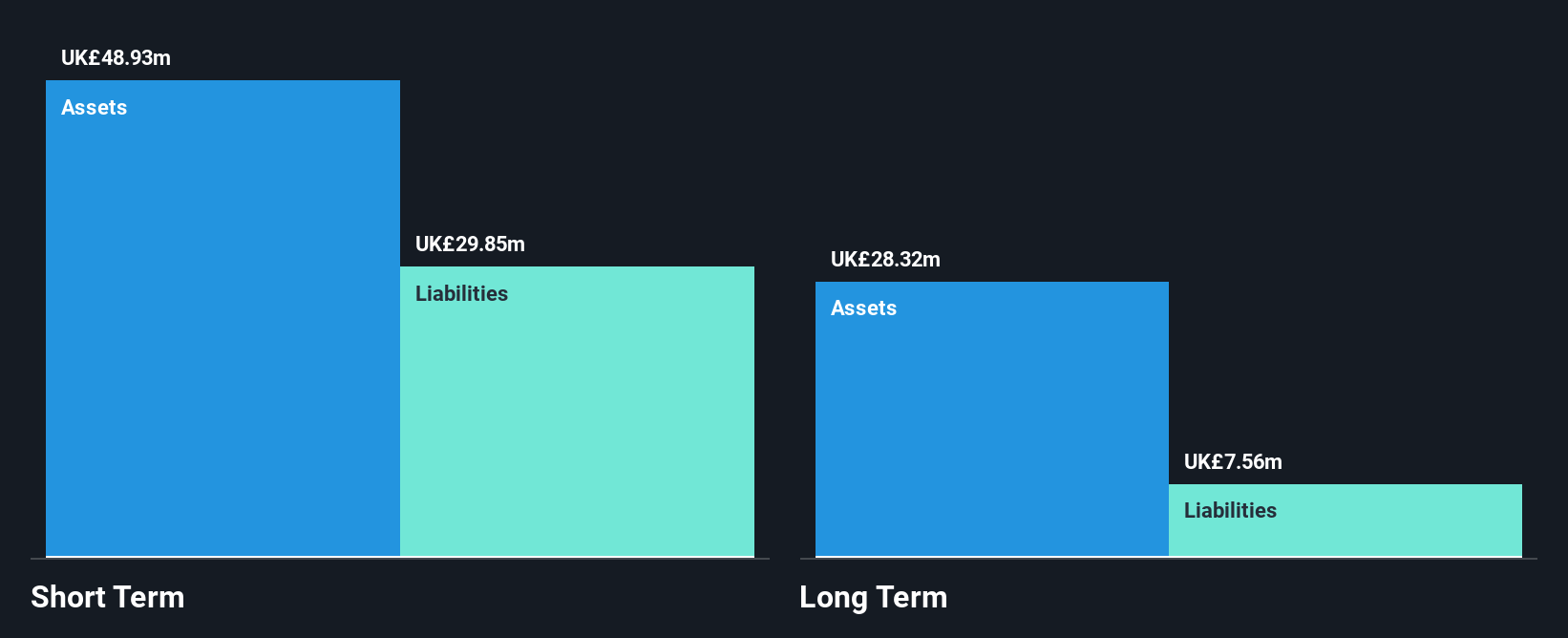

Cavendish Financial plc, with a market cap of £37.45 million, provides financial services in the UK and reported revenue of £61.75 million. Despite recent earnings improvement, it remains unprofitable with a negative return on equity and increased losses over five years. The company's board and management are relatively inexperienced, contributing to shareholder dilution by 6.7% last year. However, Cavendish's short-term assets exceed both its short- and long-term liabilities, indicating some financial stability. The company declared an interim dividend reflecting its commitment to shareholders despite the dividend not being well covered by earnings due to profitability challenges.

- Dive into the specifics of Cavendish Financial here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Cavendish Financial's track record.

Equals Group (AIM:EQLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Equals Group plc develops and sells payment platforms, including prepaid currency cards, international money transfers, and current accounts for private clients and corporations in the United Kingdom, with a market cap of £217.89 million.

Operations: The company's revenue streams are divided into Banking (£8.26 million), Solutions (£42.15 million), Travel Cash (£0.02 million), Currency Cards (£15.46 million), and International Payments excluding Solutions (£40.71 million).

Market Cap: £217.89M

Equals Group plc, with a market cap of £217.89 million, has shown consistent revenue growth and profitability over the past five years, supported by diverse revenue streams including Banking (£8.26 million) and International Payments (£40.71 million). The company is debt-free and its short-term assets comfortably cover liabilities, indicating financial stability. Recent developments include advanced M&A discussions with a consortium potentially offering 135 pence per share. Despite stable earnings growth (10.8% last year), profit margins have slightly declined from 8.8% to 7.4%. An interim dividend was declared recently, underscoring shareholder value focus amidst ongoing acquisition talks.

- Click here to discover the nuances of Equals Group with our detailed analytical financial health report.

- Assess Equals Group's future earnings estimates with our detailed growth reports.

BATM Advanced Communications (LSE:BVC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BATM Advanced Communications Ltd. develops, produces, and markets real-time technologies across Israel, the United States, and Europe with a market cap of £76.77 million.

Operations: The company's revenue is divided into four segments: Cyber ($16.96 million), Secondary ($57.05 million), Networking ($14.16 million), and Diagnostics ($34.53 million).

Market Cap: £76.77M

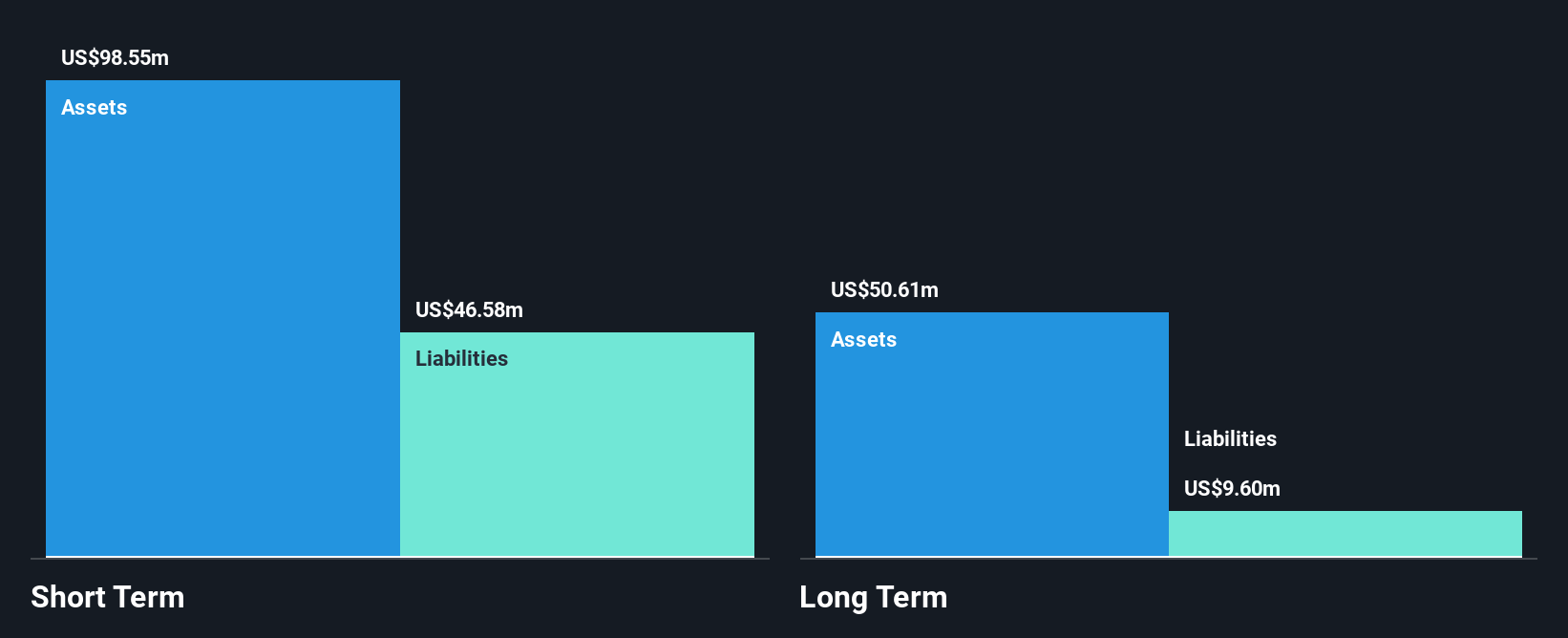

BATM Advanced Communications, with a market cap of £76.77 million, is navigating challenges as it remains unprofitable despite diverse revenue streams across Cyber (US$16.96 million), Secondary (US$57.05 million), Networking (US$14.16 million), and Diagnostics (US$34.53 million). The company's debt to equity ratio has improved over five years, and its short-term assets exceed liabilities, suggesting some financial resilience. Recent orders for its Edgility platform from a Tier 1 provider worth at least US$2.4 million over three years highlight potential growth opportunities in virtualisation services amidst ongoing volatility and management changes.

- Take a closer look at BATM Advanced Communications' potential here in our financial health report.

- Gain insights into BATM Advanced Communications' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Gain an insight into the universe of 470 UK Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CAV

Flawless balance sheet slight.

Market Insights

Community Narratives