- United Kingdom

- /

- Communications

- /

- LSE:BVC

3 UK Penny Stocks With Market Caps Under £300M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines due to weak trade data from China and falling commodity prices. Despite these broader market pressures, penny stocks remain an intriguing area for investors seeking opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, it still signifies a segment of the market where strong financials and solid fundamentals can uncover potential growth prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.80 | £537.39M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 3 ⚠️ 2 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.14 | £153.09M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.77 | £11.63M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.535 | $311.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.52 | £126.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.19 | £189.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.73 | £10.05M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.42 | £73.73M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.806 | £682.17M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 290 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Personal Group Holdings (AIM:PGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Personal Group Holdings Plc provides employee services and salary sacrifice technology products in the United Kingdom, with a market cap of £104.83 million.

Operations: The company's revenue is primarily derived from two segments: Affordable Insurance, which contributes £34.15 million, and the Benefits Platform, generating £13.26 million.

Market Cap: £104.83M

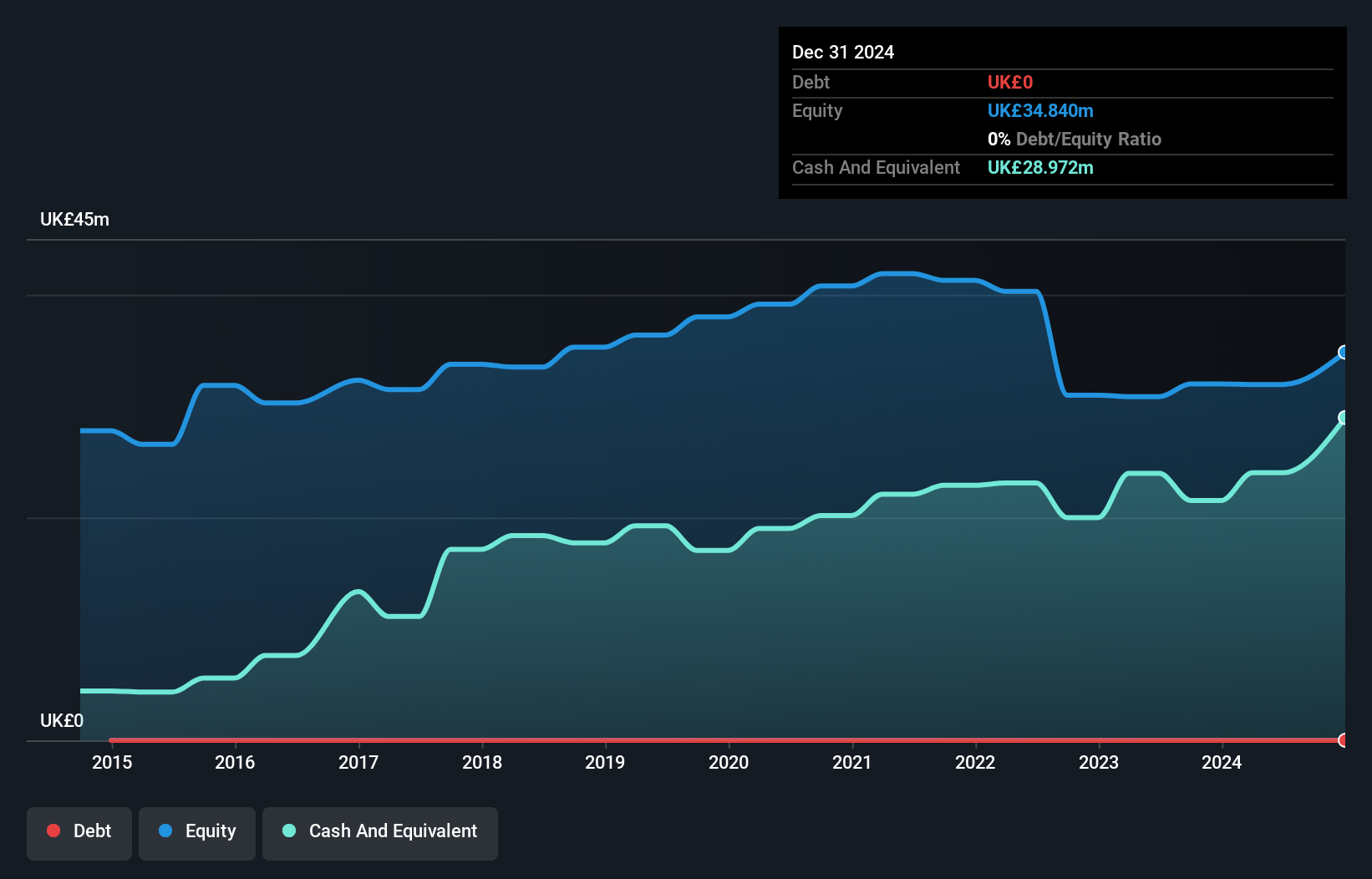

Personal Group Holdings Plc, with a market cap of £104.83 million, has shown promising financial stability and growth potential as a penny stock. The company reported half-year revenue of £23.34 million, up from £21.04 million the previous year, and net income increased to £2.99 million from £1.69 million. Despite its unstable dividend track record, it announced an interim dividend increase of 26% for 2025. The stock benefits from no debt burden and high-quality earnings; however, its return on equity is considered low at 19.1%. Earnings grew significantly by 51.5% over the past year, outpacing industry peers.

- Jump into the full analysis health report here for a deeper understanding of Personal Group Holdings.

- Examine Personal Group Holdings' earnings growth report to understand how analysts expect it to perform.

BATM Advanced Communications (LSE:BVC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BATM Advanced Communications Ltd. develops, produces, and supplies real-time technologies and services across Israel, the United States, and Europe with a market cap of £78.93 million.

Operations: The company's revenue is primarily derived from its Diagnostics segment at $42.20 million, followed by Non-Core at $57.45 million, Cyber at $9.96 million, and Networks at $9.21 million.

Market Cap: £78.93M

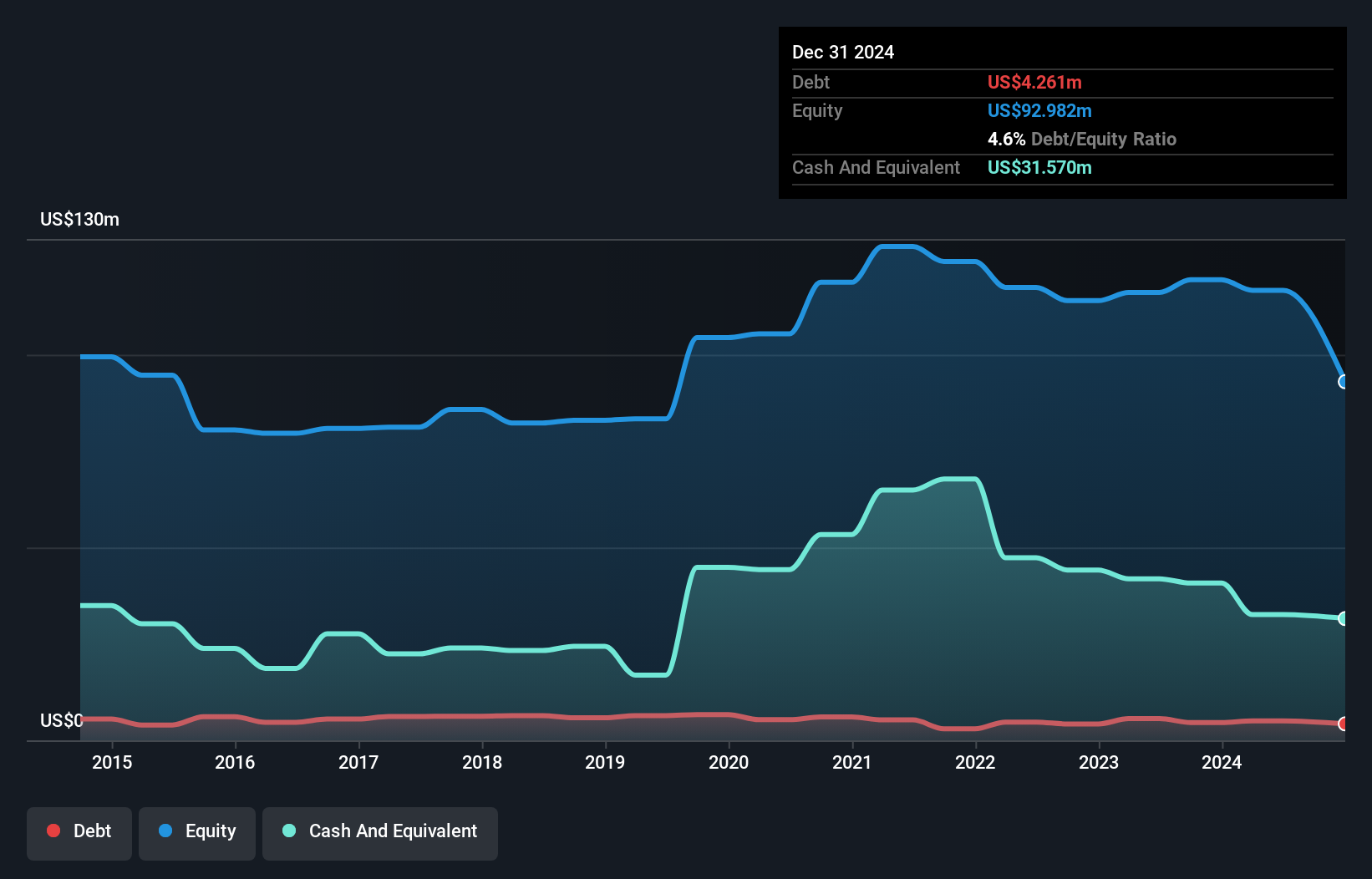

BATM Advanced Communications Ltd., with a market cap of £78.93 million, presents a mixed picture for penny stock investors. Despite its seasoned management and board, the company remains unprofitable, reporting a net loss of US$3.73 million for the first half of 2025, compared to a marginal profit last year. Revenue showed slight growth to US$60.36 million from US$58.88 million in the previous period, primarily driven by its Diagnostics segment. The company's financials are stable with short-term assets covering liabilities and more cash than debt; however, negative return on equity and declining earnings over five years highlight ongoing challenges.

- Dive into the specifics of BATM Advanced Communications here with our thorough balance sheet health report.

- Gain insights into BATM Advanced Communications' future direction by reviewing our growth report.

Stelrad Group (LSE:SRAD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stelrad Group PLC manufactures and distributes radiators across the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £213.32 million.

Operations: The company's revenue is primarily derived from its £283.94 million manufacturing and distribution operations in the radiator sector.

Market Cap: £213.32M

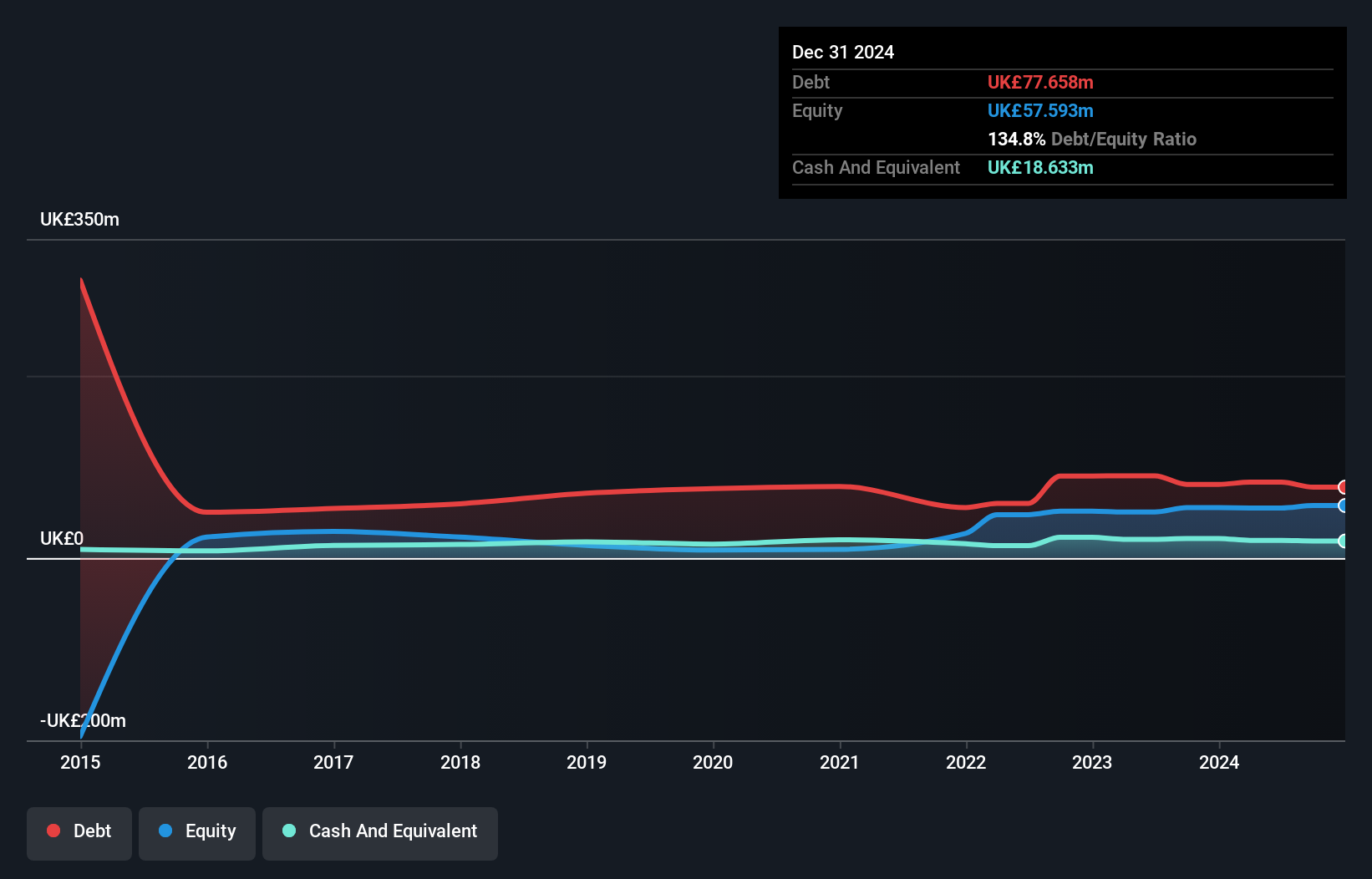

Stelrad Group PLC, with a market cap of £213.32 million, faces both opportunities and challenges as a penny stock. Recent earnings reported a net loss of £3.45 million for H1 2025, contrasting with last year's profit of £8.02 million, influenced by a significant one-off loss of £9.6 million. Despite high debt levels and reduced profit margins from 5.3% to 1.8%, the company's short-term assets exceed liabilities, providing some financial stability. The board is experienced with an average tenure of seven years, while analysts project earnings growth at 37.52% annually and anticipate potential stock price appreciation by about 20%.

- Navigate through the intricacies of Stelrad Group with our comprehensive balance sheet health report here.

- Explore Stelrad Group's analyst forecasts in our growth report.

Make It Happen

- Click through to start exploring the rest of the 287 UK Penny Stocks now.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BATM Advanced Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BVC

BATM Advanced Communications

Engages in the development, production, and supply of real-time technologies and associated services in Israel, the United States, and Europe.

Good value with adequate balance sheet.

Market Insights

Community Narratives